Tax credits were a cut too far. The Lords, the Sun, Labour and his own backbenchers had told George Osborne that was the case. He was forced to believe them. They were a cut too far, they said. And as we discovered, he agreed. He did a U turn. It was not as much of a U turn as many would hope: Universal Credit wills till leave many of those who might have lost out from the tax credit changes £1,000 a year worse off by 2020, but that is not the point of the moment. That point is twofold.

First, we learned cuts can be too extreme. Get used to the idea. A great many things announced yesterday were cuts that will lead to the same outcome.

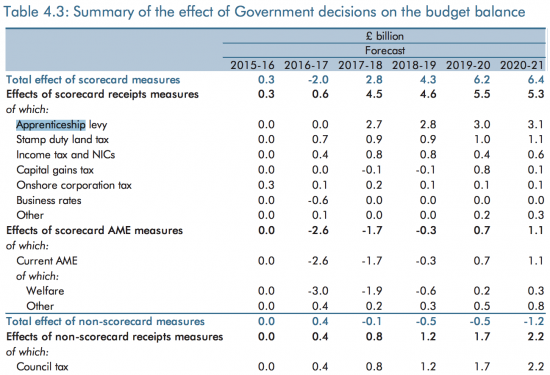

Second, we learned that there is an alternative to cuts. The detail is in this OBR table:

By 2017-18 tax revenues will increase by £2.7 billion from the apprenticeship levy, £0.9 billion form stamp duty and £0.8 billion form council tax increases announced yesterday. Add them up and guess what, they come to £4.4 billion.

Now I think the increase in council tax is deeply regressive and unfair, and the apprenticeship levy not just wholly unnecessary but unwise signalling that training is a burden on business, but that is not the point: that point is that cuts are not necessary and tax can provide an alternative.

Yesterday saw no action on the tax spends Jolyon Maugham and I have been highlighting. But, the reality is that this is where big scope for change exists. And now that the myth that cuts are necessary has been shattered because it has been found that tax is an alternative expect a massive shift in emphasis in coming budgets as all George's plans unravel, as so many have in the past.

The cuts announced are indeed a step too far. But other options are on the table.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

However there still seems to be a quid pro quo too far in this:

“Councils will see their central government grant nearly halved, forcing them to sell assets, draw on reserves and to raise council taxes by £2bn in a bid to prevent the collapse of social care in England.” (Grauniad)

The suffering this (is) will cause goes without saying and all this shuffling around in this or that account is more of the ‘Government is a Household’-rob Peter to Pay Paul stuff that pretends we aren’t a sovereign currency issuer.

They’re still pretending that the pie is a set size, and any increase in one slice means a decrease in another. As Ezra Pound put it 76 years ago

“In the United States and England there is NOT enough money. There are not enough

tickets moving about among the WHOLE people to BUY what they need – EVEN when the

goods are there on the counter or going to rot on the wharves.

When the total nation hasn’t or cannot obtain enough food for its people, that nation is poor. When enough food exists and people cannot get it by honest labour, the state is rotten, and no effort of language will say how rotten it is. But for a banker or professor to tell you that the country cannot do this, that or the other because it lacks money is as black and foetid a lie, as grovelling and imbecile, as it would be to say it cannot build roads because it has no kilometres.

It is the business of the STATE to see that there is enough money in the hands of the WHOLE people, and in adequately rapid EXCHANGE, to effect distribution of all wealth produced and produceable. Until every member of the nation eats three times a day and has shelter and clothing.”

– “What is Money For?” by Ezra Pound, 1939

https://archive.org/details/WhatIsMoneyFor

Having had a look at the two OBS Economic and fiscal outlook reports for July and November 2015, it looks like our old friend quantitative easing has contributed 12.2 billion of that 27 billion which Osborne found.

The two relevant lines from the reports are given below and indicate the “Reductions in debt interest due to APF”

http://cdn.budgetresponsibility.independent.gov.uk/July-2015-EFO-234224.pdf

Reductions in debt interest due to APF -12.4 -12.1 -10.3 -8.3 -6.5 -5.3 -4.3

http://cdn.budgetresponsibility.independent.gov.uk/EFO_November__2015.pdf

Reductions in debt interest due to APF -12.4 -11.7 -11.5 -10.6 -9.3 -8.3 -7.6

– in the November reports executive summary they explain:

– the Bank of England announced in November that it would keep the stock of gilts held in the Asset Purchase Facility (APF) at £375 billion until Bank Rate reaches a level from which it can be cut materially. The MPC currently judge this to be around 2 per cent a level that markets are not pricing in until beyond our five-year horizon.

This reduces debt interest spending (and thus borrowing). But it also increases PSND because the nominal (as opposed to the market) value of the gilts the APF holds exceeds the value of the reserves the Bank created to purchase them. (In other words, the Bank pays more for the gilts than they will be worth on redemption.) This effect diminished over time in our previous forecast, as the Bank was assumed to stop buying gilts to replace those that were redeemed from early 2016-17. So the decision to continue doing so for longer adds increasing amounts to PSND, reaching £18 billion by 2020-21. (Netting off the debt interest saving, the total increase in PSND is £12 billion);

You are right – if I just goit some other work out of the way I would finish the blog in question

Spot on

I think Pound was a sort of disciple of Sylvio Gesel blended with dodgy notions of evolution and eugenicics fashionable at the time. What he says has truth in it but he backed it up with hideous levels of Anti-semitism and tried (unsuccessfully) to ingratiate himself with the Mussolini regime.

Glad we’re not living in Poundland (or maybe we are in another sense!) Sorry, that’s my stab at humour today (‘please yerselves’, as Frankie Howerd used to say).

It was probably C.H. Douglas who had more of an impact on him, and he was definitely an antisemite, but I don’t think that should get in the way of his ideas on this subject. He was right in what he said about money, and being the gifted writer that he was, he was able to put it together in sn easily understandable book.

There’s a real problem getting the message across to people outside of the economics bubble, the media aren’t doing their job, they’re basically cheerleaders for Osbourne, and couldn’t give a toss about the human cost of his quack policies. Looking to people like Pound when it comes to framing wouldn’t be the worst thing people could do.

You’re right – but then I think that John Steinbeck was saying much the same thing as Pound at that time.