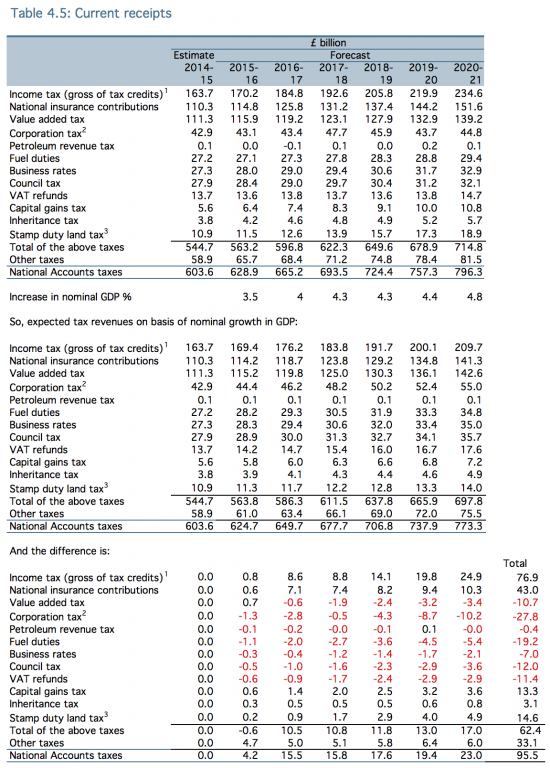

After each budget I have a habit of looking at the Office for Budget Responsibility's analysis of tax forecasts in table 4.5 of their report , which I then compare with what the revenues of each noted tax would be if they only moved in line with nominal GDP. The resulting analysis from this July was as follows:

To be clear, the first part of the table is the OBR data. The second part shows what revenues would be if the 2014-15 estimate grew on the basis of forecast nominal GDP changes alone, which means both tables allow for inflation. And the third shows the difference between the two tables which then indicates where the government expects to take more or less from the economy over the forecast period.

The relevance of this analysis at present is to show whether or not there is scope in the budget decisions on tax to recover the estimated cost of in work benefit cuts of £4.4 billion per annum from other sources.

The answer is very clear: that possibility does exist. Firstly, it is clear that there is exceptional generosity to business in this projection. When the economy is expected to grow corporation tax revenues are expected to fall significantly in real terms. Over the period the cut in corporation tax rates to 18% as well as the anticipated take up of additional allowances, such as those on R & D and offshore finance, are expected to cut the real corporation tax take by some £27.8 billion. By itself that is enough to cover the cost of the in-work tax credits.

Add to this the impact of cuts in fuel duty, which go to all families and businesses with disproportionate likely benefit to the best off, and it is obvious that just these two decisions to provide benefit to those best off in society do, by themselves, cost more than double the saving from cuts in in-work tax credits.

Now of course there are consequences to corporation tax and fuel duty changes, as there are to in-work benefits, but as yet no one has been able to provide any obvious reason bar a desire to encourage international tax competition for more corporation tax cuts in the UK whilst freezing fuel duties simply undermines the UK's programme of beating carbon emissions. Both these moves are, in other words, fundamentally counter-productive to our future well-being. In contrast, cuts in in-work benefits are profoundly damaging to individual well-being now whilst the consequent multiplier effects will be bad news for the economy as a whole in the short and long term.

The evidence is, then, rather blunt. First these cuts in benefits are not needed but are instead a matter of choice because other options are available.

Second, these cuts are deliberately targeted at those on low pay because it is clear that those on higher pay have been chosen to win instead.

Third, at the same time as these cuts are being made those who are on higher pay or who have greater wealth who see the benefits of corporation tax cuts will be enjoying largesse from the Chancellor of greater amount than these benefit cuts cost.

There is then, fourthly, a deliberate policy of upward redistribution via the tax and benefits system in play here.

Fifth, this could be reversed. Corporation tax cuts could not just be cancelled; the rate could actually be increased to ensure these cuts in in-work benefits did not need to take place. And fuel duties could be maintained or increased, especially as sustained low fuel prices are now likely.

There is no reason for in-work benefit cuts therefore. They are just a matter of choice. And it is the corporate sector's welfare bill that really needs cutting.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Quick question of clarification please?

A quick scan of the top two lines in charts one and two show the OBR figures (chart one) returning a larger amount of tax than shown in chart two which assumes only nominal GDP growth. Would it be reasonable to surmise from this that the OBR figures assume a larger than minimal GDP growth?

Should this be the case it would seem reasonable to observe that any failure to achieve growth targets, arising from the about to burst bubble, will result in target tax levels not being achieved. There seems to be a clear over dependence on tax revenues from the rest of us to offset the largest towards those who consider they can never ever have enough money. The coming recession will adversely impact on these parts of the revenue as the source will not be earning enough to sustain those projections.

Leaving the Chancellor with either the options of reversing his largesse towards the parasitic and state benefit dependent wealthy or making further cuts in public expenditure to achieve his now legalised requirement to achieve a budgetary surplus.

This second option would result in deepening the negative feedback loop neo liberalism has created and would result in further reductions in key tax revenue elements vital for the legally required budget surplus.

This could get messy.

I do think the IT and NIC estimates wildly optimistic

Which is another way of saying what you are suggesting

Good morning. The issue of ‘tax credits’ goes to the heart of how a country runs its economy. A nation should be judged not on how many (relatively) rich it has , but on how many (relatively) poor. I won’t waste time trying to explain in my own words, when Bill Mitchell does a far superior job in his customary forensic style today: http://bilbo.economicoutlook.net/blog. Have a great week!

“There is often an over-reach among the right-wing governments that feel entrenched in power. ” I think Bill Mitchell is bang on here. To do something as manifestly stupid as this the Tories must fee giddy with power-we had had Cameron bleating about the great ‘mandate’ he has and after:

Cuts to disability benefits

Bedroom Tax

An Appalling Sanctions regime

All going through without a major social upheaval -that must deepen the sense in which they can keep on hammering the poorest and applying leeches to the economy.

Q. Should a Prime Minister be allowed to lie in order to get elected into office?

It is quite clear he went out of his way to avoid the truth and mislead the electorate. When a PM cannot be believed it should be time for him to go.

Question Time ‘Leaders Special’ April 2015

#1

Audience member: Will you put to bed rumours that you plan to cut child tax credit and restrict child benefit to two children?

David Cameron: No I don’t want to do that–this report that was out today is something I rejected at the time as Prime Minister and I reject it again today

David Dimbleby: You said you didn’t want to put to bed rumours that you were going to cut child tax credits–you meant you did want to put to bed the rumours?

David Cameron: Yes–we have increased child tax credits.

#2

David Dimbleby: “Clearly there are some people who are worried that you have a plan to cut child credit and tax credits. Are you saying absolutely as a guarantee, it will never happen?”

David Cameron: “First of all, child tax credit, we increased by £450..”

David Dimbleby: “And it’s not going to fall?”

David Cameron: “It’s not going to fall. Child benefit, to me, is one of the most important benefits there is. It goes directly to the family, normally to the mother, £20 for the first child, £14 for the second. It is the key part of families’ budgets in this country. That’s not what we need to change.”

I suspect that is what a certain Mr Carmichael MP, from the the Orkney Islands, would class as a mere political lie rather than a personal lie. The latter being the kind of lie that would besmirch the character and make one unfit to remain an MP, whilst the former is perfectly acceptable within the hereditary and feudal British Establishment and therefore nothing for us serfs and peasants to concern ourselves over.

He only talked about child benefit. He didn’t rule out cuts to tax credits.

Wrong

He did not specify any benefit

He left it open ended

I think it could fairly be saying that he was being extremely economic with the truth. Or, that he was being very clever with what he said- you could perhaps extrapolate that he only talked about the first 2 children’s benefits- i.e. by inference he would be cutting benefits for the third + child when the audience would have inferred he was not going to cut child benefits. And again, strictly speaking he did not answer the question in relation to tax credits. I don’t however, think / or hope that the average person is going to credit Cameron with having told the truth

Richard – do you have a view on whether cuts to Corporation Tax have contributed to GDP growth in the way that the Government expected them to?

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/263560/4069_CT_Dynamic_effects_paper_20130312_IW_v2.pdf

That could only happen if they led directly to investment growth

There is no evidence whatsoever that it has done that

But do you of anyone who has unpicked the analysis in that HMT paper I linked to? Or done other analysis on this? Feels like a massive, massive thing (reducing CT by ten percentage points) which isn’t being widely looked at. I was vaguely aware that CT had been going down lately, but was astonished that it had actually gone from 28% to planned 18%.

Sorry Bruce: can you link again for me

This is the paper which models the effect of CT reduction:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/263560/4069_CT_Dynamic_effects_paper_20130312_IW_v2.pdf#sthash.cy6YzM78.dpuf

And this is the original 2010 “Road Map” describing the rationale for dramatic reductions in CT:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/193239/Corporation_tax_road_map.pdf

Free trade is a myth

Only regulation ensures fair distribution of outcomes

Here’s Duncan Smith perpetuating myths about Government spending being a simple transfer of Tax:

““We won’t lift you out of poverty by simply transferring taxpayers’ money to you. With our help, you’ll work your way out of poverty.”

This was in reference to disabled people.

One factor that hasn’t been taken into account is the effect on Housing Benefit.

There is a table at

https://www.lgbp3.co.uk/tcuc2016/tcuc2016.html

which basically shows that a lot of the Tax Credit cuts will be compensated for by increased Housing Benefit awards.

Didn’t think of that did he………….

If this were true there would be no fuss

It’s true that for some HB claimants the TC cuts will be partly offset by increased HB (assuming there are no other changes to the HB regs).

However, there are some important caveats…

1. Many of the affected TC recipients don’t get HB ( not just owner-occupiers but also people living with parents / on friends’ sofas, various reg 9 failures, excess earnings, savings over 16K,etc, etc.. )

2. Those claimants whose loss is partly offset through HB will face a higher marginal deduction rate (Losing 93p for each pound of additional earnings once TC,HB, income tax and NI are accounted for – that compares to 80p in the pound where not subject to HB taper.) That means they’d find it equally difficult (or impossible) to recover their losses from the TC cuts through increased earnings.

3. The offset is subject to floor/ceiling effects – so some TC claimants on HB will see a reduced or nil offset.

4. New HB claimants with children will be hit by a further £589 per annum cut in HB with the end of family premium.

5. Some commentators have suggested that CTR will provide a further offset. This is likely to prove false in many areas as a large number of CTR schemes are expected to be amended to prevent clawback. (TC+HB claimants with a CT liability will in any case face an even higher marginal deduction rate – typically 97p in the pound.)

(And obviously there’s no HB offset against the very significant cuts to UC.)

Thanks

The fuss is essentially because it presents the tenant with a choice between eating and just having a roof over their heads!!

Although the chancellor has taken 1% away from RSL rent income for the next 4 years, private sector rents are still rising. So the so-called higher HB award will go straight to the private landlords – not towards the tenant’s living costs.

If you put the corporation tax rate up on a firm, and you make the capital allowances generous then unsurprisingly firms start spending on investment rather than hoarding profits and paying the tax charge.

So you actually increase investment by putting tax rates up.

Same reason to quit issuing Gilts and offer National Savings.

Would equalising all pension tax relief to 20% produce the same fiscal benefit as osbornes projected working tax credit cuts? this would only “penalise”higher rate taxpayers by definition.

There is a lot of difference between earning 40 k and 140 k ( the proposed pension tax credit treshold) and just as the personal allowance is lost after earning 100k so perhaps should the pension tax relief be regressive by 10000 bands after 40k?so 10-40 k, get “only” 20% tax relief then reduce by 2 % for each additional 5 k earned so that there is no pension tax credit after earning 100k?the current proposal to restrict it for those earning over 140 k does not go far enough in my view as they still get more “pension tax credit”than the poor who might lose 3k”working tax credit”a year.Why isn’t anybody pointing out the unfairness of this particular tax credit ?my understanding is that half the tax relief goes to higher rate taxpayers.

Regressive rates should apply to all taxes and tax credits.

have i got it all wrong?

( of course those with pensions tend to cast their vote)

I have long argued for higher rate relief to be abolished

There is no logic to the savings of the richest being worth subsidising more than the savings of the less well off

I’m sure this is politically naive but the Tories frequently ask where Labour would find the £4.4 bn if it didn’t cut tax credits. The answer should be from those who can afford it not from some of the poorest families in the country. Taking an average of £25 per week from low paid paid workers is the soft option.

Richard-in relation to Duncan Smith saying that tax-payers money is ‘transferred’ to those receiving any type of benefit, is there ANY accounting evidence that this is the case in the whole Government accounts?

Is there any sense in which his choice of language could be seen to reflect an accounting ‘fact.’

There is no way that even in theory the claim can be justified: receipts and payments are not linked in government accounts in that way

Thanks Richard-I assumed that to be the case but just wanted to check it out-so the misrepresentation is total!

(Simon Q)

Firstly, thank you to Jon Blackwell who first put the Tax Credit/HB Tables I linked to into the public domain.

Secondly this piece – from The Telegraph is interesting

http://www.telegraph.co.uk/comment/11951705/Scotlands-small-firms-dont-need-named-and-shamed.html

In particular

It is outrageous that taxpayers should have to top up the wages of employees in some of Britain’s biggest and most profitable companies and the Chancellor is right to seek to end this practice.

Its quite interesting that there are a number of commentators on the right who are – quite rightly seeing the whole business of ‘in work’ benefits for what it is. I wonder if we might see an acceleration of the ‘National Living Wage’ possibly aimed at larger employers or certain sectors eg retail & cleaning

If you give people money and then take it away, then of course it hurts.

But being someone familiar with the Tax Credits system it was always a bizarre and inefficient one. I was always a proponent of a Negative Income Tax System, but of course HMRC were not up to the job (nor for Tax Credits for that matter).

Tax credits approximate to a negative income tax

BUT do so at an appropriate rate

” if anyone tells you you’ve run out of ammunition, we never do.” (Adair Turner re: monetisation of debt)

Worth listening to him talking about his new book which is a sort of demolition of monetarism: http://www.socialeurope.eu/2015/10/what-really-caused-the-financial-crisis-and-what-to-do-about-it/

I have not read it, but think I need to do so

It’s Damescene moment

Do expected tax returns for the next year match the current budget expenditure?

Surely any analysis of current spending should also look at future revenue.

In short, government spending in year 0 is balanced by government revenue in year 1.

So, is it more spend and tax, rather than tax and spend?

To run a gov surplus would seem to invert turn the actual model completely, as it would drain money from previous largesse to the other sectors.

This may be desirable if inflation were a problem, but that’s not where we are now.