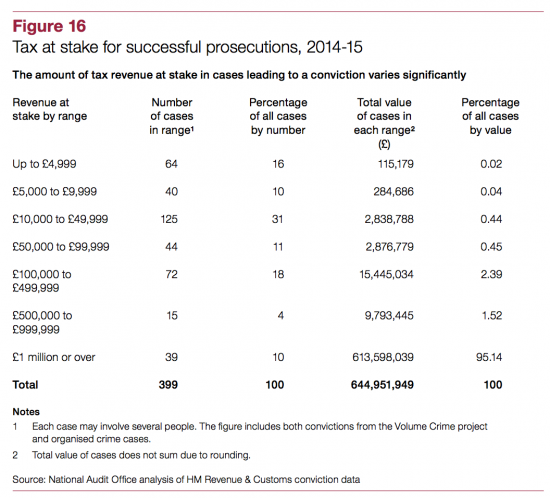

There are two charts in the National Audit Office report on HMRC's abysmal record on estimating the scale of and then tackling tax fraud that tell familiar stories. The first looks at the amount of tax at risk in HMRC prosecutions:

So, what is clear is that 273 cases (68.4%) of the cases prosecuted related to £6,115,432 of cases by value, or 0.95% of the total. Quite emphatically then HMRC go for small fry. Even the National Audit Office say so when speaking of the negative impact of targets:

This led [HMRC] to focus on less complex cases, in particular a large number of prosecutions for evading income tax, VAT and tobacco duty, and lower-value cases. HMRC has recognised that it needs to align the cases it selects for criminal investigation more closely with its analysis of risk and how effective a successful prosecution would be in creating a deterrent.

I bet that does not happen.

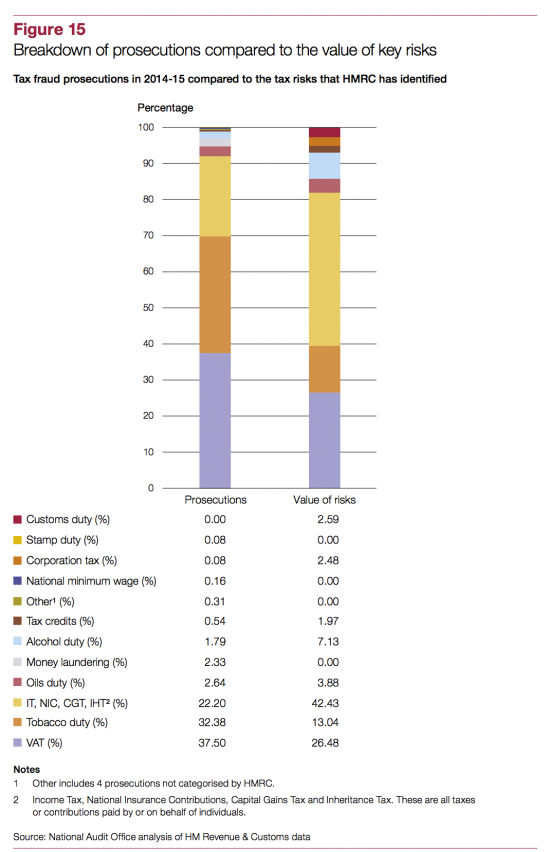

The second analysis is the type of tax prosecuted:

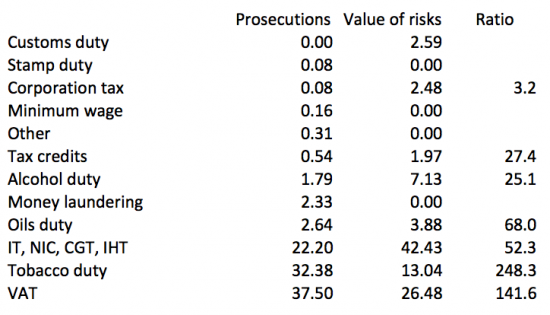

All you have to do is a quick ratio analysis to show how odd the profile of prosecutions is:

The ratio can't be calculated in some cases, but where it can be is the value of risk divided by the prosecutions to indicate the weighting given to prosecution of the tax.

Guess what? There was actually just one (I deduce) corporation tax prosecution in the year.

400,000 or so companies failed to even submit corporation tax returns requested of them and yet just one prosecution. There were seven times more for tax credits: no surprise there then.

Instead HMRC concentrated on petty crime. The tax evaders clearly got away with what they were doing.

This is why I get so annoyed with people like John Kay, the FT columnist who said yesterday:

There is plenty of waste and [tax] avoidance – but if eliminating them was painless, it would have happened.

He was talking about the tax gap in general, and to be candid, was blatantly wrong. I'll assume, to be kind, that he has just fallen for HMRC claims that it is trying as hard as possible but what is abundantly clear from this data is that this is a million miles from the truth. The reality is HMRC aren't even coming close to taking the actions required collecting missing tax revenue in the UK economy. And it is time they did.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Perhaps HMRC need to be introduced to Pareto analysis?

Just joking it is political.

Um, sorry to be picky, but haven’t you divided the “prosecutions” number (presumably a percentage) by the “value of risks” number (presuambly another percentage)? And then multiplied by 100? (Perhaps it was a typo, but you say you show “value of risk divided by the prosecutions”, which gives very different results.)

Would you interpret this as meaning that there are about 40% more VAT prosecutions, and about 2.5 times the expected number of tobacco duty prosecutions, than the “value of risks” would suggest is appropriate. But there should be about 30 times the number of corporation tax prosecutions, four times as many for tax credits and for alchohol duty evasion, and about twice as many for oil duty and IT/IHT/NICs/CGT? And about the same for customs duty fraud as there should be for corporation tax? (I am also somewhat surprised that the value of risk for stamp taxes is zero.)

Perhaps VAT and tobacco fraud are the easiest to catch? Or perhaps ex-HMCE

staff (tobacco and VAT) – or at least people working in an area with an ex-Customs culture – are more willing to prosecute than those in areas traditionally managed by the Inland Revenue (where there has always been an emphasis on getting the money in, with interest and penalties, rather than spending money on prosecutions).

Even £10,000 of tax at risk is hardly small fry or petty crime, but about two thirds of the cases prosecuted relate to amounts more than that (and half of those – a third of the total – to cases with more than £100,000 at risk). That said, I expect there are many more low-value cases in any event, and many that are not prosecuted for lack of resources. Are there figures for the cases investigated with a view to prosecution, but whichi in the event were not taken to court?

You are right

I did the other way first, then changed the approach

And it was too early in the morning…

Apologies

I think your interpretation is fine

I have no answers to the questions: data not available that I know of

It’s good to see someone at least having a look at this. Prosecutions at the top end are a farce.

Its a case of what gets measured get done. A bit like the (apocryphal?) USSR economic plan – when it made the volume of nails the targets they got millions of small nails. When they changed to by weight they got tens of thousands of 6 inch nails. As I keep saying you political economists, its the nature of demand that needs the most attention.

Isn’t the problem a resourcing one? HMRC are closing offices and having resources cut so the solution is to 1. Avoid prosecuting anyone (because it doesn’t raise revenues) and 2. Use APNs to seize taxpayer’s money because they’re going to take 20 years to get that money lawfully so it’s cheaper and politically more popular to just take the money than risk losing at tribunal.

I’ve got that right, yes? APNs are an affront – they deny justice to everyone, surely? “We don’t know when we’ll get around to deciding this, so we’ll assume you’re guilty in the meantime…” but in the meantime the treasury only havbe the money effectively in escrow/suspense (but make claims about ‘collecting tax’). Imagine if David Gauke’s house had been seized for 20 years whilst the parliamentary committee decided if his expenses claims had been dodgy or not.

If you read this blog regularly you’d know you’re wasting my time and regular readers time with these arguments on which I have written extensively

I don’t read regularly… but how arrogant must you be to suggest that I am “wasting your time” by asking a question, or that I’m expected to read a whole web site before posting…

Is this blog only for your sycophants, and anyone not toeing your line is to be derided and called a time-waster?

And, no, I can’t find where you have addressed this issue. It’s clear you hate people who try to reduce their tax – almost with a near psychopathic obsession, but in dismissing justice, you weaken your argument.

Is your position “they’re scumbags so if they’re denied justice or treated unfairly, its serves them right”.

So, genuinely, please answer the point I raised.

And it’s grossly arrogant of you to think I should answer any old question you care to post – five of them tonight

On the main article “HMRC go for small fry”. Why not? If your builder offers to knock of the VAT for cash, then you and he are both complicit and it creates a climate where it becomes acceptable. As with drugs, the police like to get the big fish, a £4M seizure and Mr. Big, but actually, if they went after the lots of little guys on the street corners, who don’t really make that much from it, they won’t take the risk and the whole ecosystem gets disrupted. So, Mr. Big gets away with it, but the drug problem goes away, which is surely more important? Yes, it would be better to get them all, but not to lose sight of what would have the greater benefit for society – stopping the problem long term, or only jailing a few big guys short term?

Are you paid to offer these sorts of excuse?