This comes from the Tax Justice Network blog this morning:

This comes from the Tax Justice Network blog this morning:

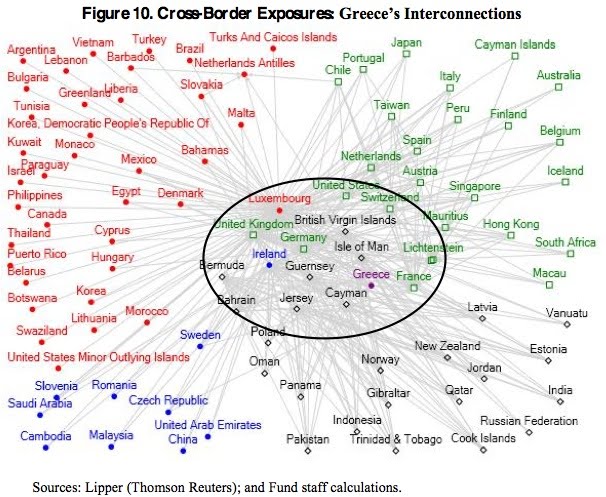

Sometimes, a picture speaks more clearly than words can. Now, courtesy of something that FT Alphaville has just pointed out, we bring you this (click to enlarge):

Look at all those jurisdictions inside the black circle. The accompanying text in the relevant IMF report, from where this graph comes, says:

"An illustration of Greece‘s interconnections in cross-border funding flows reveals why funding strains in Greece in the first half of 2010, despite being by itself small, might have translated into pressures on other Euro Area peripherals. Recall that banking exposures to Greece were relatively small in the context of banks‘ balance sheets; yet, concerns about the strength of balance sheets and the ability of other Euro Area peripheral countries with fiscal and financial vulnerabilities to finance themselves increased as the Greek situation worsened. Using the funds‘ data, Figure 10 presents four clusters (i.e., countries that together form more of a closed system), centered around a set of core connections that are closely linked to Greece: (i) a red cluster of countries with access to funds domiciled in Luxembourg; (ii) a black cluster with access to funds domiciled in the offshore centers of British Virgin Islands, Jersey, Cayman, Guernsey, and the Isle of Man; (iii) a blue cluster with Ireland at the core; and (iv) a green cluster of the U.S. with several key European and other countries. Greece is interconnected with each of the central nodes of these clusters. This close interconnection across other core countries suggests why asset re- allocations and flows might have been large systemically, with potentially significant impact on countries such as Ireland."

Contagion: it was the tax havens wot dunnit. (And you can be sure that the "United States" will have heavily featured Delaware, a tax haven inside the U.S. that has been the securitisation jurisdiction of choice; the "United Kingdom" means the City of London, that state within a state that is arguably the world's most important offshore jurisdiction.) We haven't yet fully digested the contents of this report. We will get back to you before too long.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Perhaps China or Saudi Arabia might consider bailing Ireland out?

“Contagion: it was the tax havens wot dunnit.” Got to laugh at that. You are using a picture depicting the domicile of funds as evidence?

If it was the tax havens wot dunnit, and the EU is committed to tax harmonisation, why are France, Luxembourg, Ireland and the UK all in the “magic circle”? Do they all count as “tax havens”?

If so, why doesn’t the EU put its own house in order – wasn’t there an EU Code of Conduct against tax havens? Weren’t they committed to stamping out abuses? I know the UK is outside the Eurozone, but the others are inside.

Luxembourg is always cropping up in dodgy secret transactions, but it always seems to be in a permanent blind spot when the EU is looking at tax havens. It was only when the OECD looked at ALL jurisdictions globally that it had to wriggle about (along with Austria – another dodgy EU locale).