Perhaps the most important part of my new TUC report on the 50p tax rate is my new estimate of the tax that this rate might raise.

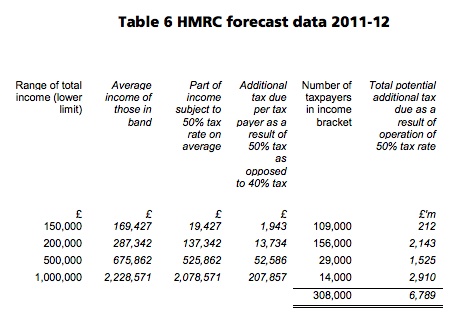

The figure I have estimated is that this tax will raise at least £6 billion in revenue in the tax year 2011/12. The calculation is, however, not really mine. This is H M Revenue & Customs' estimate. I have based my figure on HMRC's estimates of tax revenue to be raised by tax band for 2011/12, here. I extrapolated this data as follows:

Note my resulting total is £6.8 billion. I've downgraded it to £6 billion to be cautious. But this is still HMRC's data. It is their estimate of the average income of those in each of the tax brackets. It's their estimate of the number of taxpayers. It's their estimate of total income. So candidly, this is really their estimate of the tax to be raised. And it's big - much bigger than anything else anyone has said.

We know HMRC are preparing an estimate of how much this tax rate will raise. But in effect they've already done it: I reproduce it above.

If this isn't the number they publish then the question to be answered is why it is different? But for now, whatever others say, this is HMRC's best estimate of the tax the 50p tax rate will raise. My job's simply been to disclose what they have been thinking all along.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Apologies for playing the devil’s advocate (again) – but the obvious question is what is the impact on the forecast/actual figures for those in the higher tax brackets of the increase in the tax rate from 40% to 50% – how do the forecast figures for 2011-12 compare with the actuals for the previous year. Without knowing that effect it is very difficult to be definitive about the about the overall effect of the increase in the top rate. That said I very much doubt it will take away much of the £6,7bn.

Please look at the link and read the report

I deal with that there

“If this isn’t the number they publish then the question to be answered is why it is different?”

I would have thought the answer would be quite straightforward.

The estimate above is clearly labelled “potential additional tax due”. It presumably assumes that incomes will stay the same and behaviour will not change. If any actual figure subsequently comes in lower than that then one can safely conclude that there have been behavioural changes as people seek to avoid it. Of course the actual figure could come in higher, but unlikely.

Do you think they didn’t think of that when preparing the data?

Well that’s an interesting reply, because you appear to admit that there will be behavioural changes (i.e. avoidance) resulting from the introduction of a 50% tax rate. You have not made any reference to that before in your reports for the TUC etc.

And no, I don’t believe HMRC have made any allowance for that. There is no evidence that they have done so, they have simply extrapolated what the tax take would be if things stayed exactly the same. The word “potential” is a big clue. They could have done the same with a 60,70,80,90 per cent rate as well.

So you haven’t read my reports and you assert about HMRC without evidence

Please don’t waste my time again

[…] I’ve already noted that in 2011/12 H M Revenue & Customs forecasts it will collect £6.7 billion from the 50p tax rate. […]

These are very similar to figures I have seen on UK Bubble…which shows 315,000 people earning ovr £150,000. The maximum yield of £6.7bn will be interesting to compare with the ‘actual’ yield when HMRC eventually come up with the figures. But even if it still yields half, surely £3.3bn still means it is worth having ? To ‘give away’ £3bn by abandoning the higher rate would nned some justification when considering the savings recently published as ‘necessary’ by closing Remploy factories down..

I’d want to know why it only raised half

But your point is right!

Why not raise it to 60%? Or 90%? By this analysis every additional 10% would equal £6.8Bn.

Why not make it 100% and rake in an easy £68Bn

Utterly untrue

That’s not what the analysis says at all

Richard,

This analysis is nonsense. The HMRC report that you link to shows that all numbers from 2008-9 onwards are “projected estimates based upon the 2007-8 survey of personal incomes…”. So:

a. they are 4 years out of date.

b. they make no allowance whatsoever for taxpayers changing their behaviour to minimise their exposure to the 50% rate.

Try again.

Respectfully: that’s nonsense

They clearly have been updated, and not in linear fashion

So they clearly reflect HNRC expectation (not mine: I stress)

In that case you have no evidence whatsoever to support your claim

But then, when the heck did a rightwinger need evidence when some dogma will do?

Yes, the data have been updated, but they are still PROJECTIONS based on a value from 2007 which came from a SURVEY. There is NO REAL DATA here!

But the main point is that you have not allowed for changes of behaviour. You have taken the HMRC projection of the tax take in the higher brackets and then just assumed that 10% of that take is due to the 50% rate. This is nonsense.

If HMRC had produced one projection of what would happen with 40% top rate and another projection of what would happen with a 50% top rate, and you had then subtracted one from the other, then your result would be useful, but this is not what you did. You took ONE projection and produced a number out of a hat.

This is exactly the same trick that Darling did originally to justify the increase. It was nonsense then and it is nonsense now. You have added nothing.

Oh for heaven’s sake – I do wonder if people like you have ever lived in or don anything n the real world.

Decisions the world over are taken on incomplete data from sources a lot less re able than this and with a range of assumptions applied

We happen not to know the assumptions applied in this case. What we o know is you have no basis in fact for your claim.

Bu if you really think decisions can all be taken in after the event verified data you have a very, very strange understanding of what it is to manage, and how it is done.

Heisenberg was right to say prediction is hard, especially when it Is about the future, but we do it none the less and have to.

I look for a more measured contribution in future or will hit the trash button without hesitation

Richard,

You have replied at length to my opening comment, and I see the wisdom of your reply in this regard, though I’m not sure Heisenberg ever had tax take in mind.

You have not, however, addressed my main point. Your calculations simply state the projected amount which will be raised at the level of 50%. Your implication, and the implication of those who have cited you, is that this is how much extra the Govt is taking because of the higher rate (and likewise that this is how much the Govt would lose if it abolished the 50% rate). This implication is false. There is no projection as to what the tax take would have been without the 50% rate. It is therefore not possible, on these figures, to say what the “profit” to the Govt is.

Real life does not have a null hypothesis

Richard,

The end of the HMRC document that you link to contains the line:

“The next update of these tables, with information for 2010-11, will be published on 30th September, 2011”

Does this mean that you are not using the most recent projections?

Colin

p.s. “Real-life does not have a null hypothesis” sounds rather grand. What does it mean, in this context?

I used the most recent available when I wrote the report – in late December

And the last comment simply referred to the fact we have to make decisions and so the rejected options are never tested in real life

I do remember similar arguments about how little the Labour government’s bonus tax would raise and how bankers would flee the country and take their skills elsewhere – strangely enough neither predictions came to fruition. In the meantime all the major bank executives contine to receive substantial bonuses in a year where profits and bank share prices have fallen sharply – do the so called “free” marketeers really believe that such skills will be in demand elsewhere?

It’s always the same

It is always wrong

The 50p rate on these figures shows it makes a substantial contribution to the tax take. The arguments about taking into account behaviour seems ridiculous to my, admittedly untrained, mind, because changes in behaviour can only be calculated retrospectively. Therefore, laws should be tightened to stamp down on tax evasion and avoidance.

As a matter of interest, has anyone ever calculated what rates could be if everyone just payed the tax owed?

Secondly, with many middle income owners about to be squeezed by the combination of rail fare increases, and possibly losing their child benefit. Would dropping the 50p rate to £120,000 whilst raising the 40p one to £60,000 have much effect, either positively or negatively?

Dave

Only stuff that looked at that was for Compass in 2009

Me, Howard Reed, David Byrne, Sally Ruane and George Irvine

Give it a search

Richard