I have looked at the Labour and Tory manifestos and commented on LibDem tax plans. Now it is time to look at the Greens, whose manifesto is considerably more detailed on this issue than others. I have selected elements to highlight by copying the text: for some reason I can't copy text from the document.

They start by saying (click for larger versions):

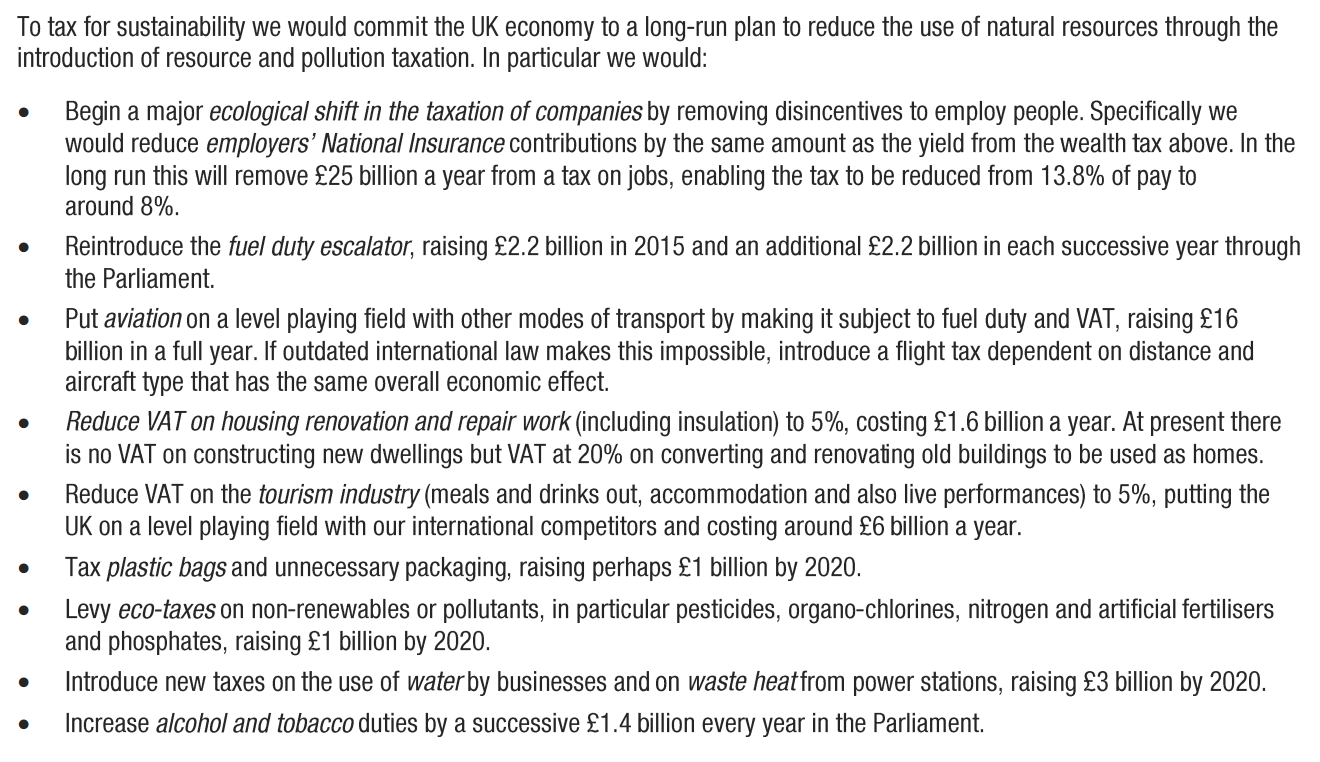

And continue with:

And they then suggest:

That's a mighty big package. And it is costed in detailed notes in the manifesto: that's a significant innovation.

For regular readers of this blog some of these proposals will seem very familiar: there is no doubt that the Greens have been here, and seemingly often. I almost feel it necessary to say that this is not my work for that reason. But there are as a result many welcome features to the package, not least being the commitment to tackling the tax gap with more resources for HMRC.

The Tax Dodging Bill campaign is something I support and so I welcome that too.

Moves against the tax abuse industry are overdue as are moves to reform council tax and to introduce land value taxation, whose time has come.

I have long argued for a cap on tax relief on high pay, and welcome it and the NI thresholds has never made sense although some reconsideration of income tax thresholds may be needed as a result, in my opinion.

An increase in the corporation tax rate is logical and necessary. I may not go quite to 30%. The yield may be a little high, but not implausible with additional HMRC inspectors at work.

As I have mentioned in comments on the blog in the last day or so, I would also look at the CGT allowance which has no economic or social justification in my opinion, but might allow a small sum to be retained for admin ease. £3,000 would more than cover that.

The inheritance tax reform is a valuable step in the right direction.

I comment relatively little on green taxes here: the package looks reasonable.

And so we come to the wealth tax. I support the idea. I have no idea if it would raise £25 billion at present. But, and this is key, that does not matter. The plan is to use proceeds to reduce employer NI and so price people into work. If the NI adjustment is based on actual tax yield then the plan is neutral but remains radical tax thinking at work because this is a deeply progressive move designed to enable many to have opportunity without practically threatening the relative well being of those with plenty, for whom relative well being is all that matters. I stress details would need to be worked out, but this seems to be a plan with mileage in it.

I am of course well aware that this plan will not result in legislation. So are all Greens, I am sure. But it is a useful contribution to debate and for that reason I welcome it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I am really impressed with the Greens, both in their core ideas and in the way they are presenting them to the public, both in written form and in live interviews/debates. There seems to be a greater respect for their audience in the way they present their ideas- very refreshing.

I appreciate their approach and I wish there could be a grown up debate about how big the state should be. I would love to see the Conservatives address the points raised in this manifesto head-on, instead of simply dismissing them as ‘unfunded’ or ‘job-killing’ without actually talking about the underlying issues.

There may be very good reasons to disagree with these ideas- the size of the state as a share of GDP is a legitimate point of disagreement between some very smart people- but disagree with them in a substantive way.

Richard

I hope that you know me well enough now to know that I don’t ask for your views in order to shoot your down or be a pedant.

So, Jolyon mentions the Laffer curve in his latest blog in relation to effective tax rates/tax takes. Is the Laffer curve something we/the Greens/Labour should pay attention too or is it in your opinion part fo neo-liberal mythology? I get the sense that you do have reasoned views on the rate of taxes.

Thanks,

Mark

Mark

There is, of course, a Laffer curve

Yield can fall

Academic research suggests that is unlike;y at rates below 60%

I think that is as far as it can go

I personally would back off slightly before then

At the rates Jolyon talks about I think he is wrong to refer to a laffer effect

Richard

Interesting – thank you. I suppose the ‘Laffer limit’ makes the spread or extent of activity covered by taxation even more important than the actual rate. And this in turn makes tax avoidance and evasion even more of a problem.

I thought you’d said the Laffer curve was bunkum 😉

Anyway, since the Greens propose to raise the upper tax rate to 60% AND remove the NI upper threshold, you will be telling them that’ll reduce revenue then?

Why do you make up what I supposedly say

And you will note I expressed my concern at the Green’s suggested top rate

Most of the Laffer effect (I feel bad calling it the “Laffer effect” as Laffer is a total far-right crank and charlatan… for example, do a search on “Krugman New York Times Laffer” on Google and you’ll find several examples of why Laffer is a nutjob…) is NOT due to reduced hours or effort by high earners because the tax rate is so high. It’s due to increased avoidance activity and (e.g.) shifting remuneration from income to capital gains. A General Anti Avoidance Rule (as proposed by Richard) would put paid to most of the Laffer effect. Personally I think we would be fine up to at least 65-70% top rate but I appreciate this is a matter about which there can be intelligent disagreement. Some commentators (e.g. Saez/Piketty) have suggested that 80% is the revenue maximising top rate.

More fundamentally, it’s not clear to me that Laffer is right even on its own terms. Would the revenue yield from a 100% tax rate be zero? If we had (e.g.) a very high Citizens Income, so that no-one *needed* to work, I’m sure some people would go on working because they enjoyed their work even if tax rates were 100%. This might well be a minority of people and so I wouldn’t suggest 100% tax rates as a serious proposal, but Laffer’s argument (that the yield of a 100% marginal rate is zero) seems to me to be flawed if work conveys any positive utility, at least for some of the population. And there are certainly people around who like their jobs – for example there is evidence of people who win the Lottery and carry on in their job.

It is a shame that their other mad cap policies like banning rabbit hutches mean they will never be taken seriously

The policy is to ban caged farming of rabbits. If you want to keep a rabbit in a hutch at home you will still be able to do so.

It’s a shame people repeat nonsense about Green policies. Hint: if you read about a Green policy that sounds ridiculous, it probably isn’t true.

I agree – most of the time when I’ve heard about a Green policy being ridiculous, it’s the person misrepresenting it who’s actually being ridiculous. There did used to be some crank policies (e.g. support for homeopathy a la Prince Charles) but I think they have been weeded out recently.

One of the great things about the Green Party is that a rolling record of policy is always available for anyone to view at policy.greenparty.org.uk. If it’s not there, then it’s not official party policy.

Their perspective requires, deserves, a more reasoned and prolonged debate. I was looking at their proposal to build 500,000 houses that seems to have caused some criticism. Firstly it can be done, but what is so terrible with the concept of allowing Councils to borrow money to build social housing? The rents pay for the loans. An asset is then created and maintained in public ownership. Surely that makes better economic sense than endlessly paying for private rented accommodation or paying for emergency accommodation? As for selling of houses cheaply in a right to buy scheme that is foolish.

More widely their idea of a sustainable economy is interesting, and is often criticised as being anti growth, but this is plainly an incorrect perception. Their argument is that the assets we hold are stock that we use and that we should seek to replenish what we use or minimise usage. So if we fell a tree we plant another, and an extra operation is involved and more employment and growth. Their outlook on the economy is perhaps more positive and optimistic than they present. Certainly the current accepted model of maximising short term profit seems almost nihilistic by comparison.

Thatcher had a top rate of 60% from 1979 budget for 9 years. Down from abt 83%. No mass exodus, so why seen as problematic?

30 years is a long time ago. Like it or not, people are for more internationally mobile than they were in the 1980s.

I was talking about 2010

I joined The Green Party because of their ideology & their local involvement in community social activities. Green drinks for people to talk to like minded people, ceilidhs & music for peace.

They are also involved with local groups trying to guide the community into eco friendly energy schemes & local currencies, They are actually doing something positive on a daily basis for humanity.

A far cry from the self seeking political parasites, the lies & deceit of the City of London fraudsters & their media puppets.

I was pleasantly surprised that the Green Party manifesto stood up to analysis.

Richard,

Your prayer has been answered. A searchable and copy/paste version of Green Party manifesto:

https://www.greenparty.org.uk/assets/files/manifesto/Green_Party_2015_General_Election_Manifesto_Searchable.pdf

thanks