I note a story from a couple of days ago that has spun in all sorts of weird ways.

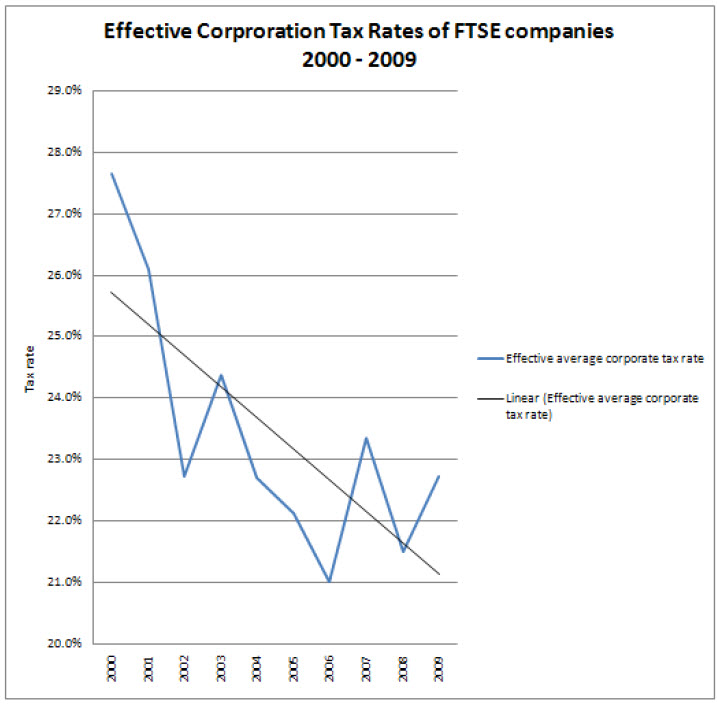

UK accountants Hacker Young have suggested that the tax rate of FTSE 100 companies has fallen by almost 30% over two years, publishing a graph that looks like this:

This is utterly misleading.

In 2009 we had economic meltdown and many companies made losses. However, many of those losses were provisions that were not tax allowable so profits were deflated by tax bills weren't, so rates rose.

Now that situation is reversing.

And in addition, of the unadjusted profit of FTSE companies before goodwill provisioning is taken as the base when goodwill provisions are almnost never tax allowable that is also misleading whilst failing to exclude rogue companies like Shell which includes oil taxes in its tax charges can also seriosuly distort reuyskts.

The reality is that, as I have shown, that the effective tax rates of companies in a controlled sample of FTSE 100 entities is much lower than Hacker Young suggest, as follows:

This makes sense, and broadly agrees with a wide body of data, none of which shows UK effective tax rates are higher than the headline rates of tax as Hacker Young are suggesting.

Candidly, this report on their part is poor work, misleading, and is simple headline grabbing to demand tax cuts when none are due. They do themselves no favours as a result by publishing it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“In 2009 we had economic meltdown and many companies made losses. However, many of those losses were provisions that were not tax allowable so profits were deflated by tax bills weren’t, so rates rose.”

wont the provision be reflected in the deferred tax line though if its ultimately tax deductible, so the effective rate actually already reflects the above reversal? what sample did you use out of interest?

Pls read my report

I do not need to spoon feed you

If the losses were due to non-tax decuctable provision, then they would have been in deferred tax and hence formed part of the effective tax rate. In the future year they either were utlised and became tax deductable or they were reversed and so was deferred tax. The net effect is a less lumpy effective tax rate, rather than the other way around (which is what the cash tax would be)

But deferred tax is hopelessly unreliable as an indicator as much research shows

Have the corporate tax figures been distorted by massive losses in banking sector and the BP losses due to gulf of mexico spill, I assume a large amount of corporate taxes come from small number of very large companies.

Yes, you,re right

You should be comparing the UK tax charge (including deferred tax credit/charge) as a %age of UK profits with the UK corporation tax rate.

But since that’s not disclosed that’s a fantasy on your part