The Tax Justice Network is holding its annual workshop / conference today and tomorrow when about 50 people will congregate at City University London to consider the them of 'BEPS and the future of corporation tax'. BEPS is 'base erosion and profit shifting' - or the process by which multinational corporations move their taxable income beyond the reach of the countries where they really earn them.

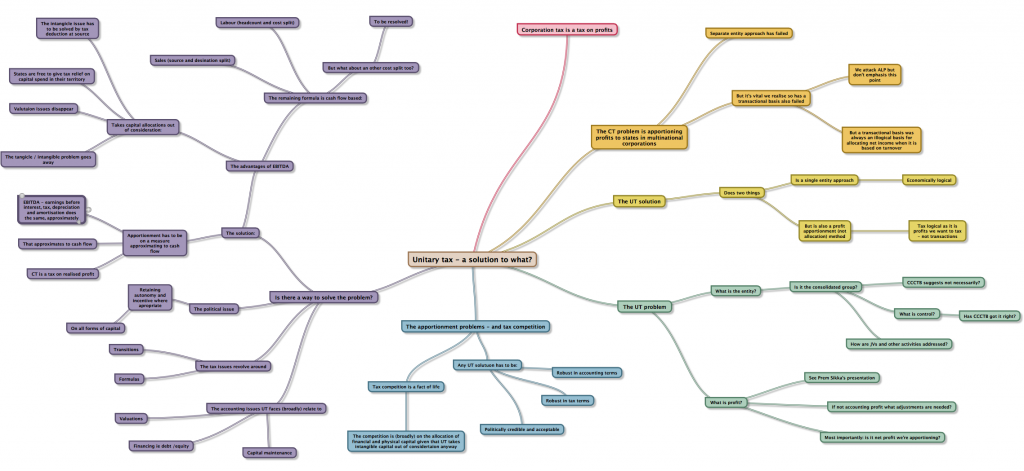

Much of the discussion during the day will focus on unitary taxation as an alternative to the now discredited system of arm's length transfer pricing for apportioning the profits of multinational corporations between states. Theoretically unitary taxation has to offer better solutions than the existing OECD endorsed methods of profit allocation which are costly, bear no relationship to economic reality and are open to widespread abuse. However, unitary taxation also has its share of problems, not least with regard to determining what is profit.

Prof Prem Sikka and I are currently looking at this issue and will be preparing a paper for publication later this year but both of us will be introducing the work at the conference. My speaking notes are as follows:

Click on the image for a bigger version because I am aware you won't have a hope of reading the above - and then optimise by using ctrl + or - keys (cmd + or - on a Mac) and start reading at 1 o'clock and work round, always going clockwise.

As yet I do not know the outcome of our thinking: that's the reason for making tomorrow's presentation. We are seeking debate and input. Comments are welcome here too.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

One small additional thought on the last part of your presentation: you talk about cashflow in terms of sale source and destination.

You miss the fact that a big operator (Amazon, say) derives profit not only from sales but from the data it amasses making those sales (because it can sell it as market research) – and that profit might be accumulated anywhere in the world, not where the sales are made.

It’s an issue that is growing, and I believe that French academics were proposing a “data tax” not unakin to the Robin Hood tax to address it.

Agreed – but that data has to be sold….otherwise it has no value

I am slightly unsure how you define a multi-national. I know it is normally defined to be a company that is registered in more than one country, but if Google was registered purely in the USA and brought all its staff back to the USA would you still call it a multi-national? Would a company become a multi-national as soon as it incorporated a second company in another country? Do you tax a company in countries that it isn’t actually established in? Would that actually result in new companies being incorporated simply to cross borders?

For example imagine company X in the UK that had no base anywhere else, but didn’t want to get dragged into the tax net of other countries. Could it perhaps sell to a company whose pure objective was to buy things in the UK to resell into other countries? The argument for that company would then be that it only makes sales in the UK?

It is company operating in more than one country

An operation is defined as having a place of business

I would like to use the OECD permanent establishment definition but it has been corrupted

It therefore only approximates to what I mean

Exporting does not make a multinational corporation