The whole premise of he government’s economic policy is that we’re going to grow out of recession and that business is going to rush in to fill the void government spending cuts create in the economy — from which business has been to date “squeezed out” by over-active government.

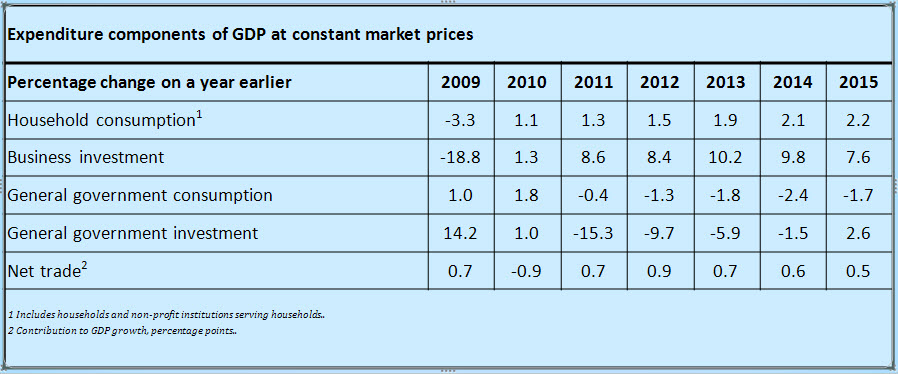

This is summarised ion this table issued by the Office for Budget Responsibility issued yesterday:

Despite cuts some households are going to spend more.

Exports are going to grow modestly — so it’s clear Ireland, Spain, Portugal and Belgium having woes won’t trouble us.

Government is slashing spending — both on current spending and most especially on investment.

And — most important — although household growth is modest at best whilst trade growth is negligible and businesses biggest customer is slashing spending — especially on investment which it always buys from the private sector — business is going to be investing enormously.

It’s just not going to happen. What it it going to be spending on? And why should it spend? What’s the rationale for doing so without any government stimulus for doing so?

Candidly if Robert Chote believes this he’s lost it. The Guardian clearly doubts he does and is much closer to the truth:

The OBR's Robert Chote went out of his way to stress the uncertainties. For all the fiendish complexities, at heart forecasting is the art of the ruler: straight lines reconnect a depressed present with a trend extrapolated from a happier past. Thus business investment — which has sunk like a stone — is now predicted to surge. Perhaps it will. If so, the wider economy may dodge the axe being flung at the state. But perhaps business will falter. If so, Mr Osborne will learn the lesson being absorbed by those early cutters in Dublin whom he once admired. Namely, that writing pain into the start of his story does not guarantee a happy ending.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Do share buybacks qualify as business investments under UK national accounts? Companies sit on an estimated minimum of $5 trillion of cash globally. That would be one way of spending that pile, and let the shareholders (i.e. you and me, directly or indirectly) decide what to do with it.

This is precisely the core failure of a planned economy – the practically impossibility to predict winners on a system-wide basis.

But just becuase no *one* person can envisage it, it does not follow that we as a collective do not know. That would be a fallacy of division. To give one example with which I am familiar: telecom operators are likely to substantially increase investment over the coming half decade or so, driven by 1) explosion in demand for data centres 2) additional spectrum and capacity for mobile data and 3) fibre rollout.

So for the 8-9% of the economy which is telecom, the OBR is right (or more likely is understating the opportunity). People familiar with other industries may be able to comment within their area of expertise. That collective wisdom may well reconcile with the OBR numbers.

But you really shouldn’t beat yourself up because you are not all-seeing. Neither were the soviets.

@Gary

Don’t be crass

If the OBR can forecast in macro terms so can I

And I have, as validly as they have

And I disagree with them

That’s it

Your argument is utterly specious

I think the OBR have access to significantly more data and higher quality modelling systems than someone sitting in front of a screen in Norfolk.

@Gary

Take a look at the success of South Korea. They have managed to pick winners.

@Gary

So the (quasi-monopoly) phone companies will be making money. As the gas and electicity companies make money. Woop-de-doo.

Meanwhile, the telecoms equipment manufacturing industry has been in the toilet for decades.

You asked a question, three questions, and he answered, rather politely and based on personal experience. What’s specious about that?

@ambrose murphy

Sorry – he did a) not answer b) did not attempt to c) made silly aspersions about Soviet style thin king d) tried to suggest I suffer that complaint

That was not an answer – it was something I should have deleted under myt comments policy

I will next time

The data is in. I quote from todays Times (behind a paywll)

“British manufacturers are on a hiring spree as they enjoy the strongest business conditions for 16 years.

The Markit/CIPS purchasing managers’ index of manufacturing activity rose to 58 in November, its highest level since September 1994 and up from 55.4 in October,

The survey suggested that weaker activity readings during the summer had given way to renewed strength, despite the malaise in the eurozone, Britain’s biggest export market. Companies reported increased sales to clients in France, Germany, the United States, China, India and the Middle East.

Thee PMI data also showed that employment at British factories rose at its fastest pace since the survey began in 1992, meaning that staffing levels have increased in each of the past eight months.”

So business is up, employment is up and exports are up.

I would dare to venture that investment might soon be up too.