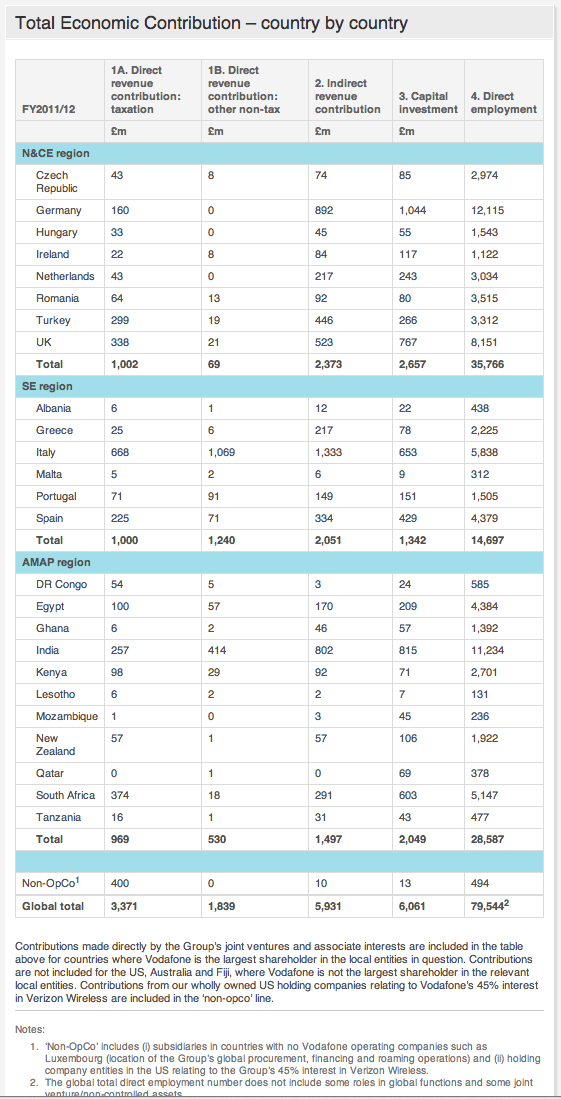

Vodafone published this report today - as if to apologise for the fact that they did not pay any corporation tax in the UK:

So let me say quite emphatically this is not country-by-country reporting, whatever Vodafone say.

First of all the tax figures are utter nonsense and comprise:

Vodafone's total direct tax contribution in each country, including corporation tax, business rates or equivalent, employers' national insurance contributions or equivalent, municipal and city taxes, sector-specific taxes (such as ‘special' taxes, ‘telecoms' taxes or ‘crisis' taxes), stamp duty land tax, stamp duty reserve tax, irrecoverable Value Added Tax (VAT), insurance premium tax, climate change levy, environmental taxes, customs duties, fuel excise duties, vehicle excise duty and acquisition taxes. An illustrative list of the types of taxes paid is set out in the Appendix

Business rates are a cost: a service is provided in exchange. All economists would agree employees really bear the cost of employer's national insurance - so it's absurd to say the company does. And I could go on, but this is just Mickey Mouse accounting trying to come up with the biggest number the company can come up with to call tax as an excuse for not paying tax on its income - which is what we expect.

Second, this is not accounting data. We don't know sales by country, profit by country, employment cost by country, purchases by country and so on. That means we have nothing to compare these absurd numbers with to see if they're reasonable. But all accounting data only gains its credibility by comparison here there is no comparison so this is not accounting information. At best you could call it disclosure; at worst lets just call it naive bragging whose only purpose is to prove that Vodafone could do proper country-by-country reporting but chose not to do so and give us misinformation instead.

We have a long way to go on this issue as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

There are things that are legal. There are things that are illegal. And there’s tax avoidance.