As I've mentioned, I've been looking for data on Cyprus. I've just noted data on the over-exposure of its banking system from Bill Mitchell who used ECB data. Now the question is why that might be has to be looked at and here the data has been found by Naomi Rovnick, using IMF data. As she notes:

The clearest sign that BRICs are leaking tax revenues is that each country's biggest source of outside investment is a tax haven. China counts the tiny Caribbean bolthole of the British Virgin Islands as its biggest source of foreign investment (not including the Chinese territory of Hong Kong). India has Mauritius, Russia has Cyprus, and Brazil has the Netherlands.

The explanation for these incongruent flows of cash is that wealthy nationals are sequestering their income offshore to avoid paying tax, and then bringing it home dressed up as foreign investment to disguise the source of the funds.

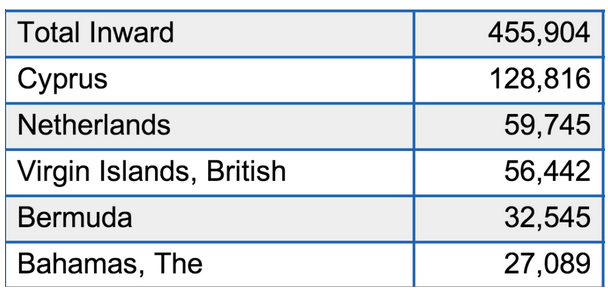

She then looks at a range of locations and their sources of inward investment, of which Russia is one. There the data looks like this:

Every single one of those locations is a tax haven, which shows how distorted the world's investment markets are by tax. But there at the top of the list is Cyprus. And almost certainly most of that was really Russian money in the first place.

When data is this obscured by tax haven abuse, and when tax havens so distort the allocation of resources in the world then the case for reform is overwhelming.

The question is - will David Cameron deliver at the G8? Don't hold your breath.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: