A quiet revolution is going on in economics. It's down to one man in particular. His name is Thomas Piketty. His new book is called ‘Capital in the 21st Century'.

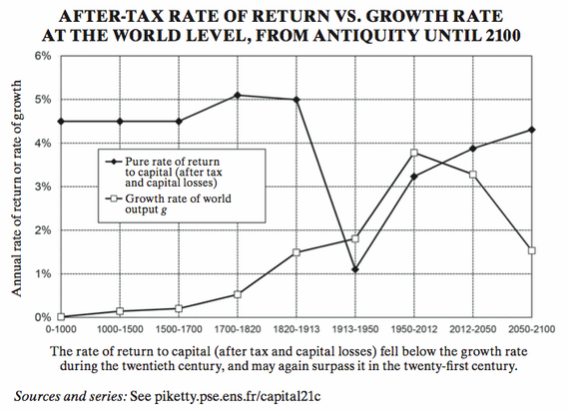

I'm not claiming to have read it all as yet, but it seems pretty clear that in his enormous work there is one central idea, ultimately summarised in one graph, reproduced in Paul Krugman's review in the New York Review of Books. This is it:

In this graph ‘r' is the rate of return to capital and ‘g' is the rate of growth in the economy.

If r is greater than g, and you'll note that expect for the period in the last century it has been, than the return to capital accumulates faster than the growth in the economy as a whole. The result has to be increased inequality because that increased accumulation of capital has to arise as a result of a reduced return to labour.

That, Piketty compellingly argues is the situation we now face. The 1% (or less) are, very literally, taking the rewards due to the rest of us.

What I like is that Piketty is brave enough to say there is a solution. It comes, as I often think solutions come, in the form of tax. He says we have to tax wealth inequalities out of the system out of the economy and we have to tax high incomes because they are not earned. I agree. Quite literally, future prosperity demands that we do so.

Now all we have to agree upon is how to do it.

And then we have to do it, soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Indeed this is looking a truly awesome book and will impact across economics, history sociology and politics; Hopefully some of us will try to summarize its main findings, significant concepts and ideas so that it’s not just our social science students who grasp its significance. Sometimes I think we forget how much our younger people do get it; they know something is fundamentally unjust about our societies both European and American which allocate income & wealth so disproportionately.

But instinctively now, many people including our comfortably off middle class voters know all is not ideal with our lurch to the right ; may I say that this feeling is summarized as ‘risk’ because as we cut health care, social welfare, family support, local government,social housing, educational opportunities, training and job opportunities then more and more people are exposed to risk including those who have traditionally voted Conservative etc.,.

This is the opportunity which the Centre Left can now use; to ‘counter attack’ the complacency and populist anti-state ideology which is perpetuated by our media almost daily. The idea that economic growth has returned and all will be OK is already being peddled; inequality, risk, social division and lack of opportunities is a narrative that Labour must adopt with more vigor.

But in the graph the growth rate is higher than the return on capital. And will be until 2030 when I presume he predicts a change (?)

At some stage there simply must be a significant if not massive re-distribution of wealth combined with higher taxation on the large rentier element of high incomes otherwise markets for the goods and services beyond the basics will disappear!

When one thinks about how much attention this book is getting it seems strange that the flat-tax trolls haven’t appeared to try to annoy you during your period of recuperation…

Best of luck by the way Richard.

James Galbraith (son of JK) offers informed critique of Piketty’s book on Capital… http://fb.me/3tlZIxv8e I would be interested in your views on the contradictions that Galbraith identifies… your taking care of your health permitting (smiley thing).