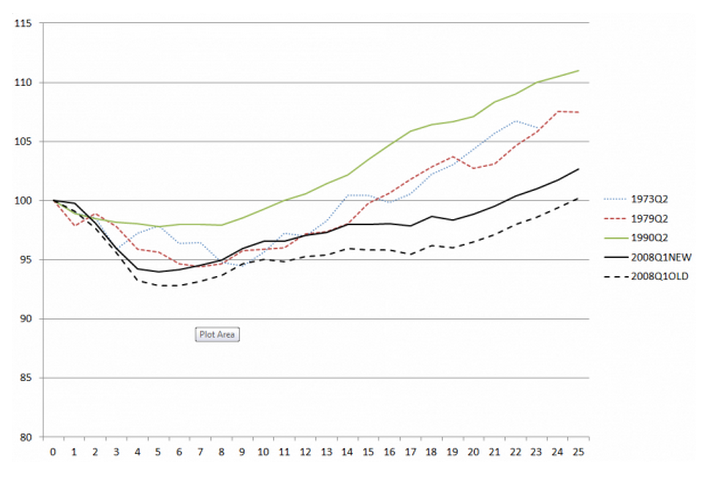

The Office for National Statistics has revised its view of the current recession and GDP movements during this period. It's allowed to do that, for better or worse, but as economist Geoff Tily, formerly of the Treasury and now at the TUC has noted the revision tells a very interesting story. This graph provides the data:

Just click the graph for a bigger version. The X axis is quarters since the recession began and the Y axis percentage change in GDP.

Just click the graph for a bigger version. The X axis is quarters since the recession began and the Y axis percentage change in GDP.

What is now clear from the new solid black line (which has replaced the old view, which is the dotted black line) is that the 2008 crisis began rapidly with a very heavy initial decline in GDP that caught everyone by surprise in 2008, and which was more severe than other recessions - whose dates are noted. But what's also clear is that before Labour was out of office the recession was tracking towards recovery remarkably like 1973 and 1979.

The change came in early 2011 - when Labour's impact and policy was replaced by the austerity agenda of the Coalition. Suddenly the black line takes a remarkably different trajectory to the blue and red lines representing progress in 1973and 1979 and almost flat lines for a period before slowly creeping upwards.

And this was not because the Eurozone really hit a crisis in 2011. As Geoff shows, the ONS data does not support that view. Instead it is because of a massive shortage of investment levels precisely because of the austerity agenda in government and the rhetoric that discouraged business from investing.

The evidence is clear: Labour had the recovery under control in 2010. The Coalition delivered austerity and the result has been lower growth, a weak recovery, a loss of investment, a decline in capacity, the creation of low value work and low productivity and a mood of economic despair. And all that was chosen and was not inevitable. That's a massive legacy of poor decision making.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Austerity taking effect in Germany as well by the looks of it: Reuters

In the case of Labour it is not so much lying, more as if they have become political Trappists and remain studiously silent on the most important issues. Essentially we have a one party state -in this context even PR wouldn’t help much because the choices aren’t there (except for greens who seem to be polling about 7%).

Surely not poor decision making but deliberate emphasis on deficit to give them the excuse to impose austerity, shrink the state and create their low wage economy?

It just goes to show that real, disposable cash (whether through good wages or adequate redistributive benefits) is the oxygen of any economy and we all benefit from a healthy economy where money is being spent. However, low wages and low benefits mean people rely more on borrowing that might provide a certain amount of uplift in economic performance in the short term. However, paying off that debt with real money means less of that real money gets spent elsewhere so the cycle of economic decline starts again. Might the slower growth (the slow crawl upwards in the graph) be a symptom of people balancing paying debt with day to day expenditure?

How can people save or create pensions (which we are all encouraged to do) in a low wage / below inflation benefit economy? In the long run it just creates more problems. I wonder what the Boards of Tesco and Sainsburys think of this Government’s economic vandalism? I wouldn’t be too happy.

BTW – this is a really interesting site and I look forward to reading your book.

Thanks

Question, Richard. If senior figures in the Labour Party read this blog, why the Hell is Ed Balls still Shadow Chancellor, and why is Labour still talking about ‘cutting the deficit’, cutting public spending, and imposing a ‘welfare cap’? Are there a million parallel universes where there is a different Labour Party? If so, how do I get there?

I don’t know Richard

But I am aware that this blog is very definitely read in many parts of SW1