One of the biggest difficulties in writing about UKIP is knowing what to say. If it's true that Labour still remains policy light, that the Tories are riven with disagreement, that the Lib Dems have steered so far right they have fallen off the map and that the Greens are thought to be a single issue party when they're not, then with UKIP the problem is finding anything to say about what they think, unless it's immigration.

Take an example. It's not long ago that I wrote, based on their website, that UKIP believed in flat taxes. Now, apparently, they don't. As Isabel Hardman wrote in the Spectator in late April:

When he spoke at a press lunch on Tuesday, Farage accepted that UKIP's flat tax policy was ‘incomplete', but that UKIP's aspiration was to have taxes as low as possible. Last night, asked whether he still wanted a flat tax, he said:

‘It was in 2010, but it isn't now, and don't tell me about manifestos: you haven't even got one!'

Simon Hughes pressed him on what his tax policy was, to which he replied:

‘We will have no tax on the minimum wage and a mass simplification of the tax policy, with a lower rate. We will abolish National Insurance, roll it into tax because all it is is tax anyway.'

He added that higher earners would pay '40 per cent or something like that', adding:

‘Every party changes their policies between general elections… Just because we stood under a different leader in a different general election with a policy of 31 per cent, doesn't mean that'll be our policy next time round: it won't.'

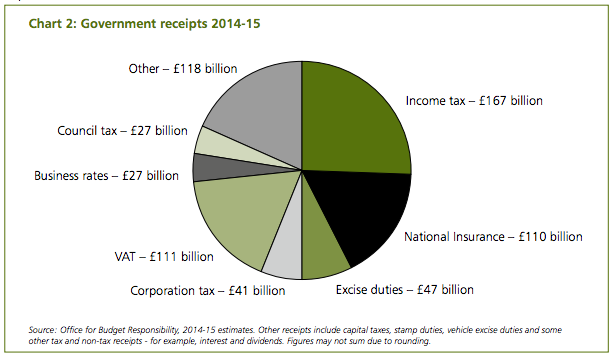

But this is not all it seems to be, incomplete as it is. Why is that? It's simply explained. This is the chart of expected government revenue for 2014-15:

So, Nigel Farage is going to scrap a tax that collects £110 billion and reduce the top rate of income tax to 40% and then raise the personal allowance by maybe £2,000. The last would cost over £12 billion by HMRC reckoning (and I am being generous here, and rounding down). What that means is he will have a black hole in revenue of well over £120 billion.

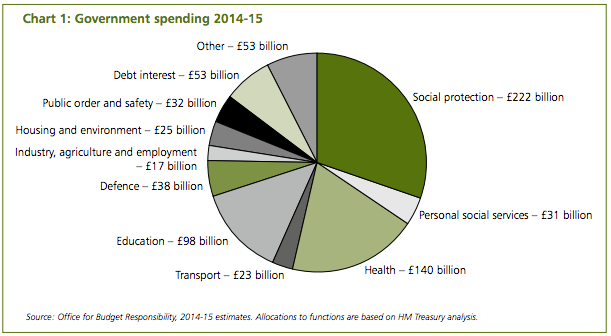

Now you take your pick of what he is going to cut from this list, remembering that a tiny proportion of all benefits paid are to the unemployed and we already have a deficit of at least £84 billion, meaning that with his additional £120 billion of tax cuts there will be more than £200 billion of savings to find:

Scraping education would help do the trick. You could also get rid of the old age pension. Or the NHS, defence and public order and safety could go and he'd balance the books. And if not that, what?

That's the question Farage needs to answer because right now his tax policy makes no sense at all and leaves us with either a £200 billion or so deficit or cuts on a scale no one has ever imagined, and someone has to ask what he really means. Until they do we have no meaningful debate in this country.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Yeah, interesting.

Speaking most definitely as a non-Ukip voter, I am surprised that you believe the deficit needs to be closed: “and we already have a deficit of at least £84 billion, meaning that with his additional £120 billion of tax cuts there will be more than £200 billion of savings to find”.

Am I right in supposing you identify the need to close the deficit as providing the need to close the tax gap?

And from there, what exactly is the macroeconomic argument for reducing the deficit and accordingly the tax gap?

I don’t suggest that

But I am sure UKIP does

And that’s all that matters for this debate

You miss the point the well off will be paying their taxes and not avoiding them. How about yu research about how much avoidance is costing us? And as human nature has it those who can afford accountants will avoid. that’ll make your figures a drop in the ocean and I suspect you know it

I have researched that point – indeed, I am the only person who offers an estimate bar HMRC in the UK

At most it is £25 billion

I am researching again now

But it will not close that gap – not be a million miles

Most intelligent comment I have heard about the ‘kippers’ as follows -‘a bunch of weathly a***holes playing Never Mind the Quality, Feel the Width.’

European elections are traditionally used to give the government of the day a kicking. It really is most provoking if people use it to say something incoherent about Europe.

Your question is one of many that should make things harder for UKIP at a general election. We have to hope that the public were not saying that they want flat taxes and NHS privatisation and will abandon them when they find out, or at least those who don’t ever vote Tory will.

OK, so you’re NOT saying we need to reduce the deficit; Ukip does, as do plenty of others.

You do say though that we need to close the tax gap don’t you; so:-

What exactly is your MACROECONOMIC argument for reducing the tax gap?

How about law enforcement?

And creation of a level playing field?

Or the value of social justice?

Sounds like Ironman is being a bit extreme – we live in an globalised interconnected financial world ( for example bond markets) – and my understanding is that you cannot let your deficit become too extreme and I believe ours is relatively high compared to others in Europe as Labour too would claim especially once economic growth does pick up. Moreover the demands of the health service/elderly population will mean re-prioritisation of our resources. Hopefully the tax gap will help but we can not go to the other extreme and say the UK deficit is insignificant going forward or we risk losing the confidence of all those thinking marginal voters we need. I am not defending Neo-Liberalism I am defending the realities of a social democratic European society.

Ironman is, to be candid, playing a game of nitpicking because he thinks it is clever

It’s a favourite troll ploy

The deficit does not really matter as the national debt is never paid and never has been. Only the interest is ever paid.

Interest rate of the debt too high? Interest rates can be manipulated. It would be cheaper than at any time in history for the government to borrow money. Rates of interest can be brought down by the BoE, as the have for the convenience of the banks at the moment, or the debt can be inflated away.

Their is so much rubbish talked about the national debt, particularly by those who wish to saddle us with austerity.

It’s almost as though they’re a bunch of clueless, fear-mongering charlatans.

“law enforcement, creation of a level playing field, the value of social justice”

Yep, I wholly agree with all of those; what reasonable person wouldn’t?

However, What exactly is your MACROECONOMIC argument for reducing the tax gap?

Those are macroeconomic arguments

Also try reading modern monetary theory

Give a man £10m and he might buy a Jaguar, a new house, and a diamond bracelet for his wife.

Give 10 men £1m each they will all buy a Jaguar, a new house and a diamond bracelet for their wives.

Net macroeconomic gain for the economy 9 car sales, 9 house sales, 9 jewellery sales, with obvious implications for employment and tax returns.

The simple fact is that the human capacity for consumption is finite, hence why so much of the world’s wealth is now simply employed creating more wealth.

Look at it another way. A single parent on low wages struggles to pay the bills, feed their family, and sends their children to school in shabby clothes. Every penny they receive is spent in their local economy, creating jobs and tax revenue.

Double their income, and they will spend that money on new school uniforms, more and better food, and go to bed happy in the knowledge that their utility bills have been paid on time. In short every penny they receive will still be spent in their local economy, x2. Net gain for the national economy.

By comparison a millionaire in the same town eats as much as he wants of the finest food every day, sends his children to the best private schools, and holidays abroad for four weeks every year. Doubling his income will increase neither his need nor capacity for consumption. He can eat neither better or more food, his children already want for nothing. If anything he is more likely to spend, save and invest offshore. Net loss to the National economy.

Tsssk. Simples!

They are not going to be elected to govern the country so I fully expect them to put little gems in their manifesto to get gullible voters to support them

The NHS will probably help contribute to the funding gap here.

This one is currently doing the rounds on Twitter: On his website the Deputy Leader of UKIP, Paul Nuttall clearly advocates privatising the NHS.

http://www.paulnuttallmep.com/?p=712

I quote:

“I would like to congratulate the coalition government for bringing a whiff of privatisation into the beleaguered National Health Service…

I would argue that the very existence of the NHS stifles competition, and as competition drives quality and choice, innovation and improvements are restricted.

Therefore, I believe, as long as the NHS is the ‘sacred cow’ of British politics, the longer the British people will suffer with a second rate health service.”

Nice man.

“Law enforcement” is macroeconomics; interesting. Your belief in MMT is also interesting, especially as simultaneously you boast of ahving been a fairly isolated voice espousing endogenous growth theory these past few years.

However, far more interesting is how you’ve reached your £200 billion figure. More than half your figure, £110 billion, comprises NI, which you say Ukip intends to scrap. Actually the Nigel Farage’s words were: “We will abolish National Insurance, ROLL IT INTO TAX BECAUSE ALL IT IS IS TAX ANYWAY” (my capitals)

Now, I ahve absolutely no brief for Ukip, but nowhere in there is anything that promises £110 billion tax cuts.

I point this out because I note you are all over Twitter urging people to put this figure to Ukip. I also note your traducing over the weekend of a respected FT economic journalist, Chris Giles. So this isn’t very impressive is it!

P.S. I understand, the Courageous State isn’t in fact at all courageous and isn’t going to post this comment.

The reason why I say the whole of the NI take is lost is easy to explain – and so obvious if you think you’re an economist you should have been able to work it out for yourself.

If you scrap NI and roll it into tax at the same time as increasing allowances and cutting the top rate of income tax there is no way you can recover the NIC lost. That is simply not possible when NIC on employees is 12% (for most) and employers 13.8% whilst basic rate tax is 20%. That just won’t work, will it? So it has to follow that abolishing NI means a flat rate tax of something like 40% – which he says he won’t do – or it means the money is foregone. There is no other obvious conclusion.

As for disagreeing with Chris Giles: I am in excellent company, form Nobel laureates onwards.

The moral is a simple one: if you’re going to nitpick get your facts straight. Giles would have done well to have noted that too.

Other than transactional expansion, or increased saving – both of which are alternatives.

You don’t need to tax to stop the economy overheating. You could try to persuade people to save more instead, and the very wealthy do tend to save quite a bit.

Perhaps the whole thing relies upon a 99.9% marginal propensity to save amongst the five people all the money will flow to 😉

1. No sorry, Farage doesn’t say what the the basic rate will be or where the top rate will bite. I have, as I have said on other blogs, a real distate for the way Ukip has turned to race in its campaigns. I also do think Farage’s answers reek of him blaging it. However, I won’t base my criticisms on fabrications. Ukip hasn’t talked anywhere of cutting £200 billion from state spending. The £110 billion you quote isn’t nitpicking; it just isn’t true.

2. I have never laid any claim to being an economist; I’m saying you’re not, any more than you are a tax expert.

3. I’m not sure you are in good company. Compare and contrast:

“Chris Giles deserves great credit for his careful scrutiny of Thomas Piketty’s data, and Piketty also deserves credit for the openness of that data and for his generous response to Chris”

with:

“Whatever else Giles is he’s not objective. He is pursuing a vendetta….all that Giles has so far proved is that he has a rather childish determination to undermine an argument he finds offensive to his wealthy patrons”

As I say, not very impressive, downright ugly in fact.

UKIP has positioned itself as a populist party, previously keen on flat taxes. I really do not see it advocating tax rises. To ask what they mean – which is all I am saying needs to be done – is wholly fair and appropriate.

Your opinion on my expertise is one you are quite entitled to hold. You should be aware some disagree with you. Newsnight have sought my advice twice today – once on tax, once on economics.

And as for my comments on Giles, please read Paulo Mason in the Guardian.

And if you think my comments ugly, I suggest you revise your style.

Ironman

As I imagine that “The Guardian” may be unfamilar territory to you, I’d thought I’s help you out and post Paul Mason’s conclusion to his article:-

“Piketty asks the question that mainstream economics doesn’t want to answer: do we want a society based on work and ingenuity or on rent?

It’s not an academic question. Figures from Lloyds Private Bank show UK asset wealth grew from £4.7tn to £7.8tn in the decade to 2013, with most of that generated by the rising value of financial portfolios, and all wealth growing faster than incomes and inflation. If Piketty’s figures are wrong, the probable cause — beyond the odd transcription error — is a mild overestimation of a clear trend, generated in an attempt to uncover modern capitalism’s guilty secret. If the FT’s figures are wrong, it is because they rely on those of governments that have become — as Peter Mandelson once put it — “intensely relaxed about people becoming filthy rich”.

But the most important question is the future: if Piketty is right then we have to “euthanase” the rentier class all over again. Only taxes on current wealth — and an end to opaque “wealth management” trails that end up in Switzerland or Cyprus — will prevent capitalism generating levels of social inequality that destroy it.”

So Ironman which camp do you fall into …those that believe work and ingenuity ought to prevail over rent seeking or those that believe in the opposite?

Given that during its 500 years of existence, I’m not aware of capitalism having produced one example of balance between “labour” and “capital”, I don’t forsee this happening any time soon, so I fall in the former camp!

Thanks

Your comment is appreciated

Now of course Farage would say that exiting the EU would save the UK £19billion a year or so, reducing the deficit to a mere £181billion. What he probably wouldn’t tell you is that such a saving would be overshadowed by the lost economic output caused by cuts leading to the UK having the infrastructure of an impoverished eastern European state. But then people would always have the option of emigrating to other parts of Europe to escape that situation…Wouldn’t they?

¨I would argue that the very existence of the NHS stifles competition, and as competition drives quality and choice, innovation and improvements are restricted.

Therefore, I believe, as long as the NHS is the ‘sacred cow’ of British politics, the longer the British people will suffer with a second rate health service.”

*********************************

¨In cost-effective terms, i.e. economic input versus clinical

output, the USA healthcare system was one of the least cost-effective in

reducing mortality rates whereas the UK was one of the most cost-

effective over the period¨

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3147241/

http://skwalker1964.wordpress.com/2013/02/26/the-real-mid-staffs-story-one-excess-death-if-that/

There is individual trolling, AN individual trolling on behalf of an organisation, and government trolling on behalf of its paymasters.

And there is perversion, deliberate perversion, of the truth, to allow those with assets to gain control of the entire countries health system to enrich themselves.

Nothing quite like being told that an operation is not available to you on the NHS, unless your condition becomes a surgical emergency, but is available at the same hospital with the same team, for 8 thousand.

Indeed

Mr Theremustbeanotherway

Let’s leave aside shall we the subject of this post, Richard’s fabrication of Ukip’s tax position. Let’s leave also his inability to discuss the tax gap in macroeconomic terms.Let’s also leave side that Paul Mason’s piece does nothing to support Richard’s scandalous comments about Chris Giles.

Let us instead just consider your amazing class warrior comments. So, it’s either work and ingenuity or rent seeking is it? A war? So those of us with employment (me) work hard whilst those with growing investments (me as a member of a pension scheme) are rent seekers?

The lack of balance the last 500 years is evidenced by the massively increased world popation, the extaordinary increase in life expectancy, the increases in height we have enjoyed, the improved diet brought about by trade and innovation, the complete shift from rural drudgery to urban living, the centrally heated housing estates you see everywhere every day. My problem with Picketty, or more accurately the great debate surrounding his work, is the almost complete lack of perspective, a refusal to consider the reasons for the improved lot of the working man. My objections to Richard Murphy are too many to list.

Martin Wolf would seem to agree rentiers are the problem

http://www.ft.com/cms/s/0/d442112e-d161-11e3-bdbb-00144feabdc0.html?ftcamp=crm/email/201457/nbe/Comment/product&siteedition=uk#axzz32nbno3xX

But please don’t let the opinion if others persuade you

I realise that I will always be wrong

Richard, your patience (with Ironman) does you credit. Theremustbeanotherway’s post, along with others above are exactly what I was urging in a previous post – tackle UKIP on the issues and what they advance as their policies, in so far that they have any. Brilliant! Thank you

Richard, thank you for your clear analysis of what we always suspected was bull poo from Farage and his lot. The problem, as always, is that the voter out there has no interest in, or knowledge of, such information. They will vote on gut instinct. As for the likes of Ironman, it is hard to understand why or how they just can’t ‘get it’ or accept what appears to be blindingly obvious. Like annoying mosquitoes, you have to keep swatting them.

Rolling NI and IT together does NOT eliminate the £120 billion collected by NI – indeed, since it would now be collected from pensioners too (who don’t pay NI) it follows that the total tax take from a combined NI + IT would be very considerably greater than from separate NI and IT (as now).

Indeed, it is the impact on pensioners (who are more likely to vote) which has prevented successive Chancellors from enacting this very measure.

It’s worth noting that NI alone does not remotely begin to cover the cost of:

State Pensions,

Soc Sec,

Child Benefit,

Tax credits

NHS

which is what most people THINK it pays for; indeed, it barely covers the cost of the NHS alone.

Accordingly, to reduce spending by HMG to the level which senior LD politician David Laws claims is ‘the maximum sustainable level’ of 33% of GDP, requires cuts from the present level of around £300 billion pa.

Since he’s a socialist, we may assume that his figure is both too high and wasteful in the extreme, so a reasonable figure might be 20-25% of GDP.

That means cutting current State expenditure by £500 billion pa…

Is that remotely possible? Certainly – it merely requires indexation of pensions to life expectancy (back-dated to 1945, if not 1906) and the abolition of insdnities such as the ‘bribed to breed’ program which is child benefit.

Coupled with the full privatisation of:

State Pensions

Roads

NHS

Soc Sec

Schools

We’d have a State which does what only a State can do (Justice, Defence, Law) AND NO MORE.

Once we can keep our own money (the Personal Allowance of 1960 would be the equivalent of £29,000 today, and fully-transferable within marriage, too, so a married couple could earn close to £60,000 today AND PAY NO IT)

The State pension age of 65 (in 1945 – it was 70 in 1906) indexed for life-expectancy would now be …89 (and rising since 1840 at a constant rate of 3.5 years per decade) so it’s not a party political point to say that every government since WW2 has been grossly negligent over this.

Since the author of this article hasn’t a clue what they’re talking about, I’ll leave it there.

I think anyone who can call David Laws a socialist shows how far out of touch with reality they are

As for my suggestion that Farage was suggesting a tax cut, of course I agree that in principle merging NI and IT does not mean a cut. But it does when yoj set a maximum 40% top rate for income tax and increase personal allowances and are a party who says it wants to lower tax. In that case what I say logically follows

The rest of what is said is so absurd that I post it to show just how absurd some political thinking in the UK is

PS I’d also add that cutting state spending by £500 billion would reduce it to about £230bn. GDP is currently £1.7 trn. So 25% of GDP is £425 billion. I think this commentator may have a few problems with things like facts and numbers in that case. But why let that worry a good rant?