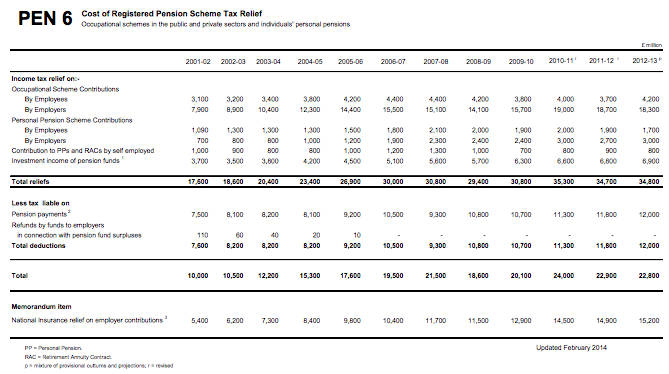

The cost of subsidising UK pension tax relief has reached £50 billion a year. The following table, issued earlier this year, has been re-issued by the government today:

The relevant figures are £34.8 billion tax and £15.2 billion NI from right hand column.

It's long been my suggestion that this relief should be abolished at higher rates. The new stats provide no estimate that I can see of what this cost is (but if anyone else has found it, please point it out).

What I have also argued is that a condition of this relief is that 25% of all contributions - likely to easily exceed £80 billion pa - should be invested in job creation programmes. It is impossible to specify that these must be in the UK but the availability of specific infrastructure bonds would make this incredibly easy to link to investment in UK sustainable growth. £20 billion a year would transform that.

So why is no one adopting the idea? Is it another case of cowardly politics where it is too risky to demand that pension funds be used for social good rather then funding speculative bubbles?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting that employer tax relief has more than doubled, but that for employees it has only increased by about 50%

Is this evidence that employers are being more generous with pension contributions, or is there another interpretation of the figures?

It is likely to be employers making good pension deficits

Dear Richard

I hope that you are well.

Thank you for your blog. Just one minor £12bn point on PEN 6. You have given the gross income relieved from income tax on pension contributions but you have not mentioned the £12bn of pension payments liable to income tax. I think that you should recognise the current net tax effect in the EET system we have.

From my perspective the only real tax leakage is the tax-free lump sum and the NIC exemption for pensions in payment.

Kind regards

Alan

I ignore the £12 bn because it relates to past contributions not present ones

To offset the two is Wholly mistaken – they are independent variables

The tax on pensions now is, broadly, the tax not charged on the income put into the pot: pensions work by deferring tax on income from now to later.

In many cases the tax now is 20% when the relief was given at 40%, but in my view that is the whole point.

To omit the tax actually received in respect of pensions, and look only at the tax relief given, is like saying that VAT is a subsidy to businesses because they get to reclaim so much of it (purchases and sales being independent variables).

This is true to some degree of all savings

Pensions just get special favour of not being taxed when saved which other savings do not get

We do not therefore need to relate the two

That is just a figment of a tax adviser’s imagination

And the two, as I have already said, are not related. Current pensions are not related to current contributions: they are wholly independent variables

I am wholly justified in treating them as such as a result

The difference with pensions is that you get taxed on the capital element that comes out of the fund, as well as the income.

With most savings you only get taxed on the interest, and the principal is already yours.

Simplifying enormously, and assuming the same rates of tax and of return:

– With a pension, you put 100 in. If the pot doubles in size you get 200 out, and pay 40 in tax on that.

– With savings, you put 80 in (having paid 20 in tax on your original 100), which doubles to 160, of which only 80 (the increase in value) is taxable when you extract the funds. You therefore only pay tax of 16 on exit, because you’ve already paid tax before entry.

It’s swings and roundabouts, except that the pension works out slightly better for you overall – which is your reward for doing what the state has asked you to.

You’re right that current contributions aren’t directly related to current pensions, but when you take a scheme in the round they are. The tax relief given now will be clawed back at some point in the future. Probably the best way of looking at it, though, is not to net the current tax off against the current relief, but to include a credit for the deferred tax on the contributions that the relief is in respect of.

You’d end up with a net cost, I would expect, but it would be a lot lower – and it would be a direct result of the express will of Parliament that we should shift income from our productive years to our non-productive ones.

I know all that

But you ignore many facts

Like tax out is deferred considerably and so worth a lot less

And is usually at lower rate

And NIC is saved

And on, and on and on

So this is not neutral as you would like to claim

And your claim that in the round past and present contributions are linked is just cloud cuckoo stuff: sorry, but it’s simply untrue.

Oh, and we don’t shift income at all. We shift its recognition. Which is not the same thing by a very long way

I’ve not ignored those at all – in fact, I’ve explicitly mentioned the lower rate, and that the deferred tax would be less than the relief given, and so on.

The underlying principle of taxing the cash on exit rather than before entry is broadly neutral, but as I’ve mentioned the other factors involved do mean that it does end up with a pension normally being better overall (at least from a tax perspective).

The thing is that this is a tax reduction which is explicitly sanctioned by Parliament, for reasons which I find fairly convincing. I find it hard to object to that sort of thing.

Past and present contributions are not linked, but contributions past-present-and-future and linked to pensions past-present-and-future. That which comes out of a (private) pension pot is directly linked to what went in. you cannot deny that, surely? If they are not linked, then can you advise me on how to get money out without having put it in?

Oh, and I think that locking my income up in a fund which I am unable to access for several decades is as near as one can get to shifting the income. For all practical purposes, the cash which left my employer 10 years ago will not reach me for another 20. The pension fund keeps it in limbo.

I presume you know you’re making this up?

I am not arguing tax evasion here, or avoidance

I am arguing misused funds when cutting the deficit is a priority

And I am arguing pension funds misallocate funds to speculation

And I am saying – and it is undeniable – that current pensions are not linked to current reliefs

And you ignore all that

Just as you somehow equate money with income. No, it’s a claim on a property right and that’s not income. All you can hope is that when you retire someone will want to buy your underlying property right in your pension fund to permit you a claim on their effort which will reduce their income and increase yours at that time as a result

But you have not in any way deferred your income as a result

Please learn some economic thinking at a macro, not micro, level

So all you’re saying is that it would be better to do away with relief for pension contributions, in order to raise funds for current spending?

In other words: make pensions completely unviable as a savings mechanism, as the capital would be taxed twice (before entry and on exit), rather than once as is the case with other savings vehicles.

Your argument that “pension funds misallocate funds to speculation” is completely specious – it’s my money, where I choose to have it invested is up to me. If I think that putting my money into a certain fund is best, then who are you to tell me otherwise?

And “All you can hope is that when you retire someone will want to buy your underlying property right in your pension fund to permit you a claim on their effort which will reduce their income and increase yours at that time as a result” makes no sense at all. My pension in the future will be paid out of my contributions, and the income thereon. There is no need for there to be anyone else involved.

Take a SSAS as a simple case, set up for the benefit of a single person: when that person retires and starts to draw the income out, whose income is reduced? All you have is one person putting money into a fund, and taking it out a few decades later. By locking away income now, they’ve deferred it until they start drawing it.

Income is a stream of money, by the way. They are perfectly well equated in contexts such as this.

As for micro/macro, I wonder if you’re spending too much time looking at the wood, and not enough appreciating that it’s made up of trees?

I have never said anything about taxing twice

And nor for most people is where there funds are saved up to them – the choices are very limited or non-existent

So you make things up and then ignore reality

But you correctly add pensions are just a stream of money – so why should we give a massive tax subsidy to a stream belonging to the wealthy when we are now to consign those without work to poverty?

What is your justification for tax spending on the wealthy?

PS I ignored your comment on macro / micro – you clearly do not comprehend the issues

Dear Richard

Interesting discussion but not all that polite. You asked “What is your justification for tax spending on the wealthy?” It is what Parliament has decided, Nigel Lawson changed the basis of taxation of employment income from an earnings basis to a receipts basis. What were then approved pension schemes and what are now known as registered pension schemes were always treated in that manner. What you describe as tax spending is just a deferral of the income tax liability from the year of earning until the earnings are paid. The only leakage from the system is the tax free lump sum in a registered scheme and the exemption of pensions earnings from NICs. For the wealthy it is easy to set up an unlimited pension arrangement on an unfunded basis and in that way to defer income tax until retirement and avoid NICs, there is, however, no tax free lump sum for such arrangements.

On the mature pension plans that pay pensions from member contributions this makes a great deal of sense, as Jim pointed out, if the fund is satisfied with its asset allocation as it saves dealing costs and stamp duties by not selling and then buying similar securities. This also shows the strength of the argument for reducing the gross cost by the £12bn.

Andrew, Richard’s point on micro vs macro is that even a fully funded pension plan is dependent on there being a solvent government and country at the time of retirement – typically you would be invested in a mix of gilts and shares and those assets would not be able to pay you your pension if the government defaulted on its debts and the underlying companies that you had invested in went bankrupt. Funded is not always that much more secure than unfunded, and that makes unfunded schemes relatively attractive if the covenant of the employer is good.

Richard, £38bn is still a very large number and I am surprised you cannot see that and note the income of £12bn available to government.

Kind regards

Alan

Alan

This discussion is not all that polite because those who seem to be commenting based on so called professional expertise seem to be doing so through what is either a veil of ignorance or by making deliberately disingenuous comment, and despite the fact that we shared an office in 1983 I would put you firmly in that category.

Your claim is that:

“What you describe as tax spending is just a deferral of the income tax liability from the year of earning until the earnings are paid. The only leakage from the system is the tax free lump sum in a registered scheme and the exemption of pensions earnings from NICs”

Politely, this is nonsense, and I am all too well aware of the fact that your are plenty intelligent enough to know it. The leakages are not to be dismissed as you say. They come because:

a) The NIC leakage is £15 billion and there is no justification for it: it is even highly selective in nature

b) The tax deferral is not neutral as you suggest. Firstly the rate at which pensioners tend to pay tax is lower than that at which they paid tax during their working careers. This is, then, a very real leakage. Secondly, a tax receipt at an unknown time in an unknown amount at a future date is not the same as a tax relief given now: it has to be discounted for risk and it has to be discounted for timing and put those two factors together and you will find that its value is enormously lower than the current tax relief given.

c) The value of pension lump sums is material.

Your claims with regard to leakage are, therefore, as bogus as your claim that current pensions must paid out of current contributions merely because the existing fund is not touched because fund managers are satisfied with its allocation. Your comment might suggest cash flow, but it is a complete misrepresentation of the underlying economics and contractual actualities of what is going on and I’m disappointed that you so seriously misrepresent the truth.

In that case your conclusions on the £12 billion are, respectfully, wholly misplaced.

Richard

If you remove the tax relief on funds going into a pension fund, but still tax the funds coming out, then there is double tax.

If you haven’t appreciated that, then it’s no wonder we’re talking at cross purposes.

I really do wonder what you are trying to prove with your comments

I have never said I would remove tax relief on funds going into a pension fund and tax all withdrawals

I have said tax paid now on past contributions does not relate to relief we have to give now on current contributions or how those current contributions are invested. That is glaringly obviously true

You have made up a pure fiction that I am seeking to deny relief on all contributions

And that I would then tax withdrawals of capital from such a fund if that was what I suggested (and I have not)

So you’re either deliberately lying or being very…..I need not add the rest

I’m not trying to prove anything, I’m just trying to work out what you object to and what you’d put in its place. You were originally fairly clear about it, but your later comments have muddied the waters somewhat.

When Carol Wilcox said “Private savings schemes should get no tax subsidy”, you replied “I am strongly inclined to agree”. If by that you didn’t mean there should be no tax relief on pension contributions, what did you mean?

The whole structure of a pension fund at the moment is that there is tax relief when you put money in, and tax on exit. If you remove the tax on capital on exit, then you have a savings account not a pension – the tax on exit is the distinguishing feature of a pension. So I have assumed that you would retain that tax, as you’ve not said that you want to do away with pensions altogether.

If you do want to remove the relief on contributions (as indicated by your reply to Carol Wilcox) and compensate by removing the tax on exit, then fine: but that means doing away with pensions. A perfectly reasonable approach, but you have to recognise that this it what it would mean.

I have some sympathy (although I disagree) with your suggestion that tax relief should be restricted to basic rate – which I assume is what you really want (notwithstanding the above reply). What I don’t understand is your insistence on looking only at the cost of reliefs, and not the other side of the coin. You look at the fact that people get relief for contributions, but not that the capital then gets taxed on exit; you look at the overall reduction in tax take due to contributions, but not the increase in tax take due to taxing the pensions.

A perfect illustration of this is your comment “Pensions just get special favour of not being taxed when saved which other savings do not get” – you ignore the quid pro quo, which is that pensions have the capital taxed when other savings do not.

Anyway, I doubt I’m going to change your mind, but you should be aware that many things you think are “undeniable” are denied by people not for any ideological reason, but because they’ve looked at them and come to a different opinion from yours. Being aware of different opinions is a valuable thing – it’s why I read your blog, after all.

Carol made it quite clear what she wanted – a SERPS fund

I said I agreed

What was there not to understand about that?

Except it would appear that you are unable to think it possible to support more than one idea with different ramifications at a time

I won’t debate further with you: I will however assure you that in your disagreement with me there is room for only one opinion, and that is that you are wrong.

If current pension contributions and current pension payments are independent variables, as you say they are, then you should produce an additional report showing how much pension income costs the receipient in tax. After all, there are very few other savings vehicles where you are taxed on withdrawal of capital. You could then net this amount off against the amount you say it “costs” the government in tax relief, in order to give a fairer picture.

Or you could have just combined the two in one report.

If someone produced a report saying, “Look at how much the taxpayer is having to pay to get his capital back from this saving scheme”, you would fairly respond, “Well, you haven’t taken into account the tax relief given at the time the contributions were made”. Yet that is precisely what you are saying, but in reverse.

Yes, there is a differential between the 40% rate the taxpayer was paying during his lifetime, and the 20% he might be paying in retirement, but as another commentator noted this appears to be an entirely reasonable and sensible policy choice to encourage saving for retirement which successive governments appear to have embraced.

Current tax receipts from pension income and tax releif on current contributions are independent

As a matter of fact

That is what I said

Unless someone pays in and withdraws in the same period (and yes a tiny proportion do and I would except that is a tiny exception to my rule) then I am right

There is really no point arguing. It’s true

“Current tax receipts from pension income and tax releif on current contributions are independent”

Didn’t you used to tell us that private pensions were wholly funded by tax relief on the grounds that the relief granted to current savers exceeds the cash payments to current beneficiaries?

I’m glad we’ve moved on from that.

The two statements are wholly compatible

As things stand, it’s impossible for anyone on a low or average wage to build up enough of a pension to ensure that they are independently comfortable in old age. They will usually survive OK, of course, because the state pension provides for basic subsistence. People who were lucky/old enough to buy property before the year 2000 might have that as a helping hand too.

I think you should be honest and state that you think the same impossibility should be extended to higher earners. Not the super-high earners, of course, because they’ll be OK regardless. But the ‘managerial class’ (or the ‘squeezed middle’, or whatever term we’re using for them now) would lose any chance of maintaining their relative advantage over others into retirement. Unless they work in the public sector, of course, but that’s a different debate.

Because you must know that restricting tax relief and/or diverting contributions into bonds long before that’s the right choice will have that effect.

It’s a policy objective you’re entitled to have. It reduces inequality amongst pensioners by making the bottom 95% (of non-public sector workers) fairly equal in retirement. It also increases money available for things you approve of because you believe (and are entitled to) that they are beneficial things. If we assume that they are beneficial, and for all of society, then that’s a positive.

I wonder how you’d feel if you were 30 years old, not a beneficiary of wealth accumulated before the property boom, and not married to a well paid public servant with excellent pension provision… If you were looking at ludicrous house prices, inflated equity markets, poor bond returns and awful annuity rates. I know lots of people earning £50k-£100k and not one of them wouldn’t glady settle for a promise of a £20k p/a pension right now.. y’know, the sort of sums that many teachers and nurses can (quite rightly) look forward to.

I share your discomfort at the pensions industry, but it, together with tax relief, is as good an option as there is for a great many people who are ‘doing ok’, but are highly taxed, victims of being born too late to ride the property boom, and far from seeing themselves as financially secure. They are not the worst off in society, and are not the most deserving of state support.. but nor are they the people who should be hammered yet again as they were when their free university educations and chances to buy decent houses were taken away.

I don’t mean to know your personal retirement prospects, but I don’t think it unreasonable to suppose that you’re going to be fine. That is an incredibly privileged position to be in, and I’m not sure you appreciate that. Your proposal is a bigger slap in the face to aspirational younger generations as anything that our recent governments have come up with.

Pension tax relief is a deferment to encourage and support people making their own provision. We pay the tax when we draw our pensions if we’re lucky enough to have built up enough to do so. That’s what those of us in the private sector get as our alternative to those in public schemes who get a taxpayer guarantee of their income. It’s pretty poor in comparison, but it’s better than the ‘nothing’ that you propose.

I think what I suggest is the only way of providing pensions

I explain why here http://www.financeforthefuture.com/MakingPensionsWork.pdf

Investing in short term speculation can never deliver because it ignores the long term fundamental pension equation I explain in that link and confuses savings with wealth – which at a macro level is just not a relationship that holds true

The only way to provide pensions at the least cost is a SERPS type scheme – there there is no leakage: payments in; payments out. Private savings schemes should get no tax subsidy.

I am strongly inclined to agree

There is merit in Carol’s point about a SERPS type scheme……but what would we do with the occupational pension schemes (not sure I’d describe them as “private”) which exist? They control large amounts of capital…..UK funds valued in the region of £2tr in total…..they need to be put to a useful purpose. Convert them into a sovereign wealth fund and invest directly in the real economy rather than in asset trading?

Excellent idea

Lee

I though your thread quite interesting. These are my thoughts;

1) Plainly, we don’t want & can’t cope with the assumption that property prices always rise. They need to fall through the floor & stay there. The next Govt needs a strategy for achieving this. My view would be a combination of LVT, SDLT & Credit controls.

2) I think you slightly misunderstand public sector pensions. As Richard intimates above, they are a bit of a Govt ponzi scheme. No public servant has any kind of pension pot. They have a guarantee that the Govt will keep paying them a pension as long as they are in retirement. The Govt can, therefore, easily reduce the pension burden by the simple expedient of raising the retirement age. It has gone from 60 to 65 to 67. 67 isn’t a nice round number so I suspect it’ll settle at 70.

I see no reason why desk-jockeys shouldn’t work to 70, but would you seriously want Prison Warders or Policemen to be working at 70? I mean I’m not 50 yet & I feel my fighting days are behind me.

3) A point you don’t mention is how much value is sucked out of funds every day by the City of London.

Value is sucked out pension funds by the City because pension fund trustees keep handing over pension money to the “asset management” industry to trade (speculate) with, This is not true investment. The “evergreen investing” idea I mention in one of my comments on this thread advocates pension funds investing directly, bypassing the asset management industry altogether. Check out the Capital Institute (based in the US) website.

Local Government pension schemes are funded schemes…..they differ from the unfunded schemes of the civil service, armed forces, fire service and others. The point about funded LGPS schemes is that they should be required to stop speculating with taxpayer money and invest productively……the evergreen model is one way they could do that.

I entirely agree with you that this is not saving: this is not about investing: this is an extremely expensive savings scheme where the only real beneficiary is likely to be the fund manager, with any possible return being entirely due to the fact that there has been a subsidy from the taxpayer

“Current pensions are not related to current contributions: they are wholly independent variables”

Not withstanding my post above, this is clearly a false statement anyway. Current pensions are paid out of current contributions (where else do you think they come from?). So to claim they are wholly independent is absurd.

True of the state

Not, hopefully, true of funded schemes unless you’re saying they’re ponzi schemes

Are you?

In pensions fund jargon, it depends upon whether the funds are “earmarked” or “non-earmarked.” Earmarked funds may only be used for the earmarked individual but those in receipt of pensions from other collective schemes may well be paid from incoming contributions or indeed from the proceeds of sales of other assets.

I think you’re talking cash flow, not underlying principle here

By definition if in an invested fund current pensions are paid out of current contributions the fund is in deep trouble

If you check out the current financial statements of Scotlands LGPS funds they all seem to be paying current pension and management costs out of current contributions. Does that not make them PAYG schemes with a big speculative fund attached to them?…….surely justification for halting the speculative activity and directing the investing towards support for the real economy to benefit the taxpayers who actually fund these schemes ultimately? Or am I missing something?

On hopes that you are merely equating levels of payment, not actuality

If you are right the fund is in trouble

If course it may be, and few, if any, could survive without tax relief

If there is enough contributions income to cover current pension costs why would a fund incur transaction costs by purchasing “assets” which then have to converted back to cash later, incurring more transaction costs?

A focus on income instead of valuation strikes me as a desirable shift in how pebsion funds are managed, When you spoke in Glasgow on 10/9 you suggested pension funds should invest more to support social infrastructure, such as housing. Good idea…..that would be income generating investment which is more certain than securities trading where future values are unknown….it would also be socially and economically beneficial.

Check out Capital Institute in the US who are advocating pension fund investment in cash flow sharing partnerships with enterprise across the whole economy, not just in infrastructure and real estate….they call it “evergreen investing”. Worthy of further consideration.

In a well run mature pension fund the pensions in payment could all be financed from rent derived from assets such as office blocks, shopping centres etc, share dividends, interest from gilts and capital gains accrued from asset sales. Incoming contributions could then be used to purchase further income-yielding assets for future pensioners.

The fact that almost all final salary schemes have now closed suggests that the picture I have described here no longer exists. I am sure you are right, Richard, that incoming contributions are only used immediately to help cashflow in insured schemes because large assets cannot easily be bought and sold profitably within an ideal timescale.

These large funds available should of course be used for investment in projects which will enrich our lives both now and in the future and not just disappear into the City.

not just “projects” but in revenue generating enterprises of all kinds right across the diversity of the whole real economy. The “evergreen” model I mentioned previously advocates a partnership investing approach….a bit like a form of private equity without the exit-by-sale feature of normal PE. What is attractive about the “evergreen” idea is that it doesn’t require valuation – it focusses on cashflows and on the sharing of them…..it implies a shift from worrying about the balance sheet and “deficits” to a focus on income and matching that to expenditure (pension benefits and admin costs).

Agreed

Then there are the many ways the pension ¨industry¨ increases its take from your ¨pot¨:

¨Pillaged! How They Are Looting £413 Million a Day from Your Savings and Pensions¨ (David craig)

“Current tax receipts from pension income and tax releif on current contributions are independent

As a matter of fact”

It is fairly easy to argue that they are not independent: other things being equal, the person who paid in more to a pension pot would expect to both receive more tax relief on contributions going in and pay more tax on the pension income coming out, than someone who paid less into a pension pot.

Your position is like saying the recovery of input VAT is a subsidy to VAT-registered businesses, whilst completely ignoring the output VAT accounted for by those companies. To do this you would claim that sales and purchases are independent variables. When it is clear that they are not (higher purchases will generally be associated with higher sales).

What I find mildly annoying is that you are almost certainly aware of this, Richard, but you refuse to accept it because either (i) you hate admitting that you are wrong or because (ii) you wish to put across a message which fits with your narrative of “more tax”.

I have to admit that the repetitive comments of the sort that you have made are extremely tedious. I am trying hard to resist the temptation to say that those who are making them must be extremely thick, but it is becoming difficult to resist

Note your opening quote, which is:

“Current tax receipts from pension income and tax relief on current contributions are independent

As a matter of fact”

You then proceed to argue that this is wrong because somebody making a contribution now will expect to pay tax on the resulting pension in the future. In other words you have related current pension relief contribution to future tax receipts and that is precisely what I did not do.

There is, of course, a relationship between current tax reliefs and future tax paid. If we did, for example, abolish all current pension tax reliefs then I would only expect to receive tax income in the future on the investment returns that a person receives on their savings, and not on any capital sum. I would presume that that was glaringly obvious and implicit in any argument that I might have offered and is in fact the entire substance on which I presented this statement that current tax receipts are not related to current pension contributions, because current tax receipts relate only to the conditions given on past pension contributions. You have, however, entirely missed this point and come up with a wholly spurious argument of no merit whatsoever with regard to VAT whilst accusing me of putting forward an argument that I know to be wrong when in fact what I said is exactly correct ( subject to the only exception of those who make a contribution in the period and then immediately withdraw it, which is a very rare exception, one I have already acknowledged).

What I’m actually arguing for is not “more tax”. I am arguing that what we should be doing with taxes using the tax spend associated with private pensions of some 50 billion a year to greatest effect. I do not think that greatest effect is achieved by subsidising the pension savings of the wealthy, and not others, and nor do I think this best achieved by providing a subsidy to the stock exchange which is a lottery or casino in which gains are unpredictable, have no relationship to any real wealth creation or employment creation, booms and busts are inevitable, and all with taxpayer subsidised funds which can only increase inequality in this country by providing unnecessary and excessive incomes to those in the City of London.

If you think that a good use of “taxpayer money”, well I don’t, and I remain completely astonished that those on the right of politics somehow think that it is.

What none of you have done is rise to my challenge of trying to justify why such enormous subsidies should be given to those who are already well off when the income of those who are already in poverty is currently being reduced by deliberate malicious intent of this government. Please explain or, very politely, shut up.

Richard, I can see that you are worn out trying to explain your concept so I am providing some background information which should make the picture clearer.

The Treasury encourages investment/savings into pension schemes by offering full tax relief to employers, employees and self employed but does not fully explain the tax implications upon withdrawal – ie taxation applied to both capital and interest in the annuity fund.

Income tax relief at 50% of the personal rate was also applied to qualifying savings plans and these had to run for a minimum of 10 years but in practice could be cashed after 7.5 years tax free. This facility has now been withdrawn.

There were also tax exemptions within a pension fund which were too complex to detail here but they equated to about 2% extra growth per annum compared with the equivalent savings plan and assuming annual charges, bid/offer spread were the same. These exemptions have also been withdrawn.

You and others have mentioned that a very small proportion of people made a single large payment with top tax relief and then took an immediate annuity. The policy and set up costs may well have been 10% so only those getting 40% relief would do this and they generally were still 40% taxpayers once in receipt of their annuities.

There is really no relation between tax relief applied to incoming premiums and tax charged on annuity income. A given parcel of money will attract various taxes and reliefs during its life in a pension fund, the incoming relief and outgoing tax are only a very small part of the story.

In the instance where annuities are paid directly to retirees from incoming premiums, then the parcel of money goes straight back out into the general economy again and will be subjected to all the various taxes and reliefs we all experience on a day-to-day trading and living basis – unless the pensioner hoards it under his bed.

There is a lot to be said for the new system where workers may simply use ISAs with increased limits ie no tax relief in and tax free out.

Its a pity that this debate has become a rather turgid discussion about the technicalities of tax relief on pensions/contributions…it has obscured what I thought was the key point Richard has been making….initially in his excellent piece in 2010 “Making Pensions Work”. The key issue is that pension funds “invest” too much in the form of securities trading which is essentially nothing more then financial speculation. It is damaging the economy and it is not supporting genuine wealth creation…..it is just promoting asset bubbles and boom & bust. Tax relief on pension contributions denies government tax revenue it could employ more usefully in the economy than pension funds are doing. That, I think, is the nub of Richard’s position.

If we were to start afresh now I doubt that creating pension funds would be the best way of providing for decent pension provision for the whole population – a state PAYG pension with a SERPS type of addition would do the job better. However, we are where we are….we do have pension funds and they are huge. Ways must be found to stop them indulging in so much financial speculation and to invest more in the productive economy for the benefit of all.

LGPS schemes are funded ultimately by taxpayers so they really should be directed to invest productively and not speculatively. Government has been active in public sector pension reform……unfortunately taking action to promote productive investment has not been on the agenda.

Those who oppose ideas always try to deflect debate

It is a standard right wing tactic

Thanks for your support