The latest report from the Bank of England on the scale of cash usage in the UK economy has opened an intriguing question on UK tax gap.

The BoE has accepted the idea that the UK shadow economy might represent 10.3% of all UK economic activity. They have also noted that this is low by international standards.

The rate is unsurprising: as I have noted the figure is consistent with the UK VAT gap when averaged with the EU version for the same figure. The VAT gap is the one reasonably reliable macroeconomic element of the UK tax gap estimate from HMRC at present.

When I made enquiry of the Office for National Statistics a couple of years ago on the extent of the shadow economy included in UK official GDP I was advised it was at most 1%. This may have increased slightly since then because of the inclusion of prostitution and one or two other items in GDP but the implication of the Bank of England's position and this advice from the ONS is that at least 9% of gross UK economic activity is not reflected in GDP data.

UK GDP in 2014 was £1,705 billion.

This implies unrecorded economic activity of at least £168 billion. Do, however, note that this is only the illicit element: that part relates to criminality is on top of this sum according to the BoE.

Total taxes collected in 2014-15 were £603 billion. That is 35.4% of official GDP.

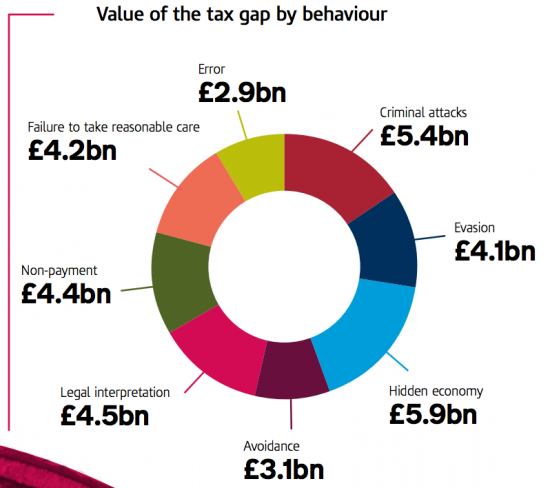

HMRC say that the tax gap is made up as follows:

Criminal attacks are in addition to the 10.3% the BoE describes as the shadow economy.

Bad debt is an unrelated issue as is avoidance and legal interpretation.

I would suggest that failure to take reasonable care and error also fall into the category of systems errors and not the shadow economy.

This leaves just £10 billion of tax lost to the shadow economy by this definition.

This is an effective tax rate in that case of £10 billion on £168 billion, or 6%.

If, generously, I add back in the systems errors but not the criminal attacks that tax rate on the shadow economy that the BoE recognise to exist increases to 10.2%.

I have argued that in practice the tax rate in the shadow economy may well be higher than in the mainstream economy because much of it is top sliced i.e. allowances and reliefs are already claimed. I will ignore that argument here, but I can see no reason at all why the overall rate of tax in the shadow economy as a part of GDP should be less than that for the economy as a whole. If it was, why would people evade?

So the tax due by the shadow economy should be at least £168 billion at 35.4%, or £59 billion.

On top of this there is then, I think, tax due as a result of error and not taking care of £7.1 billion. This does not come from the shadow economy, but is mistakes in the recorded economy.

And tax evasion on activity that does not make up part of GDP i.e. CGT and inheritance tax, which I estimate at £10.4 billion must then be added.

Then there are criminal attacks. Based on official fraud data I make this higher than HMRC at £6.5 billion.

And offshore is not, of course, in GDP so that £4.3 billion needs to be added in for that as well.

Now tax evasion amounts to £87.3 billion.

Then there may be £19 billion of avoidance.

However, I do recognise HMRC say debt may be down this year. Including write-offs internally it may not be much more than £13 billion at present. So we come back, as ever, to a tax gap of about £120 billion.

This is frequently denied. But there is a core question the tax gap deficit deniers do now have to answer and that is given that the BoE now accepts that there is a shadow economy exceeding 10% in the UK, and that it is undertaken to evade tax obligations, how come the tax lost on that is, if HMRC are right, due at only 10.2% (at most, and maybe less) when the reality is that tax on GDP as a whole exceeds 35%?

The claim that tax evasion is as low as HMRC say it is only makes sense if:

a) the shadow economy is only 3% of GDP - which is beyond the bounds of possibility in known macro data by some considerable way, or

b) much of the activity in the shadow economy is exempt from tax - which would make not declaring it pointless.

Until anyone can explain this HMRC claim my own data on the tax gap looks right, whatever naysayers suggest. With the BoE on my side the doubters now have to prove their case, I suggest.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What’s the difference between economic activity and GDP? (I don’t know the answer, but the question was prompted by this rather illuminating video: https://www.thersa.org/discover/videos/event-videos/2015/07/dirk-philipsen-on-gdp/ )The point though is that the numbers and percentages set out here are so broad brush that a minor discrepancy at that primary input stage could be having a huge impact on your final conclusions?

Sorry: that is just not plausible

OK; you’re not prepared to engage on the numbers. How about something where maybe we can agree, which is the recoverability? Would I be right in thinking that although you consider eg the illegal narcotics trade to be theoretically taxable, and therefore part of the tax gap, this is some of how you get to your “only £20bn is recoverable” figure – because let’s face it, a bunch of this activity will just evaporate before you could ever tax it (both illicit and criminal).

Or in other words, the top end estimate of £120bn really is just a theoretical construct – it’s money that couldn’t ever be recovered, because if you knew enough about the drug smugglers and blackmailers and fences to tax them, they wouldn’t be doing it anyway?

If you do not think £100 bn enough allowance for behavioural change I am not sure what is

“This implies unrecorded economic activity of at least £168 billion. Do, however, note that this is only the illicit element: that part relates to criminality is on top of this sum according to the BoE.”

Assuming that by “that part relates to criminality” you mean “the criminal part”, what is the difference between “the illicit element” and that which is “criminality”?

Illicit is undeclared legal activity

Criminal is that

If the BoE uses the 10.2% figure as the shadow economy, you are perfectly entitled to use that figures in your tax gap calculations. In fact it is exactly the right thing to do.

These figures, though, come from Prof Schneider, who has made himself an “expert” trying to estimate shadow economies in various European countries. I personally think Prof Schneider’s estimates are far, far too high.

Because what does 10% of the UK economy, £168bn mean?

If the whole of the shadow economy was made up by people working full time without tax payments, and earning the average wage of £25,000 per year, we would have a total of 6.7 million people living entirely of shadow economy earnings, that is 1 in ten of the population. That is a ludicrously high amount.

However, there is a more accurate way of looking at the £168bn figure.

If, what is more likely, small businesses and the self employed do not report all their turnover, and leave £168bn off their books. That seems to be about 11% of the total turnover of £1,600 bn per year. The small business sector employs 14.4 million people, so the extra turnover per employee in the shadow economy is only £11,700 per year, compared to a average turnover (in the books) per employee of about £110,000.

A self-employed plumber, for example, would have to undertake 117 cash-in-hand jobs a year, at £100 each, to reach that figure of £11,700 a year. Which still seems quite high. But a lot more feasible.

But I still think the £168bn is too high. Because if we accept that on average 11% of turnover is “off the books”, for the larger “small businesses” (from 49 to 250 employees), which have an average turnover of £16 million per year, that would mean on average £1.6 million of their sales is not recorded in their books. That is an unfeasibly high figure.

So the upshot of all this, I still think Prof. Schneider’s figures are too high, but in the absence of any other estimated figures, it is right to use these, especially if also accepted by the BoE.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/254552/13-92-business-population-estimates-2013-stats-release-4.pdf

And what do you say to 10% of VAT being lost?

The implication is that this scale of liss is plausible

The HMRC tax gap report measures the VAT tax gap as follows (from their report, page 17):

“Methods

VAT and excise tax gaps are estimated using a ‘top-down’ approach; by comparing consumption expenditure data with tax receipts. ”

So arguably any of the £168bn are not even measured, because if £168bn is additional sales “off the books” it will not necessarily be recorded in consumption expenditure, I would have thought.

So it could well be plausible that £168bn is not taxed and the loss is enormous. But we do not know for certain, ever. Unless we force everyone to abandon cash and have every transaction paid through a bank account. And even then we will have people using bitcoins or other alternatives, just to avoid paying taxes, as they do already.

So using the HMRC figures there is £35 billion of tax lost each year, £175 billion over a five year term.

I am sure that this is an understatement however it is astonishing that there is no agreed method of calculation, available for public scrutiny.

I also note that Corporation Tax amounted to only 6.32% of total tax in 2014/15, this against the context of rising GDP figures.