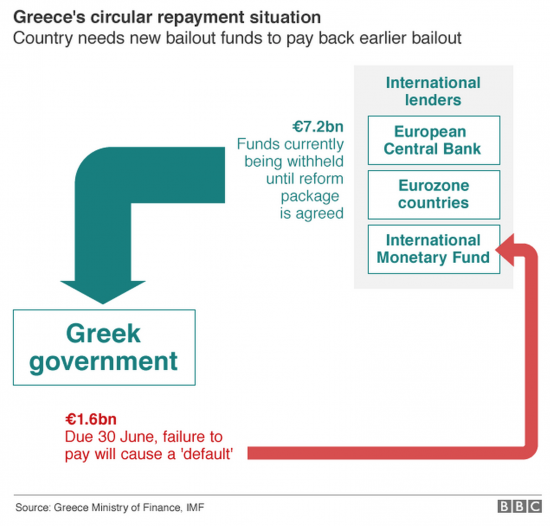

I don't know who created this image for the BBC on Greek debt but they hit the nail on the head:

The Greek debt default that is threatened will happen because the three main lenders - the IMF, ECB and Eurozone countries - will not lend the money needed to let Greece pay the IMF.

Let me be clear: no one ever thought that Greece would pay the IMF itself. It can't. So a game is being played by the creditors here.

The game is that of the bully. Bullies make their victims pay for the bully's mistakes. Greece should never have been lent the money advanced to it by commercial banks, whose debt has now been bailed out by the ECB and others. But they did make these loans and for that Greeks have been enormously punished with their economy trashed and mass unemployment and desperate enormous hardship, all to save the face of bankers.

That is the game that is still ongoing.

And in all this the Greeks and their democratic rights are being ignored and the bankers of other countries, and especially Germany, are instead being treated as the aggrieved when it was their own errors, for which they should be accountable and for which they should pay the price, that caused this crisis. That was because the Greeks could not have borrowed if those banks had not made the funds available in pursuit of their own gain.

No one knows what will happen in Greece yet. But remember the EU is currently printing €1 trillion to keep its banks solvent, interest rates low and boost economies. But it has deliberately excluded Greece, whose debts are utterly insignificant in the context of these sums, from this scheme. Again, that is the politics of punishment. It also shows that this whole crisis is manufactured and wholly artificial.

It is a game bankers are playing to show who us who is in control.

It is a ruse to show that debt is above democracy.

It is a device to show that states must bow to banks.

It is contrived to show people matter less than money.

Remember all that, whatever the outcome.

And remember that all that is being argued about is whether the IMF will or will not, in effect, pay itself, but that this is being used to seek to destroy a legitimate government and its people.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Credit requires neither private bank nor public government risk intermediaries to create it. The true source of credit is not the middlemen/intermediaries but the value in use of land and other productive assets, and the productive capacity of people.

In my view we need new (in fact very old) agreements and protocols to mobilise productive people and productive assets. We also need updated forms of the (‘stock’) credit instrument which pre-dates all other instruments such as equity, debt and derivatives. Such social contracts and instruments may be introduced bottom up starting tomorrow because they are complementary to existing agreements and instruments.

This presentation recently in Paris at the Ouishare conference outlined this networked & bottom up approach

http://www.slideshare.net/ChrisJCook/open-capital-2015

Most of the original Greek sovereign debt was held by Greek banks. If they hadn’t been bailed out then the Greek banking system would have failed, ordinary Greeks would have lost their savings, and the Greek economy would be in even more of a mess than it is now.

So it’s simplistic to blame “the banks”, and just wrong to blame foreign banks.

Respectfully, that’s just wrong

The issue was the commercial debt from other countries

The internal debt was solved by a haircut long ago

Foreign banks lent to Greece and indeed (check Goldman Sachs) played a role in misleading others on the state of Greek finances. Instead of being forced to take a haircut, their debts have been substantially bailed out by the EU and ECB – private sector finance bailed out by public finance.

In other words, much the same as in the financial crash. Reckless and dishonest bank lending and speculation, bailed out by the public … so those banks can continue much as before. Whilst CamBourne and co continue to blog the kinds of actions needed to tackle the banking sector

No it is not simplistic to put banks in the dock – and of course the Greek state is also a big part of the problem. But they should not have been lent to in the past without the reforms now been attempted. Just as NINJNA loans should not have been lent by banks

Agreed Robin

Good to meet you last week

Ciaran, I think you need to look at this issue again…

http://www.attac.org/en/Stories/greek-bail-out-77-went-financial-sector

My thoughts on the IMF are unprintable..

http://www.zerohedge.com/news/2015-06-19/imf-humiliates-greece-repeats-it-will-keep-funding-ukraine-even-case-default

http://www.zerohedge.com/news/2014-07-14/guest-post-real-purpose-imf

http://www.economichitman.com/pages/bookpages/thebook.html

Am I the only one looking at a return of the Junta?

After all, Greece has disproportionally-sized military….about 4-times larger than its population would suggest is needed, and a substantial military reserve.

With a population a sixth of the UK, Greece has a larger military manpower than the UK.

A look at their defence budget reveals about $6.7 billion annually, for Greece, against $51 billion for the UK.

Things look interesting on the Greece/Russia front….especially as the Russia-China V US/EU problems are getting greater by the day.

Uncommented upon is that the “countdown-clock” is at 3-minutes to armageddon….back at the same point it was when the US was considering a space-based anti-ballistic-missile system in 1984.

I do share that fear

This may be a simplistic view – but perhaps it’s time to have a moratorium for a while on all interest rates on debt. Low rates (like savers get!) or none, preferably.

To be borrowing more to be able to pay back loans is neverending. Unless of course the whole indebtedness is being carefully calculated:

“Give me control of a nation’s money and I care not who makes the laws”

Anselm Rothschild (1744 -1812)

A major economist Mr Gailbraith says what actually happened:

http://www.socialeurope.eu/2015/06/bad-faith-why-real-debt-relief-is-not-on-the-table-for-greece/

The people who paid for what the bankers did, were the poorest, the oldest, the sickest, the disabled, the young, all business however small.

Capitalism has been wiped out in Greece by the EU.

Now the IMF and EU demand that the lowest pensioners get a third more cut from even that few bit of money.

But the cost of everthing has shot up, there is no basic tax allowance and multiple taxes leveied, with VAT (FPA) ever growing.

With the Drachma and without the EU, Greece was far better off in the past. Shops full of customers, roads full of new cars, and a thriving community.

The EU has destroyed most of Europe, and will do the same to the Ukraine, already in debt.

“And in all this the Greeks and their democratic rights are being ignored and the bankers of other countries, and especially Germany, are instead being treated as the aggrieved”

Richard, that so echoes with anthropologist David Graeber’s finding that this very moral dilemma has echoed in all societies the down throughout the ages…

Namely what is least immoral. Honouring a debt (and by doing so dishonouring political promises made to the people) or honouring the will of the people (and in doing so dishonouring the debt)?

I highly recommend his BBC Radio 4 series “Promises, Promises: A History of Debt”. (the title says it all with what’s going on in Greece right now) is still available on BBC I-Player…

http://www.bbc.co.uk/programmes/b054zdp6

Virtually each country of the EU owes one another money. Each charging interest on the said amounts owed.

Is it not possible to find the “Highest Common Debt” for each EU country and simply “Erase” that debt. None of the countries would suffer as such because they would all have that amount wiped of their debt’s.

Obviously this would mean the loss of “Perceived” interest on the money owed, but at least it would assist those countries in trouble.

Thought’s?

Interesting

But I can’t see it happening because Germany owns too much debt

That should be irrelevant as it would be “Pro Rata” ALL countries would benefit from the same reduction amount. I think it would take a genius to work out how much the amount would be though.