I mentioned yesterday how hard it would be for the Bank of England to get rid of cash, as Andy Haldane has suggested might be necessary for monetary policy to work.

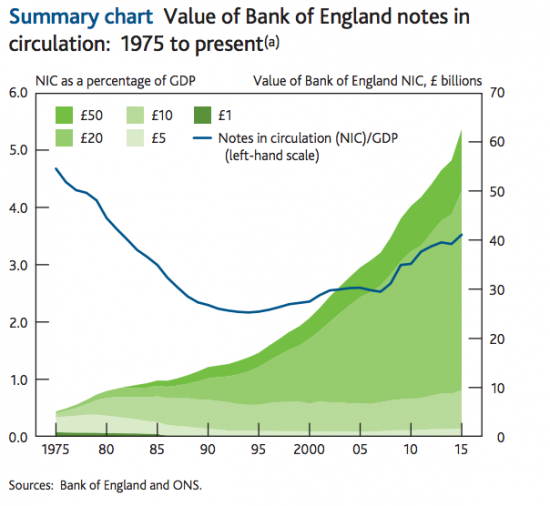

It was odd he suggested this in the same week that the Bank of England Quarterly Report suggested a rising demand for cash (that is notes, especially). As they noted in a new article out last week the demand is up:

And as they say:

The growth in demand has been driven by three different markets.

The evidence available indicates that no more than half of Bank of England notes in circulation are likely to be held for use within the domestic economy for transactions and for ‘hoarding'.

The remainder is likely to be held overseas or for use in the shadow economy. However, given the untraceable nature of cash, it is not possible to determine precisely how much is held in each market.

So the three markets are for legitimate transactions, illicit transactions and overseas hoarding.

The demand for cash for legitimate transactions is falling. As the BoE note:

This suggests that between 21% and 27% of total UK cash was held within the domestic transactional cycle at any one time in 2014. However, as a proportion of UK cash, transactional holdings have been in gradual decline, down from between 34% and 45% since 2000.

And they also note that the demand for domestic hoarding is relatively immaterial (£5 billion).

Despite this they say:

[G]rowth, which has been concentrated in the two highest denominations – £20 and £50 notes – has outpaced growth in aggregate spending in the economy.

And that makes no sense, given the declining demand in the domestic economy, unless the growth relates to an increase in the shadow economy, on which the BoE commentary is (to be polite) naive. They say:

The shadow economy is defined broadly as covering ‘those economic activities and the income derived from them that circumvent or otherwise avoid government regulation, taxation, or observation'.

The source for that is Prof Friedrich Schneider, whose work I have also used. Then they add:

This comprises of two elements: (i) legitimate activities that are concealed from the authorities; and (ii) illegal activities and transactions.

And then they quote a Schneider report for the Institute of Economic Affairs report that estimated the size of concealed legitimate activities to be equivalent to 10.3% of GDP in 2012, with it having declined relative to GDP since the late 1990s. There are two things not mentioned here. The first is that the decline is small. The second is that this figure does not cover illegal activities and transactions. They instead note:

This estimate was one of the lowest of all OECD countries

And that

HM Revenue and Customs estimates that the value of uncollected tax, which includes estimates for hidden activity and tax evasion, has been broadly stable over the past decade

This makes the heroic assumption that HMRC, on a massively declining sample size which they use to make this estimate got it right, and that with a massively declining number of staff the data available from which to sample had not itself shrunk. I think neither an appropriate assumption.

They're also wilfully optimistic on illegal activity, saying:

In relation to illegal activities, data from the Home Office indicate that incidents of crime may have fallen in each year for the past decade, with significant reductions in robbery, theft and domestic burglary.

This is ridiculous data to use: it is fraud that matters here and they appear to be specifically ignoring it to conclude that:

Together, this evidence suggests that activity in the shadow economy has not seen significant growth, so transactional holdings of cash in the shadow economy are unlikely to have been the primary driver of the growth in banknote demand in recent years.

Which is a conclusion in stark contrast with a previous statement in the report that said:

No single source of demand is likely to have been behind the sustained growth. Indeed, the stock of notes held within each of the three markets for cash is likely to have grown.

This comment is hard to understand when they have already said domestic legitimate demand appears to be falling, as noted above, and when they also note that the use of money in the overseas shadow economies is restricted almost entirely to those largely domestically unseen £50 notes that it seems the Bank of England produce almost entirely to assist criminality but which constitute only about 20% of all cash.

In fact, given that the Bank of England specifically endorses the view that I share that at least 10% of the UK economy is in the shade, meaning that the recorded economy that is reflected in GDP is only about 90% of the total and that therefore £180 billion of shadow economy transactions take place a year (at a tax evasion cost of around £70 billion, whatever HMRC might like to say) the explanation for the rise in cash use and holding would actually seem to be obvious. The facts all point to there being a rise in illicit trading in cash, as I have long suggested. In that case it seems to me that the BoE is offering internally inconsistent explanations in its article to avoid reaching that same conclusion when it seems to be the only obvious one available.

So three obvious questions arise.

The first is why the BoE is offering such inconsistent explanations within its own work?

The second is why is it that the obvious conclusion that if domestic demand for legitimate cash is falling and overseas demand is not changing significantly the obvious conclusion that increased demand for cash for illicit transactions is growing cannot be stated, even if it contradicts HMRC?

And third, why is the BoE still producing £50 notes and what is more, why have they no plans to replace them and so withdraw this currency when it is used for largely illicit purposes?

I think some explanations are required.

In the meantime, all I can see is evidence that my tax gap estimates look very likely to be right.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Aah, the shadow economy, where not long ago I could pay a trusted filly with a cheque accompanied by a cheque guarantee card. Now it’s all cash of course.

I recommend reading the summaries of that Schneider report guardian here and iea here

It will give some ideas as to why the sector hasn’t grown, and talks about the high withdrawal rates of welfare benefits which incentivise participation. It will also give some ideas as to how to close the gap and give better estimates as to what is collectible, because it’s clear if as you say you could collect an extra £20bn in year 1, you certainly couldn’t repeat that number in year 2 due to behaviour modification.

In year 2 it the earnings would be legit, of course

“cash accounted for 71% of all payments in the UK 10 years ago.

By 2012, the figure had fallen to 54%”

http://www.retail-week.com/technology/analysis-will-the-uk-ever-be-a-cashless-society/5051837.article

So, no.

But while the quantity of cash is rising, the use of cash is decreasing. An interesting conundrum.

Note that a few large discount retailers refuse CREDIT cards as a payment option; presumably because of the transaction charge?

Gov benefit payments are almost entirely electronic now…and gov charges, like car tax etc, are increasingly by DD.

So cash will not be king for much longer, but its use will remain for a while.

So increased cash use must be in the shadow economy

if you are creating a sanctions regime that reduces people to food bank use and desperation (or the imminent fear of it) its hardly surprising that people turn to illicit cash help when available, albeit illegally-but if you can’t buy a pair of shoes or get food on the table what the bejabbers are people to do-obey the law to the letter?

Richard-I’m aware that you can’t condone law breaking (although Corbyn has spoken of reserving this ‘right’ when sever injustice is the issue) but I think we need to be clear that it is Government that forces this issue when people are pushed into excessive penury.

And I thin we should differentiate between those that break the law in a big way whilst not in an indigent state and those that do-there’s a danger that by grouping this activity together you play into the Tory agenda.

I doubt that minnows working cash-in-hand are a major component of the tax gap. Or even those transacting cash-in-suitcases.

They’re worth chasing, just to keep the numbers down (and to moderate the ‘dodginess’ of the small-enterprise economy) by offering a credible deterrent to all but the desperate.

And. of course, a route to the discovery of crime: but when we get to suitcase-sized transactions, we’ve already got intrusive money-laundering investigative powers.

But I believe the greater part of the tax gap is transacted in plain view, between the banks of London and the tax havens. And, pound for pound recovered, it’s more cost-effective to pursue this than to look for cash.

And the desperate, who cannot be deterred – undocumented labour, sex workers, and staff evading the ‘exclusively-available’ clauses in a zero-hours contract – will still do what they need to do in order to survive.

And that leads to a more general point about the abolition of paper cash, and it’s presumed reolacement with an electronic currency…

Marginalised people are ingenious – possibly more so than the legal and financial geniuses of the City – and those who have been forced so far into the margins that they cannot use a bank account for everything will find a way around the abolition of cash.

Unfortunately, their workarounds will almost certainly be illegal; or, at best, they will involve transacting ‘pseudo-cash’ exchanges with criminals. So the unintended (or intended!) consequence will be a population shift from ‘marginalised’ to ‘criminalised’ – and the marginalised massively outnumber the criminal – and a dangerous expansion in the criminal economy.

On the whole, I’d go with the withdrawal of fifties, and no further, in the abolition of paper cash. And if they all came back to banks tomorrow, I doubt that one in fifty thousand shows the slightest evidence of ever having been counted out of the bundle it was issued in.

.

I think you massively underestimate small business evasion

HMRC think more than 40% of businesses do it

Nearly a fifth of all banknotes are held by domestic banks:

“Data reported to the Bank indicate that £10 billion of cash was

held on average by banks in 2014. This figure has grown by a

third in the space of a decade. This growth partly results from

historically low interest rates which have reduced the

opportunity cost of holding non interest bearing assets.

An additional factor is likely to be the expansion in the

United Kingdom’s ATM estate, which has grown by a fifth

to 70,000 machines in the past decade.”

There are about £60bn worth of issued bank notes. The Bank estimates that half of these are in the domestic economy. So if £10bn of those are in banks, that leaves about £20bn. Of this, the Bank estimates a further £5-9bn is held in safes, tills, wallets and purses for transactional purposes. The figure of £5bn hoarded cash you quote dates from 2012 and may be an underestimate. So, putting all this together, the above-board domestic economy accounts for £20-£24bn of banknotes, and possibly more. That leaves about £6bn for shadow activities.

The Bank’s overseas analysis is considerably sketchier. But they are only talking about half of total bank notes in circulation, so about £30bn, and some of that is held in bureaux de change.

I am therefore struggling to see how the Bank’s figures support your £120bn tax gap estimate.

By the way, if banks are holding vaulted cash as an alternative to other assets as the Bank says, they will be holding it in the highest possible denomination – i.e. £50 notes. And ATMs are notorious for only spitting out £20 notes these days.

It will not surprise me if you decide not to post this comment.

Of course I will post it

But what you seem to prove is that this report offers remarkably inconsistent views and is open to wide interpretation

I am happy with mine

Let me ask you the more interesting question Frances

The BoE thinks there is a 10% shadow economy

HMRC say they lose at least 10% of VAT

How come in that case HMRC can say the maximum loss to evasion is £21 bn (of their gap about £9 bn is avoidance and £4 bn bad debt)?

Total tax yield exceeds £600 billion on 90% of the economy (about 35%)

How come the remaining 10% (£180 billion +) yields 11%

Would ypu like to explain that?

I’m not sure that it’s at all reasonable to link the size of the shadow/black economy with the use of cash.

There’s lots of transactions which go through nearly all bank accounts (including paypal accounts) which are totally legitimate but involve no tax payments at all. Such as: Payments to dependent children and sales of cars and other second hand goods.

So there’s really no difficulty in slipping through a few extra which perhaps should be subject to tax!

Barter also is alive and well especially (so I’m told) in the agricultural community where bales of hay can be paid for in livestock etc. Does that constitute a form of tax evasion?

As inflation falls to nearly zero it makes much more sense to hoard cash in a safe than it did. Recent events in Greece have led many to be suspicious of governments and banks, and even though it’s unlikely to be a problem in the UK it’s hard to convince everyone on that point.