Three of the U.K.'s major aid agencies have published a report on corporation tax:

I welcome this report: a long time ago I remember working hard to get such agencies involved in tax campaigning. What the organisations have to say is interesting. First they place the issue in the context of their work:

As organisations working to end poverty and build fairer and more equitable societies that are financially, socially and environmentally sustainable, we understand the importance of business, and its ability to shape and transform lives around the world. Much of our work is focused on developing countries, where millions of women and men live in poverty and are denied their rights. The pressing problems of ending poverty and tackling economic inequality require businesses to be part of the solution.

In our work we also see how vital it is for developing country governments to collect revenues from taxation, and in particular corporate tax revenue. This funds essential public services to fulfil people's rights such as healthcare and education, and the public infrastructure needed to raise living standards, increase equality and build well-functioning economies. This is why advocating for government-led reforms and binding rules underpins our tax justice work and the work of the wider tax justice community of which we are a part.

That is entirely appropriate. But then they broaden this out:

But tax is also an issue of good corporate governance and responsible business practice. There are immediate and meaningful steps companies can take to improve the impact of their tax behaviour on the developing countries in which they do business.

The paper contains a wide range of positive behaviours and actions companies can undertake on their journey towards responsible corporate tax behaviour — some are immediately implementable (and perhaps already being implemented), while others may evolve over a longer time. The spectrum of propositions and examples (though not exhaustive) reflects a conscious decision on our part not to limit the ambition of the paper — allowing multiple entry points for businesses, and more importantly, resulting in significant gains for developing countries.

This is interesting: what these NGOs are doing are reaching out to a wide range of businesses, where they are. In contrast to, say the Fair Tax Mark, with which I am involved, which is seeking exemplars of good behaviour, this approach aims at all business, by stressing the gains for them of doing so:

Companies, too, will benefit because responsible tax behaviour helps mitigate risk and is in companies' own longterm interest. The best companies — and their investors — recognise that their success is inseparable from the success of the society in which they operate. Paying tax is an investment by companies because it supports the development of the type of societies in which profitable, sustainable companies can thrive. These are peaceful, stable societies that have sustainable transport networks and power systems, educated, gender-balanced, healthy and productive workforces, prosperous economies and strong consumer bases with purchasing power.

By promoting effective governance, responsible tax behaviour also helps tackle corruption, which is harmful to the business-enabling environment. Those who understand this will appreciate our call for tax responsibility beyond legal compliance, by which we mean conduct that reflects a company's broader duties to contribute to public goods on which companies depend.

In the process there is acknowledgement that the debate needs to move on:

We acknowledge that the need to inform the public on this issue has sometimes resulted in debate that has been polarised, often adopting a ‘pass or fail' approach to evaluating corporate tax practices. With this paper we seek to progress the discussion and to establish a genuine, constructive dialogue between our organisations and business, in order to move towards a better understanding of what ‘good' looks like in responsible corporate tax behaviour. We hope this paper provides a practical approach (as opposed to a onesize-fits-all standard) for companies working to improve their tax behaviour, and that it also serves as a useful resource for investors seeking to ask the right questions of companies to guide their investment decisions.

It's time to place tax management squarely at the heart of responsible and truly sustainable business.

I wholeheartedly agree that we do need to move on. I can quibble with the rejection of base line standards: I think they are both essential and will come, and suspect the quibble may only be on language because of what I note below. But this new approach is welcome because it brings more companies into the debate. Forewords from Unilever, the Ecuadorean Revenue, KPMG and Kepler Cheuvreux help prove that.

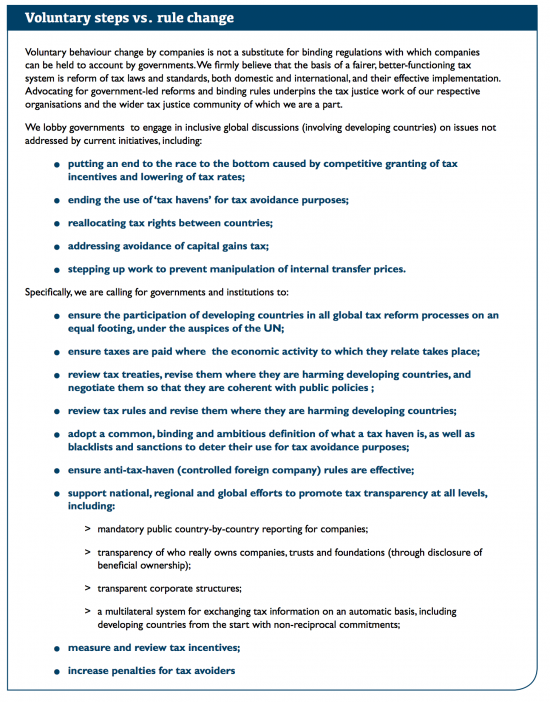

So what does the paper say? This is its summary of demands on government:

Whilst regarding voluntary change the steps required (many of which are elaborated in detail) cover the following areas:

(1) tax planning practices;

(2) public transparency and reporting;

(3) governance of the corporate tax function;

(4) relationships with revenue authorities;

(5) impact assessment;

(6) policy and practice in developing countries;

(7) tax lobbying; and

(8) tax incentives.

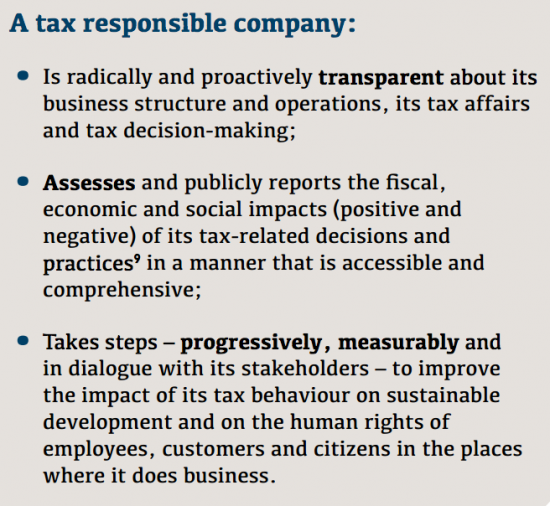

This box may be taken as a summary:

It's hard to argue with that.

This is a welcome and important contribution to debate.

How to achieve these goals, especially amongst those reluctant to embrace the ideas, is the next focus for my attention in this area.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This whole approach can be summed up by asking companies to:

1) Pay tax that is due under the current law

2) Make additional voluntary contributions

Perhaps it might be better to simply change the law or properly enforce or tighten the current transfer pricing rules rather than let companies decide amongst themselves the appropriate voluntary contributions to make?

If you wish to avoid deletion you have got to start being credible very soon Jim

Richard – it’s a serious point. I’m all for corporates paying tax where they do their business. If they can’t be trusted currently and seek to bend the existing rules, surely the answer is we tighten the rules (transfer pricing for example). If we encourage companies to pay what is “fair” of their own accord why wouldn’t they just pick an inappropriate amount? This feels like letting a fox look after the chickens.

Why not go and read the report

Or even the blog before making such comments?

As long as we have the well-used and well-lubricated rotating doorways between government [employees] and government [politicians] we are stuck with the present grease-my-palms-with-loads-of-money situation that we have at the moment.

I expect the above documents to be greeted with cries of “just what we need” and “hallelujah”, after which it will be business as usual.

I have a lot of sympathy with corrupt third world government. At least they’re honest about being dishonest, as opposed to our lot, who are just dishonest.

Rather like the NHS at the moment…just look at all the interested parties carving themselves niches in the budget…just look at the private health interests in local commissioning groups, and the health department !!!