WPP was one of the companies that 'left' the UK in protest at the controlled foreign company rules that were intended to bring their tax haven activities within the cope of the UK tax net.

But, as Ernst & Young have trumpeted in their publication for the Conservatives to which I have drawn attention this morning:

The Government's drive to making the UK a more attractive headquarter location is further illustrated by the recent move to a territorial basis of taxation. This has already reversed the trend of multinationals moving their headquarters out of the UK, and various high-profile multinationals, such as Ensco, Rowan and WPP, have relocated to the UK. In this context, the key reforms include:

â–º Controlled foreign companies(CFC)

â–º Branch exemption

â–º Dividend exemption

â–º Foreign exchange management

More specifically, the CFC rules have been totally rewritten, so that from 1 January 2013 it is an “all out, unless brought in” regime.

To out it another way, the UK has pretty much put taxing tax havens off limits.

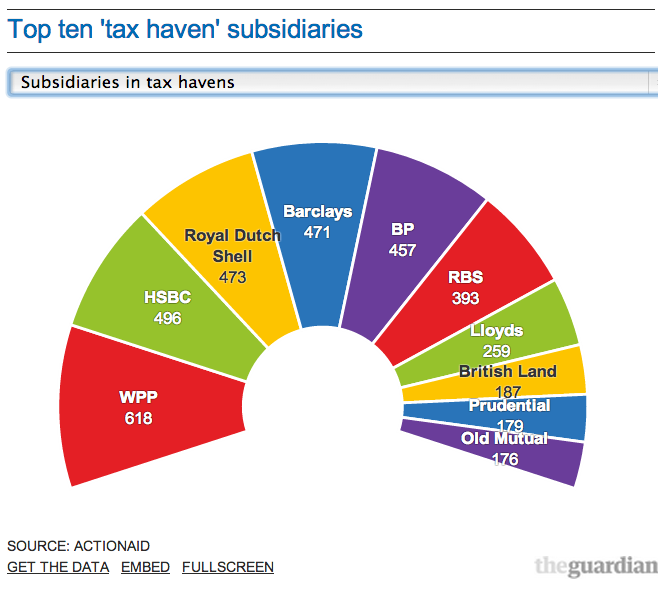

All of which is good news for WPP, who according to the Guardian and Action Aid this morning top the top 10 of tax haven users in the FTSE 100:

WPP's return was a clearly orchestrated move with George Osborne. The timing could not have meant otherwise.

The question to be asked is how much did it cost to leave so many tax haven companies out of tax?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: