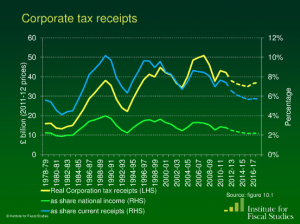

The Institute for Fiscal Studies Green Budget last week included the following chart:

I think it's a telling graph. As a result of deliberate UK government policy of cutting corporate tax receipts, whilst raising taxes elsewhere, and of cutting the UK corporate tax base by excluding all profits arising from outside the UK, the real level of corporate tax receipts is falling, as a share of tax revenues it is on a long term downward trend when the trend in corporate profits over the same period is markedly upwards and as a share of national income it will near enough halve since the late 1990s. contributing in the process to the massive increases in inequality in wealth and income over that period.

I stress: this is not chance. This is by design. The Tories can't blame all the fall in corporation tax receipts on tax avoidance; most of it they're just giving away during a period of austerity and at a time when Ernst & Young estimate large UK corporates have more than £750 billion in cash on their balance sheets, meaning that they do not need tax cuts to provide the means to invest.

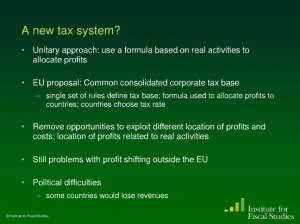

What this actually means is the corporate tax system is itself bankrupt. The answer according to the IFS is:

Yes, that's unitary taxation; the same answer as the Tax Justice Network proposes.

For once we're on the same hymn sheet.

There's more on all this here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What part does a declining economy play in this data?

Profits are rising

gross or net?

“Profits are rising”

And so are receipts of capital gains and dividends taxes.

Mr Murphy

This analysis is meaningless in isolation. Most economists agree that the incidence of corporate taxes falls mostly on workers in the form of lower total wages, with the few dissenters arguing that it actually falls on shareholders in the form of lower returns.

Your analysis should therefore also look at income tax receipts, as well as receipts of taxes on dividends and capital gains. Once you do this, the outcome may be very different.

Most economists do not think that

That is dogma, not fact and the methodology used to ‘prove’ it is flawed, at best

Read my new book where I show lefty of counter evidence

Mr Murphy

Regardless of whether workers or shareholders bear the incidence of corporation tax, the point remains that your analysis of corporation tax receipts is meaningless if you fail to include revenues from income tax, dividends tax and capital gains tax.

I have done, often, elsewhere

Have you noticed we have a deficit?

Mr Murphy

The deficit is the difference between total revenues and expenditures. It does not say much about the make up of tax receipts or the growth rates of the various revenue streams.

Btw, I thought that the deficit, measured in real terms, was actually falling.

Only based on som very dubious stats and unlikely to be true this year

MRubio let’s have your source(s). I would say that this is simply another flimsy neo-liberal excuse amongst the many to justify low wages for the workers. This only enters and is part of mainstream narrative, because in most areas of commerce* the balance of power has shifted too far away from “labour” to “capital”.

*certain areas of banking for example being an exception to the rule!

A breakdown of “who pays” the tax would be useful. This is especially the case if it is the workers are bearing the costs of these fat cat giveaways, the cost being lower wages.

Anyone have sources?

Otherway

To the best of my knowledge the seminal academic paper on the topic is Arnold C. Harberger (1962) “The incidence of the corporation income tax”, Journal of Political Economy 70(3): 215—240. The issue is also well researched in the UK. There is a summary in Devereux, Michael P. and Loretz, Simon, “Corporation tax in the United Kingdom”, Oxford University Centre for Business Taxation, February 2011.

These are macro-economic academic papers and so they are not neo-liberal per se. However, they show that some policies typically associate with the neo-liberal ‘agenda’, such as open trade and capital flows as well as low regulation of labor markets, will result in a higher incidence of corporation taxes on workers’ compensation.

This is important for the UK, which is a very small and open economy with competitive labor markets. In such an economy, workers bear the majority of the economic impact of corporation taxes.

And there is as much evidence the other way

I discuss it in Over here an under-taxed

Devereux’s work, in particular, is highly unreliable in my opinion. You can’t test unidirectionally. He did

Mr Murphy

Would you please share here some academic research that contradicts the findings of Harberger.

For all their qualities, I think we can agree that your books do not meet the standards of rigorous economic research.

Go buy it

And if you don’t think the US budget office qualifies as research – that’s your problem

And in the meantime – if you hold my opinion in such low regard why are you commenting here,and why do you think I have so much more influence than 99% of academics?

Mr Murphy

Interestingly, the Congressional Budget office (which I assume you are referring to) has historically taken the view that the incidence of corporation income tax in an open economy like the United States mostly falls on labor. In recent working papers (see here http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/115xx/doc11519/05-2010-working_paper-corp_tax_incidence-review_of_gen_eq_estimates.pdf), it has somewhat nuanced this conclusion, without refuting it, by saying that labor’s exact share of the economic cost of corporation tax is uncertain, and depends on a number of factor such as product and factor substitution in an economy.

However, in its research the CBO continues to take the view that smaller and more open economies (like the UK) would see labor carrying a the highest share of the burden.

It would seem you are so objective you can’t even read their reports properly

???? The linked paper seems to say exactly the opposite of what you claim.

As I noted….

Fiona

As I was writing, this paper revisits earlier findings that used certain model assumptions to attribute the majority of the burden to labor. It makes clear that other assumptions can lead to different conclusions.

So you agree you were wrong to say the burden falls on labour when the evidence does not support the claim?