Npower has said today, in response to the allegation that it has avoided tax that:

it worked with the Malta company "for a couple of years".

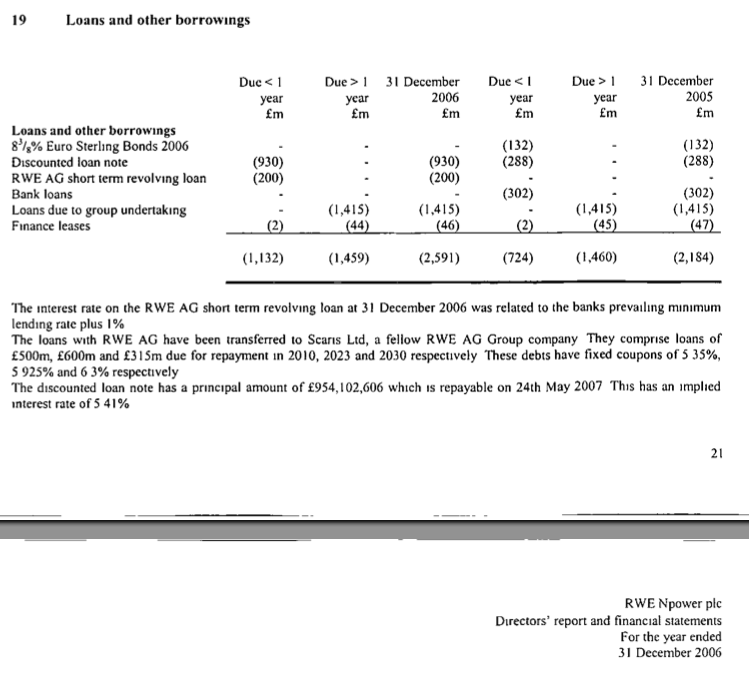

This comes from RWE Npower plc's accounts for 2006:

Npower has also said:

The use of Malta made no difference to our UK tax contributions and we've not used this route since last year.

So, the loans were in existence from 2006 to 2012. How's that "a couple of years" Npower?

And the loans weren't repayable until 2030 in some cases, but were wrapped up in 2012. Now why was that?

More answers needed Npower because nothing you're saying makes any sense right now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

But if you argue that they must be funded by equity why wouldn’t your German tax activist equivalent – Reinhard Meister – say that it is very unfair as your proposal represents a significant German tax avoidance scheme. This is on the basis that they should have funded the UK business direct from Germany using a loan. The interest on which would result in more German tax being paid compared with equity funding the venture. They could also argue it’s normal for UK utility businesses to be heavily debt funded After all, this is fair as it is German money and they have the right to expect a taxable return on it? It also results in the most tax being paid overall but crucially no more UK tax is collected than is the case now.

So the defence against an allegation of tax avoidance in the Uk is “no, we avoided tax in Germany”

Next time someone is charged with murder is there defence going to be “you can’t say that, I didn’t kill X; I killed Y, so you have to let me off”

Do you have any sense of logic?

No, that’s not my logic at all. The example does, however, demonstrate that there is no UK tax avoidance. This is because your suggested route leads German tax avoidance and Npower can only get around this by the UK company paying interest as it does now. Additionally, the German position is unproved as the Maltese structure could well be caught by the German CFC rules for all we know. So Npower’s statements could well be entirely true.

They have to prove it

No, they don’t as you have presented no hard evidence that they have avoided German tax and concentrated on UK avoidance on which there isn’t any per the above.

Like Margaret Hodge they have explicitly said (several times) that they haven’t avoided tax. Why believe her and not Npower? If not, why do different standards of proof apply to certain taxpayesr?

Only a fool would deny the relevance of the evidence presented

I leave you to reach your own conclusions

Yes, but those excusing Npower imply there is no other offence

James

Are there any fairies at the bottom of your garden?

Just checking. 😉