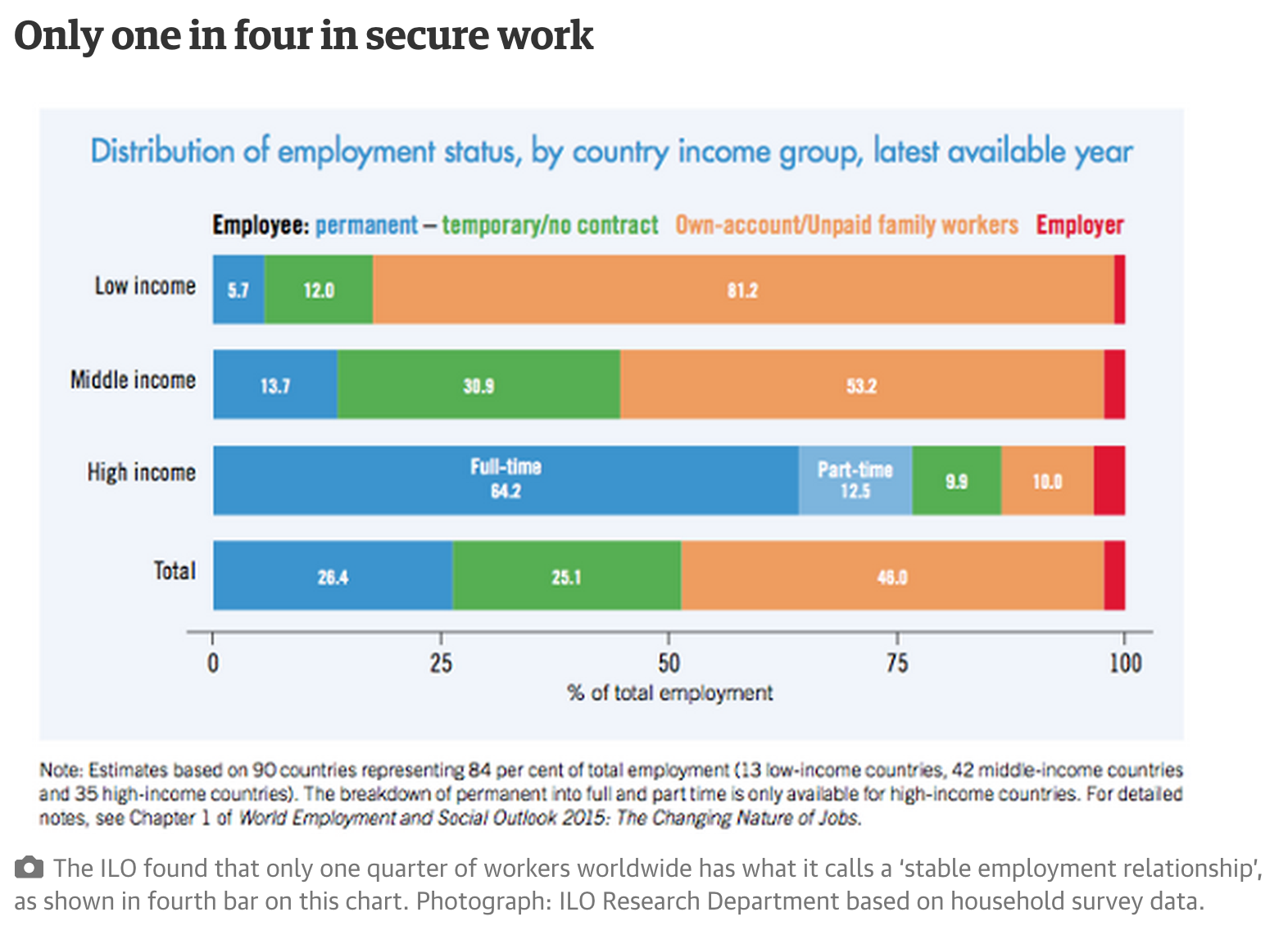

As the Guardian has reported this morning, the International Labour Organisation has issued a new report whose finding is that only one in four people seeking work achieve the goal of secure employment. The Guardian summarises their results with reference to an ILO chart as follows:

The trend towards temporary and self employed work is growing. This is important, but perhaps most importantly because the lens through which this issue is being viewed is wrong, in my opinion. The International Labour Organisation is looking at this as a work issue. And of course, to some degree, it is. But it has also to be viewed, at least as appropriately, as a business issue.

Anyone who is self employed is in business.

Many of these on temporary contracts are in pretty much the same position: they just have one short term predominant customer.

Such people are not just suppliers of labour though; many will also be suppliers of capital. Some of that capital will be tangible. Some will be knowledge or human capital: in the current economy the difference is largely semantic when it comes to relevance.

The fact is that what this report says is that at least 46% of the people engaged in economic activity in the world are in business on their own account. It is only one in six in the UK, rising to maybe quarter when those on temporary contracts are considered. But this is important for several reasons.

First, in the context of this blog, unless we know how to tax the self employed we can't tax this effort appropriately. It's as blunt as that.

Second, given the higher rates of prevalence of tax evasion amongst the self employed than amongst employees this trend has implications for tax gaps, the imposition of tax and the size of the state (it will not be coincidence that states with higher employment rates have larger government sectors).

But third, and perhaps most significantly, this perception changes the whole rhetoric about wealth creation. How can the wealth creators be those working on very highly paid employed contracts with guaranteed bonuses when they are the most removed from risk? Surely they are the furthest removed from being described as business people in this world view? Where is their down side? For all practical purposes there is none: even their futures are guaranteed through pensions that provide security to them and their families, come what may.

Don't get me wrong: I am not saying these people do not have abilities: they do. But so too does the person who has to provide for a family with no security at all where all their ingenuity has to be brought into play precisely because there is no guaranteed outcome, whatsoever.

If business is characterised by risk taking (and by and large it is) who are the real business people? And who are the wealth extractors? The question is genuine because the answer is so important to our economies, our politics and our tax systems, where the taxation of rents has traditionally been accepted at higher rates. And I think we have that answer wrong. It is the self employed and the temporary workers who are the real wealth creators almost precisely because they are the main repository of risk within the world economy.

And if that's right then when someone wants to talk to business people the self employed have to be at the table.

And when someone wants to get tax for business right they are the main people to consider.

It's a big issue. It's one I need to give some more attention because it is some time since I wrote this, which was my last major foray on the issue.

And why does it matter? Because these people could decide elections, and so tax systems, and so the shape of society. That's why.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

http://thosebigwords.forumcommunity.net/?t=50691165

The whole narrative of “risk takers” is nicely taken apart in this post, by a friend of mine

I like the last line

I like all of it. Should be more widely discussed, as you are doing here

Yes. The wealth creators are the capitalist class. Those who put their own savings on the line, or who are only paid once money is made. The fact that this class consists of lots of not well off self employed people is beside the point. The class which gets paid up front, and regardless of whether money is paid and thus takes less risk is the worker class. And that is true even if they are highly paid executives. It is the level if prior investment and risk taking which separates the two groups in how we consider them, not how well off they are.

Yes, if we conveniently forget the generous state subsidies, grants and tax breaks that big business can claim…and often do.

@ james g.

I think that is out and out nonsense. The risk takers are those with no power over the decisions which determine their lives: there is no greater risk than handing your security over to someone else, in the hope that their interests align with yours. They don’t, at bottom.

Agreed

But what is a worker risking? If you have nothing, can you risk anything?

For goodness sake Chris…………..

So that rich investors and even poorer ones can have a level playing field (even though the law puts them above any other consideration anyway), more ordinary working people have to put up with more uncertainty – a less level playing field.

Consider my position. When we had our children between 2003 /2005, having bought our first house in 2001 after saving up for a deposit, things were quite stable in the economy and jobs were plentiful with pay in my sector and many others going up. We based those decisions on how things were at that time – where State expenditure was mixed with private to produce a functioning economy (although house prices were overheating). Everything else we insured for – illness etc.

After the 2008 crash and especially from 2010 when the Coalition got in and started to bring in austerity, those decisions of ours to go into debt for a house, work in the public sector and have children were essentially put at risk. We lost what little tax credit we were entitled to; our pay was frozen (mine was cut) and of course inflation rose as the wider economy began to slow down. VAT went up to 20%.

So what were things we could afford and wanted to do have become more like liabilities that if we were to endure more cuts would make life very hard indeed and end up with us joining the ranks of the unfortunates to whom this has happened already. And it won’t matter how hard we are working or anything like that.

We are by no means the worst case – I’m not saying this to attract pity – we have not had to use foodbanks as we’ve always made our own food but my partner and I buy second hand clothes and our elderly parents have helped us out with major crises here and there.

What I’m saying is that even lower middle-class well educated people like my partner and I have felt the pinch because of this obssession with austerity and a desire to use the financial crises as an excuse to shrink the public sector as well as the intention of the Tories to reshape this country as a low wage economy.

This sort of economic brutality from the Tories who plan to do more of this is what makes aspirations to own a house or to have kids so risky. You may not be able to afford what you set out to do because some stupid politician does not like the sector you work in or wants to cut your wages even though they tell you that they back ‘hard working people’ and want to have a ‘property owning democracy’.

And all that will come from this is ‘Oh, didn’t you think of this or that before you had kids’ or ‘Were you sure that you could have afforded a house’. The assumption will be that we have made the mistake – not that our aspirations have been taken away from us by nasty and stupid economics from Tory and Lib Dem politicians.

Others will say ‘Oh, life is like that ,what did you expect’? Well yes, I accept that awful things can happen throughout one’s life, but when they are done deliberately to you by more powerful people for no other reason than helping investors cream off more profit by reducing the living wage or for working in the wrong sector I say NO! I do not accept that – I do not accept that at all.

Hurting people in this way just to reshape our economy is totally unnecessary – whether it is my family or anyone elses.

https://www.youtube.com/watch?v=LIh5dUOz824

That is a song about the relative risks, Chris Dixon.

That is why trade unions matter

@MarkC

The problem, Mark, is that you based your financial decisions on a lie. You were told by Gordon Brown that the public sector expansion he oversaw was both sustainable and affordable. It turned out that it was neither.

You trusted him with your future and he let you down. Blaming the Tories for that (and I am no Tory) is blaming the wrong person.

Hang on – who marketed the lie?

The entire financial services sector for a start

And did you not notice it was pretty much the same across the whole of the West

Gordon thought he was powerful but he was nowhere near as powerful as you are suggesting

And increasingly, not in the middle either dependent on what sector you are working in. There is a big debate about the shrinking of the middle class because increasingly in the West it may be shrinking. Most people I know of are 1 to 2 pay cheques away from being skink. If this trend continues, increasing numbers of us will be on lower wages than when we started our working lives in the first place. The cycle of becoming secure in older life and building up wealth for our families to pass on will be nigh impossible for more and more people.

The middle class IS the economy as Robert Reich’s film ‘Inequality for All’ and others points out.

The lack of rainy day funds is a massive issue

Ed note:

If you wish to be facetious I will delete you

And have

Sorry but one final observation.

What we seem to be facing is that the aim of the Tories is that all of the UK’s workers are seen to be ‘temporary’ – and I’m not kidding either.

Hi Mark – Is there any chance you could provide some actual evidence for your statement? On the face of it the remark seems ridiculous. What legislation have the Tories proposed to make all UK workers ‘temporary?

Supply side reforms have sought to achieve this goal

Please don’t deny what is obviously policy

Andrew

David Cameron himself has said this earlier on in the Coalition government – he saw low wages as THE way for us to compete on the global market. All you have to do is Google it and you will find him speaking those very words.

A properly ran Labour election campaign (the Greens too) could have had a field day with that speech – ensuring that the British public knew that their Prime Minister is prepared to sell the talent and the hard work of his citizens and their children on the global labour market for peanuts.

I don’t want to be rude, but instead of me having to provide you with evidence, why don’t you GOYA and do some research? It might be because you are one of those people who relies on the Daily Mail, Sun, The Times or the Telegraph for your ‘education’ and that you subscribe to the lazy consensus dribbled out daily in those rags. Apologies if this is not the case.

On this blog, Richard provides all his arguments based on facts – not dogma – so when we observe and comment on matters we do so based on evidence – not mythology. We think for ourselves here. So go on Andrew – go and see for yourself. Take control of your knowledge and become an informed citizen.

My tirade above recounting how life has got harder for my family under the last government and could get worse under this one is trying to explain the process of the destruction of affluence and security lower down the social strata in this country. Not only will it harm me and my family’s aspirations, but it will remove spending power from the general every day economy as more people like are affected. That’s how you create a recession.

Worth noting that one of the last acts of the Coalition was to restrict zero hours contracts. It’s no longer permitted to hold employees to exclusivity if you don’t offer them work.

Only to spoil a Labour initiative

Would not have happened otherwise

Will it be enforced?

Certainly. That is what a “flexible labour market” means, in english

………and finally, what I describe above is how you create INEQUALITY.