It is often said that government income and expenditure were out of synch before 2008.

And it is also claimed that it is excessive spending before then that caused the current crisis.

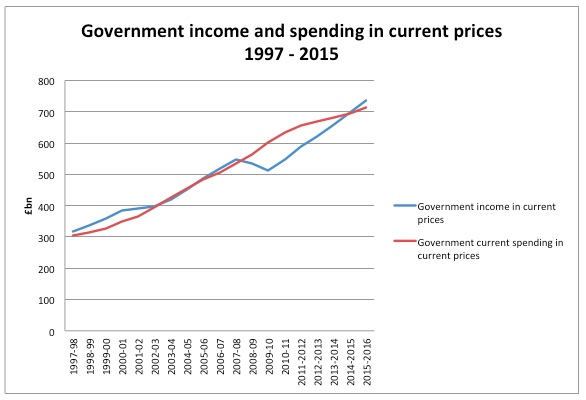

Neither claim is supported by data. The following reflects HM Treasury out-turn data to 2009-10 and June 2011 budget data for 2010-11 onwards:

The visual imaging tells the story.

Labour ran surpluses.

And then it ran tiny deficits that related in large part to investment spending.

And then tax revenues collapsed, which had nothing whatsoever to do with excessive spending and had everything to do with banking collapsing.

Supposedly this will correct by 2015. I don't believe that.

But let's not for a minute think that Labour mismanaged the economy. The data simply does not suggest it did. Banks did that. And it was banks that created the deficit.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Your graph misleads on 2 fronts:

First of all you omit all of the off balance sheet liabilities that accrued in the 10 years from 2001 (PFI, public sector pension liabilities) and whose real costs are now kicking in.

Second you present the tax revenues as though they were generated at a constant rate. The reality was that the rate of taxation was increased by dozens if not hundreds of stealth tax increases.

It wasn’t City generated taxes that went missing that caused the problem. Treasury revenue from the City never came anywhere near the £170 billion deficit in 2010. That was down to the private sector flatlining for many years (probably from about 2003), and because of a lack of investment from around the time that Labour came to power.

No – all that is your hypoethesis

The reality is you can’t deal with facts – including ones published by Osborne

Richard

I think we will have to accept lower tax revenues, greater budget constrictions, not for the reasons the right give.

Even though they constantly sought to avoid their fair share of tax, back in the 2000s the banks (CT) & their traders (IT via PAYE & NICs) did pay a lot of tax. What we now know is that much of the profit they booked wasn’t genuine. Some was, in fact, flat out fraudulent. They “marked to market” gains & somehow lost their losses in SPVs.

In reality, even though the banks are currently showing healthy profits, we know that if they really “marked to market” all those property loans they have no realistic hope of recovering they’d be as screwed as, .. well, a screw.

So, if the banks are loss-making they’ll pay no CT.

IF they do the right thing (unlikely I admit) & account for their losses then they should pay no bonuses either.

Result. we are going to have a LOT less tax flowing in.

This, I hope, isn’t a political point, just what seems common sense.

cheers anyway

True – although mark to market did not give rise to CT profits, so no tax there

And if he banking decline means clever people do clever things instead of dumb things there may be a lot more wealth

In other words, I’m expecting real growth in what is of worth

Spending more than you earn especially when it’s the good times is no way to run a house or a government

But investing for the future is always wide if you want one

And that as what created the deficits

MarkT raises two old chestnuts which seem always to be rolled out by a certain political persuaded type of commentator in these circumstances: PFI and public sector pension liabilities. Surely these are genuinely off balance sheet as regards assets, even though they represent a call on future tax revenues.

After all, PFI deals were freely entered into by private companies, and are secured against certain assets. Presumably the private companies involved in these deals show these assets in their books, rather than loans to HM Government.

As regards pensions, if the state can pay pensions out of current income, there is no need for the pension obligation to be funded. You only need to do this if there is a possibility that the income stream will cease in the future – as is the case with private companies. So you only need a public sector pension fund if you think that HMG is going to cease to be able to collect taxes. I appreciate that some commentators on this blog might hope for this, but surely even they cannot expect it.

I write as a non accountant – perhaps Richard could confirm or deny the position if he has a moment?.

Your logic is entirely sound

I do not approve of PFI on grounds of cost

But if the loan was on the books so would the asset be

As for state pension obligations – they’re expected to eb a falling part of GDP i.e. wholly affordable

But surely PFI costs will be a major revenue drain for years which will simply be added to the budget deficit? I’ve no idea how much these costs would be compared to the costs of servicing conventional debt and would be very much like to be told by someone who knows.

Seems to me that as the current government are continuing the PFI fest it needs determining whether this is an issue and I see hardly any discussion of this outside Private Eye.

When PFI costs up to 16% and the government can borrow for a bit over 3% the false economy of PFI is obvious

But the Tories are wedded to it too

Whoever was in “power” should have been able to predict that if you give loans to people who are unable to pay them back because they are either:-

* Unemployed

* Too thick to understand

* Greedy

* Conmen

* All four

Then eventually something nasty will happen.

While your graph isd entirely correct, it misses the point of the what comprised the income side. Most private sector GDP growth in the period 2001-2007 came from the financial sector, real estate and construction, driven by a credit bubble as a result of totally inept monetary policy. The rest of GDP growth came from government spending. So most of the GDP growth over that period was illusionary and hence so was a lot of the tax income. By not only spending all this tax revenue, but then still borrowing more in the mistaken belief that debt to GDP was under control (easy to do when measured against GDP that is peak cycle and bouyed by the very public spending you are borrowing for), the previous government created the situation that we are in now. That is not to say another government would have done any different, it would have taken massive political will to run a surplus over those boom years, but if they had we would be in a fantastic position to borrow more and run a bigger deficit.

Did you say that at the time?

This is a good point, I remember in 2007 the Conservative Party’s top priority was to cut inheritance tax and maintain Labour’s spending plans. There was the book Fantasy Island by Guardian journalists Dan Atkinson and Larry Elliott published in 2007. The book did say that Britain was living beyond its means but that the problem was soaring private debt and that New Labour had abandoned an interventionist approach to the economy.

I have been studying Bill Stills and Ellen Browns “Money Masters” “Web of Debt” and “Secret of Oz”. Also following the online reports of “Positive Money” in Britain.

If their analysis is correct, Governments build up deficits simply by borrowing money by selling bonds, when they should simply issue money themselves. Apparently it has been done before by Lincoln and Jackson in the USA, and by Peel in the UK. Governments should tax the rich more as well to pay for public services etc. Yes, and crack down on tax havens!

By allowing deregulation the banks can row the economy through booms and busts, and according to Bill Still, move wealth up to them selves and the rich due to forclosures etc, and bailouts.

Money is as ludicrously simple as they say

It’s bankers who seek to hide that fact

I’m no accountant either, and find it hard to make sense of it all sometimes; I just follow hopefully reliable analysis.

One bit of analysis I will never forget. At the TUC conference last year, Mervyn King addressed the deligates and catergorically stated that the banks were firmly to blame for the government deficit. Rather brave I thought!

If he said it, of all people, and in front of such a left-field audience, then surely we can accept his analysis?

I see that the chart indicates that government spending will continue to increase over this parliament. This doesn’t seem to fit with the popular narrative about savage cuts and a government determined to shrink the state.

As a proportion of GDP it falls

That means real cuts result

And since much more is in benefits due to deliberate unemployment front line services suffer heavily

Should government spending rise and fall in line with GDP? Did the financial boom mean we needed more nurses? Did the bust mean we needed less?

Regardless, even if there is modest fall in spending as a proportion of GDP, that does not fit with the narrative. I am, I should add, well aware that there are large and real cuts happening in many areas.. but the big picture simply doesn’t reflect a government of neoliberal zealots turning the UK into a small-state low-tax economy. Much of the tory talk abot ‘cutting back’ is rhetoric for the Daily Telegraph crowd.. the reality is only a modest retrenchment of GB’s final couple of years of generosity.

I find it amazing you have time and inclination to write stuff like that