This is a guest post by David Cobham, who is professor of economics at Heriot-Watt University, Edinburgh. He co-edited the ‘Economic record of the 1997-2010 Labour government' issue of the Oxford Review of Economic Policy, spring 2013, and is co-organiser of the www.coalitioneconomics.org website, on which a companion pice on Monetary Policy Under the Coalition is published this morning:

- Labour caused the financial crisis in the UK:

No, the crisis was essentially international, that is US, in origin, but spread abroad mainly via other countries' banks' purchases of the asset-backed securities into which US sub-prime lending contracts had been bundled.

- Labour caused the financial crisis by lax financial regulation:

Poor regulation was certainly involved but most of the deregulation in the UK had been done under Thatcher and Major, and the Labour government was typically accused of being too strict rather than too lax by the Conservative opposition. If only Cameron and Osborne had gone around in 2005 clamouring for more regulation!

- Labour caused the crisis by overspending:

No, the evidence suggests that the Labour government may have allowed a slightly stronger rise in spending relative to GDP than might have been desirable in the mid-2000s, but this was not a large rise and in any case it was not a factor in the causation of the crisis.

- Labour allowed the public finances to get out of control:

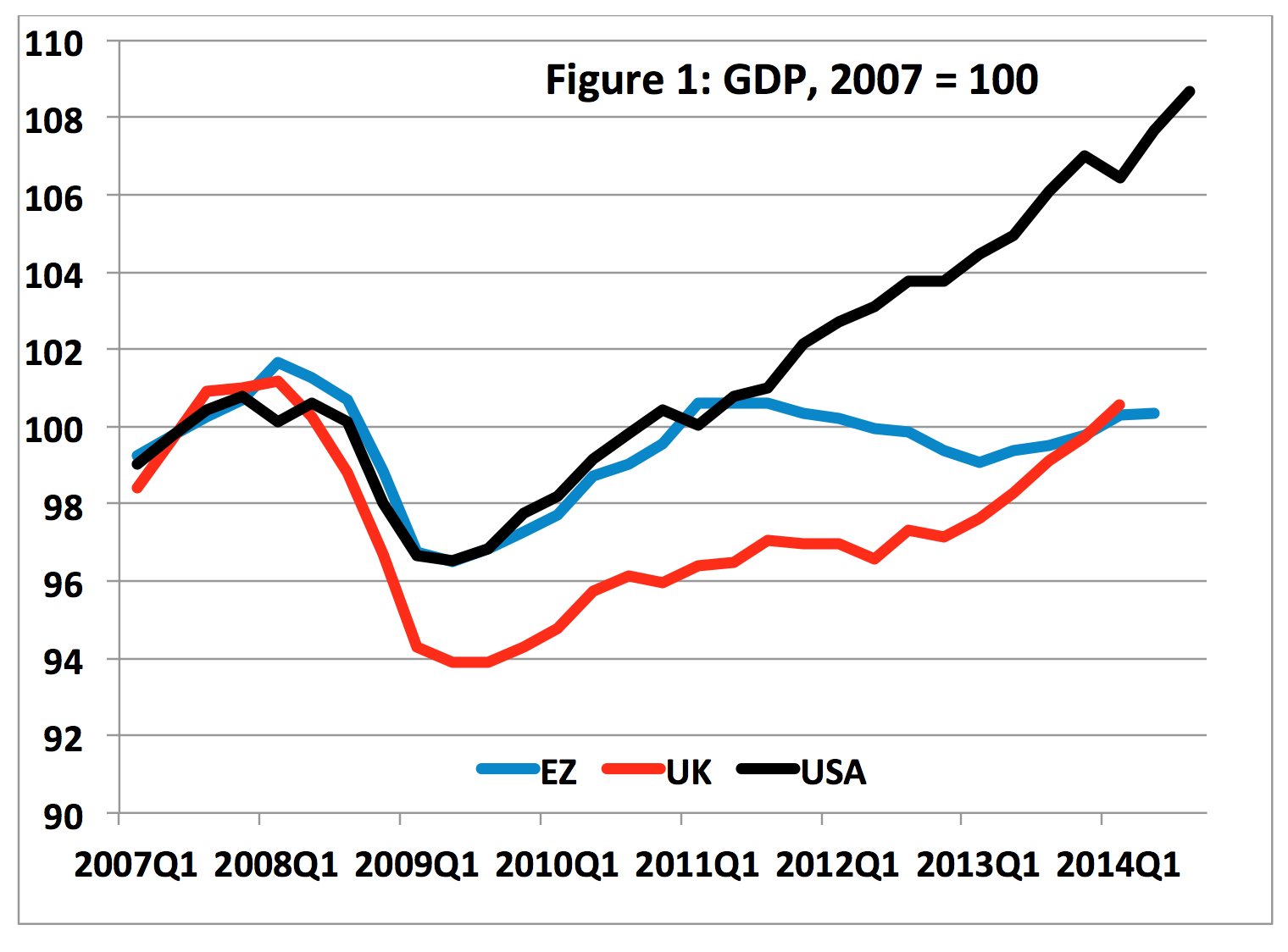

No, neither the budget deficit nor the stock of debt outstanding (relative to GDP) were particularly or dangerously high before the crisis; the deficit rose after the crisis struck, partly because the Labour government did some limited fiscal stimulus (especially the temporary cut in VAT over 2009) but mainly because income and corporate tax revenues coming from the financial sector fell sharply from the crisis; in any case, fiscal stimulus — along with monetary stimulus, which started under Labour but which the Conservatives have tried to intensify — is a normal and sensible response to a once-in-a-generation crisis. Under Labour the UK led the world through the G20 in responding to the crisis, and the fiscal and monetary stimulus carried out in the US (but in the former case aborted by the Coalition in the UK) is one of the principal reasons why the recession has been so much less deep and less long in the US than in the UK, see Figure 1.

- Public expenditure had to be cut under the Coalition to prevent an even worse crisis:

No, there was no need for immediate fiscal consolidation, that should have come after the economy had had a chance to recover; consolidation was not required to prevent a Greece scenario, which was never plausible for the UK (with, for example, the much longer maturity of its debt, its better tax administration and the much lower starting point for the size of its debt), nor was it required by the government's new fiscal rules (which excluded capital expenditure); instead the Coalition's fiscal austerity knocked the nascent recovery in 2010 on its head.

- The UK's economic recovery shows the Coalition was right:

No, the recovery has been exceptionally slow and partial, with the living standards of much of the population seriously depressed (and not yet restored); the recovery such as it is is due mainly to (a) Osborne's decision in 2012 to go slow on his fiscal consolidation plans, and (b) the slow and imperfect self-adjustment processes that can be expected of a squeezed market economy, together with (c) some small effects from the monetary expansion that the government desperately sought to engineer (via Funding for Lending, Help to Buy and Forward Guidance); and the fall in unemployment (in many cases into part-time and insecure employment) is in part the result of welfare cuts and pressures that ‘starve people back into work' in lousy conditions.

- The UK economy is returning to prosperity and growth:

No, the current recovery in the UK is slower than previous recoveries; almost none of the ‘rebalancing' which the economy needs and the Coalition said it would bring about has occurred; and the recovery is associated with a much worse productivity performance since the crisis than other members of the G7: employment has increased but it is not generating the output which it should nor paying the wages which people want and deserve.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is the best blog I have seen about the economy but lets face most of your blogs are very goodt

Very interesting but of course this is not the story that is widely perceived thanks to allowing the right wing press to hammer home that it was all Labour’s fault. I particularly feel for Gordon Brown who has received a very bad press as chancellor despite the leadership shown in the immediate aftermath of the financial crisis.

Milliband should have been banging on about number 5 in PMQs ages ago. Not doing so allowed Cameron to say Labour were ”didn’t want to talk about the economy”.

This is a clear demonstration of the capture of the political process by the dead hand of Neo-liberalism. From the eerie silence of Ed Miliband on this – I suspect Labour strategists have weighed it up and thought of the tidal wave of counter claims the media might make and get traction on e.g. “You let Fred Goodwin ruin…”, the Paul Flowers’ story, Blair’s personal wealth, the Labour spin doctor is a non-dom etc. Also Labour leaders are signed up to IMF, BoE, WTO, US Fed’s mystical explanations; Ed Balls and Osborne rub shoulders in supra-Govt meetings – Bilderberg – outside the [democratic] process. The Ed’s want their seats in power.

Spot on!!!

Spot on

But it does not take much analysis of readily available data to work this out. The killer question is why virtually no commentators or politicians are hammering these points, with Danny Blanchflower being one of the few exceptions. They’ve all been ‘captured’

When the analyses of the causes are so profoundly wrong, little surprise that most of the proposed solutions are equally misguided – and just plain ideological

Oh dear – I think I’m reverting to my radical 19 year old self!

@Robin: the process of capture and being taught what is acceptable, nay “profitable”, behaviour has taken a long time to accomplish. An historic achievement. Alternatively one can take the view that raw capital is the norm and post-war years, to the 1970s in the western world, was an exception of free market behaviour.

Many *Commentators* may fear they are in the same predicament as all workers and recognise the dangers of sticking their heads above the trenches, in fear of losing their jobs or not progressing. The Establishment has shown how Whistleblowers are dealt with and the reward for very good boys and girls — uber riches. As for *Politicians* – many are in Faustian pacts and again see progression in life as dependent on those above who can advance their careers. Only a few [today] have the confidence, self awareness and wit to see beyond that and are prepared to take the consequences. Trade unions are so weakened their voices and champions too infrequently heard (Mark Serwotka et al). In fact have we heard or seen trade union voices on telly (not that I can bare to watch). In public sector management meetings there is often an “industry friend” or “knowledgeable advisor” who is all too ready to put down those who drift from the “real world” or ”business friendly” or “that won’t make profit” dialogue. The right always commented on the “political commissar” in trade unions, now it’s the “Neoliberal commissar” who watches over the little people to keep the project on theme.

All 7 “rebuttals” are full of holes. I haven’t got time to go demolish them all but the one that always strikes me as particularly ludicrous is #2.

What Thatcher or Major did, or what the Tories would have done hypothetically had they been in power, is irrelevant. The fact is that Labour not only failed to reverse the deregulation of the 1980s and 1990s (thereby implicitly approving of that deregulation) it actually went further in many respects. For example, the creation of the “tripartite” system of regulation is widely seen as a toothless failure.

#2 might carry weight if you are speaking to someone like John Redwood. But for everybody else it’s a perfectly legitimate argument to make.

Are you defining “everybody” as “you”?

That makes this argument work

Nothing else does

No, I’m defining “everybody else” as everybody apart from those who were publically calling for less regulation (e.g. Redwood).

You demonstrate one of the right’s most contemptible characteristics; hypocrisy. For people who talk about responsibility, it’s strange how right wingers refuse to take any for the abject failure of their ‘the market always knows best’ ideology which caused the 2008 crash.

Point 2 is perfectly valid; the grounds for the crash were laid by the previous 18 years of right wing anti-regulation politics from the Conservatives. Had Labour adopted much stricter regulation of the finance sector, people like yourself who now say Labour didn’t regulate enough would have been screaming about the ‘nanny state’, ‘strangling enterprise/competition/entrepeneurship’, and so on.

In fact, isn’t it the case that the same Conservative politicians who like to blame Labour now were saying before the crash that deregulation should have gone even further? Hypocrisy and dishonesty from the right, as usual.

Regarding (3) would you agree that GDP was significantly inflated by a credit boom fuelled by private borrowing? Given that do you think debt/gbp is a good way of looking at Labour’s borrowing?

Do you think Brown was wise to run deficits 2002 to 2007?

I have answered these questions many times

Richard,

Your site is normally excellent, but this blog is in a class of its own. I nearly stood up and cheered.

What depresses me most about politicians (of all parties) is their skill at misleading without directly lying. So when a Conservative talks about “the mess we inherited from Labour”, there was certainly a mess. But it implies, without actually stating it, that the mess was CAUSED by Labour.

Thank you

And I did not write it! David Cobham did

‘consolidation was not required to prevent a Greece scenario, which was never plausible for the UK’

Not least because the UK has its own currency

The Labour Party must take some blame for allowing the Tories to get away with this narrative. They spent the summer of 2010 distracted by a leadership contest, and notwithstanding one speech by Ed Balls, allowed the Tories to set the agenda. By doing this, they almost certainly lost any chance of winning the 2015 election. But in the five years since then, there has been no attempt to create a narrative that non economists can follow, or even shout every time the Tories blame Gordon Brown for the global financial crash – “Oh No he didn’t.”

Depressingly Stephen, that is the case, and it’s probably one of the reasons Labour, despite the awfulness of the coalition, is still on only 33% of the vote. Labour should know that the Conservatives, and their fellow right wingers, will shamelessly repeat the lies about Labour’s so-called responsibility about a financial crash that was in fact caused, as I pointed out above to Douglas, by the right’s very own neoliberal ideology.

Whu dies it take the smaller parties like the SNP, Greens and Plaid Cymru to whole heartedly oppose the ‘austerity’ agenda?

*Point 1* It seems incredible that Labour does not explain [silence] it was financial deregulation, starting in 1970s by Reagan and Thatcher et al. Incredibly foolish, but hypnotic to the elites, to squeeze more out of the Financial system e.g. see repel of Glass—Steagall Act in 1999 (Clinton era). The US economic research literature [most behind pay walls] prior to 1999 actively down plays the “safety net” role of the Fed if Glass-Steagall were repelled. The defense of their “intellectual position” is now more through blather, lies, bullshit and silence.

I wonder what the elites might say to letting alcohol manufacturers’ be totally deregulated — alcohol in our cornflakes? 🙂

The suspicion is strong that Labour (and the other parties and their politician) don’t actually understand anything like enough of what is going on, especially where it concerns economics. To begin a discussion in terms of anything other than currently popular economic policies, they would either have to admit this or be found out by their arguments falling short of competence. It would also lead to an admission (oblique or otherwise) that our politicians don’t have much control over anything other than the policies they inflict on the general public and that their hands are basically tied by those that control and own both corporate and private wealth.

Myth Number 8 – The UK was in total economic chaos before the competent Tories took charge.

In reality, in Labour’s final year in power there was a 2% growth in GDP! In fact, in Alistair Darling’s final three months as Chancellor, GDP grew by a whole 1%. The decisive crisis-management of the Labour administration in 2008 allowed the country, even by 2009, to return very swiftly to a level of growth which it still remains near (current estimates put growth at 3%). In every quarter, from mid-2009 to mid 2010, growth steadily increased on the previous quarter.

It was only after Osborne launched an ideological programme of cuts that the country was plunged back into recession, from which it only now recovers. After the 1% growth in Labour’s final quarter, Osborne managed to halve this in the next quarter, and then reduce growth to exactly 0 by the end of 2010. By the second quarter of 2012, the economy was actually shrinking again.

For more, or to see it graphically – http://www.tradingeconomics.com/united-kingdom/gdp-growth

Reality has no relation to Cameron’s line that “it was all terrible, then the Tories fixed it”. In fact, the situation was steadily improving, until the Tories butchered it.

Agreed

Perhaps the best way to make this point is graphically and sarcastically –

http://generationvent.blogspot.co.uk/2015/04/did-conservatives-save-economy.html

Good work

What does ‘EZ’ stand for on the GDP graph? Is that meant to be ‘EU’?

EuroZone