So far every company that has been awarded the Fair Tax Mark has had to make some change to its financial reporting to achieve the ranking needed to be awarded the Mark. It's been interesting to work with all the companies in question on these disclosure issues.

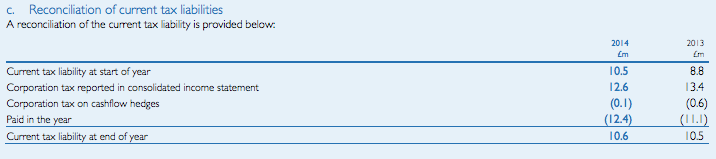

Go-Ahead Group plc has innovated in its tax notes, published this morning, by including a note almost never seen in statutory accounts. This reconciles the various ways in which tax is presented in the accounts, whether in the balance sheet, income statement, the statement of changes in equity or the cash flow. This is as follows:

This appears to be a simple statement but in the vast majority of published accounts it is nigh on impossible to reproduce this reconciliation based on the available published data and yet it is a basic test of the credibility for the tax data presented by a company.

I am delighted that Go-Ahead have offered this statement in their accounts. I hope a great many companies copy their example. It may be a small change, but it's of great importance to those wanting to know that companies really are willing to be accountable for the taxes that they pay.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

According to the annual report, they paid £12.4m in corporation tax on profits of £103.2m (turnover of £2.7bn) – how’s that “fair”?

The profit was £91.2 billion

And cash paid is not the tax charge

Do you have any clue how to read a set of accounts?

Please also read our criteria

“The profit was £91.2 billion”

No wonder public transport in this country is so expensive 😉

Richard; I think you may mean £91 million of profits, otherwise I’ll be making a dash to my stockbroker post haste to buy some of their shares if they’re making £91bn 🙂

I am so used to writing billions….

£12.4m over pbt of 91m is an effective cash paid tax rate of 13%.

Most of us know that the amount of tax paid varies enormously depending on various things like reliefs available etc, but I wonder whether the “man on the street” is going to wonder how a company with an effective tax rate of 13% was awarded a fair tax mark?

Is this something that you are going to be doing some publicity around as I worry that without it, people will just assume that the fair tax make is saying its fine to be paying an effective tax rate 7% below the mainstream CT rate – which would likely be detrimental to the mark/brand?

We highlight all these issues on our web site

The underlying tax rate is actually higher – deferred tax reduced the rate this year and you are comparing with tax paid – which is wrong

Go-Ahead expect to pay at or above statutory rates in coming years

We would give a Fair Tax Mark to a company that paid no tax if it explained why

Our focus is on that explanation – which we think is key – plus avoiding tax abuse – which is what people want, we think

Go Ahead could be expected to have a large deferred tax figure. Buses are very expensive and their fleet looks quite modern.

“For current purposes, its most important feature is the fact that for many companies it is very unlikely that the deferred tax charges made in their profit and loss accounts will result in real tax liabilities being paid at any time in the foreseeable future. In that case, for all practical purposes deferred tax charges included in the profit and loss account can be, and should be, excluded from any consideration of taxes to be paid when measuring the Tax Gaps.”

Richard Murphy, Mind the Gap

So either your methodology for calculating the Tax Gap is to be scrapped, or the Fair Tax Mark guidance should be scrapped. Which one?

My work on the tax gap from 2008 is currently being revised

And you will note the emphasis in the FTM is on the current tax rate

The two are compatible

What about the expectation gap from the same report. You say that a difference between the headline rate and the actual rate must be avoidance. How come that doesn’t apply in this case?

If due to detail explanation by GOG, why not assume that all companies can offer similar explanations?

I have explained this countless times already

OK, no problem. Will take it that getting a FTSE350 with a FTM is more important marketing than sticking to principles.

Except that as I just said – our emphasis on the current tax rate shows I have stuck exactly to principles

The problem is yours alone in creating a straw man that does not exist

But no companies have applied/qualified apart from 4?

Yes

They have

I can’t recall precise numbers because I do not manage the process

Many are waiting for their next accounts to announce it

That is the main reason for a time lag

OK, so nobody currently satisfies your requirements, you need them to change their accounts filings to do so?

So far, without exception, yes

So how many applied? As a Director you must know what business the company is doing?

As a director I do not a) micro manage and b) need to disclose everything we do on demand