Labour tabled an amendment (reproduced at the bottom of this blog) to require preparation of a comprehensive report on the tax gap during debate on the Finance Bill in the House of Commons last night. For the record, I was not involved in drafting this, although it is very clearly based upon my work on this issue.

As Rebecca Long Bailey said for Labour during the debate on this amendment:

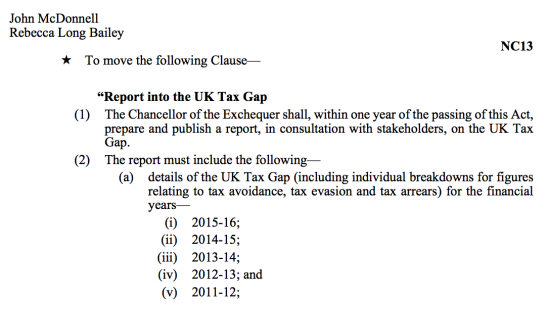

[N]ew clause 13 would require a comprehensive report into the UK tax gap, which is defined as the difference in any financial year between the amount of tax HMRC should be entitled to collect and the tax that it collects. Such difference derives from tax avoidance and evasion. The contents of the report would be as set out in the new clause, and it would have to be carried out in consultation with stakeholders. It would examine a number of areas relating to tax avoidance in the hope that the Government might review their policy and tailor it to deal adequately with such issues.

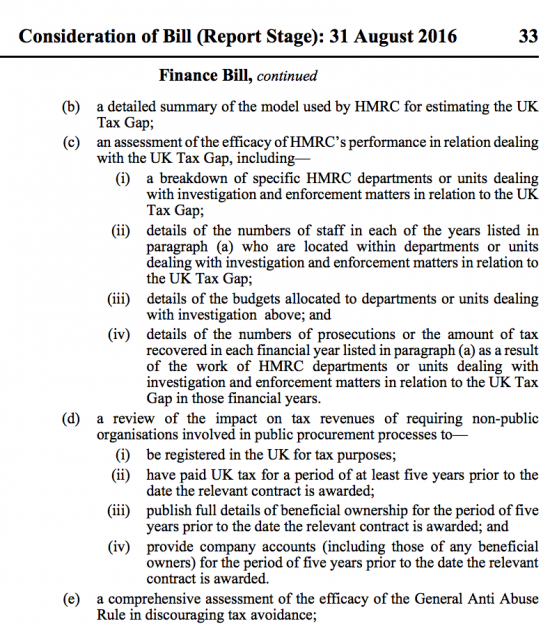

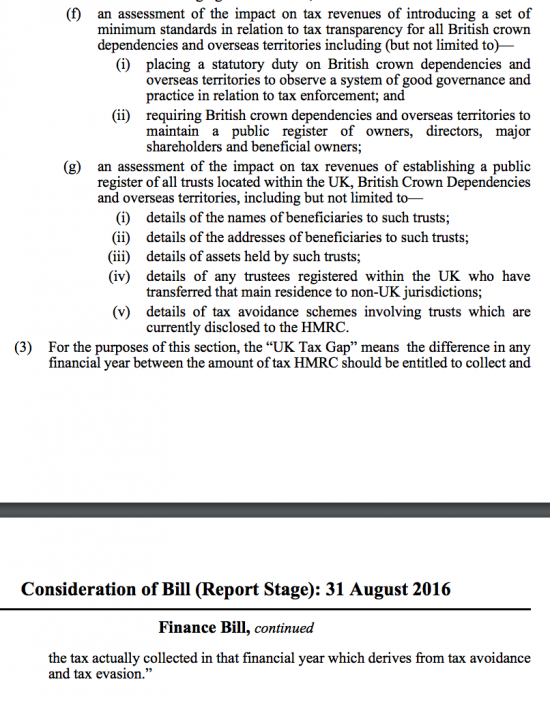

As Members who read new clause 13 will see, the part relating to HMRC goes into a lot of detail. Briefly, however, the report would be required to cover figures for the UK tax gap for the past five financial years; details of the model used by HMRC for estimating the UK tax gap; an assessment of HMRC's efficacy in dealing with the UK tax gap; details of the tax revenue benefits for companies engaged in public procurement that are registered in the UK only for tax purposes; an assessment of the efficacy of the general anti-abuse rule in discouraging tax avoidance; consideration of the benefits for tax revenue of introducing a set of minimum standards in tax transparency for all British Crown dependencies and overseas territories; and, finally, an assessment of the impact on tax revenues of establishing a public register of all trusts located within the UK, British Crown dependencies and overseas territories.

The point made is, in effect, very simply. There is obvious and very real doubt that HMRC have got the tax gap right. When 40% of it is made up of 'illustrative estimates' (fiction, in other words) that has to be the case.

The government was in full denial mode. Jane Ellison replied for it, saying:

Turning to deal with the lengthy speech and case made for Labour's new clause 13, which provides for a report on the UK tax gap, the tax gap is an official statistic published each October and it is produced in accordance with a code of practice for official statistics, which assures objectivity and integrity. The methodology is judged by independent third parties to be robust, and it has been intensively reviewed and given a clean bill of health by both the International Monetary Fund and the National Audit Office. There is therefore no need for a report on the tax gap. Furthermore, HMRC publishes a methodological annexe alongside the tax gap publication, which provides details of the data and methodology used to produce estimates of the gap.

I think it fair to say that, in speaking about new clause 13, the hon. Member for Salford and Eccles painted a picture which, on the Government of the House and, I suspect in other parts as well, could be regarded as at the very least ungenerous and in many ways inaccurate, unfair and, indeed, unrecognisable, given the way in which the she downplayed the efforts made by the Government. To call that tinkering at the edges is simply nonsense.

I regret to say that I think it was Jane Ellison offering the House nonsense. The NAO says the tax gap is right within the framework in which it is reported, and has still said improvements are needed. So did the IMF: it said a whole new top down methodology should be tried and yet the minister ignored that. And she simply ignored that for much of the HMRC report there simply is no data: bluntly, it's made up. Pointing that out is not being unfair: it's doing the country a service.

-------------------

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I’ve never rated Ms. Flint. She was a total waste of space as shadow sec. for energy and climate change. But she deserves all the plaudits coming her way for this intervention.

I also hope it will highlight the value of, and the hard work involved in, securing all-party support for crucial amendments to legislation that government would prefer to squash. This is what responsible and effective opposition involves in a representative parliamentary democracy. I suspect that neither Mr. Corbyn nor Mr. McDonnell (Messrs McCorbyll?) had any involvement in this effort. Given their previous form I expect that, rather than put in the hard work in the Commons, they would much prefer to address a gathering of Momentum activists in Parliament Square demanding that all these multinational firms be nationalised, “democratised” or “co-operatised” so that they’d have operations in only one country and there would be no need for country-by-country reporting.

As far as I know the Labour front bench had no involvement in this but did say in debate that they supported it

I was under the impression that a large part of the tax gap was made up of tax owed by companies that had gone bust or individuals that were now bankrupt. How would you suggest that this be accounted for?

It seems evident that no matter how much resource is put towards it, this money cannot be reclaimed, so I’d suggest it should be either removed from the “tax gap” figure or at least listed separately.

£4 billion according to the government, who do list it separately for that reason

Rather more according to me: they cannot explain what they write off before they consider soemthing debt

So, to be clear, where there is no data it’s wrong for HMRC to ‘make things up’, but entirely reasonable for you to make up the numbers to justify your elevated figures?

The tax gap HMRC are measuring is the gap between tax legally due and tax actually paid. You appear to be measuring something entirely different – the different between tax paid and tax due IF THE RULES WERE ENTIRELY DIFFERENT.

Except I have not made anything up – I have evidenced my case

i do not deny there may be better evidence available, but I have offered no estimate without support

Gap? More like one of those chasms where you cannot see the bottom, unless the lava flows are going strong.

It’s heartening to see Labour doing its job as the opposition party. Presumably it wasn’t to be expected that an opposition amendment as contentious as this would pass (do they ever…?), but that’s not the point; the point is to make the point, if you see what I mean. To actually pass legislation embodying what the amendment would have done requirea that Labour become the governing party.

One can only hope that that message will start being taken to heart once more by the party as a whole. (Or should I say by “the movement”)?

I would draw a careful distinction between those who are ‘in denial’, and those who make public denials.

I find it difficult to think well of our new Prime Minister, but there were good reasons and a good decision in her firing our former Chancellor: but he was not the only only public denier of unpleasant truths about tax compliance, nor the most skilful; and I fear that he enjoys support on both sides of the House in this self-interested mendacity.

I offer no comment on denial and denials within HMRC and among their patrons.