![]()

In 1819 David Ricardo promoted the idea of comparative advantage in trade.

He used this example (which I have borrowed from Wikipedia in this form):

In Portugal it is possible to produce both wine and cloth with less labour than it would take to produce the same quantities in England. However the relative costs of producing those two goods are different in the two countries. In England it is very hard to produce wine, and only moderately difficult to produce cloth. In Portugal both are easy to produce. Therefore while it is cheaper to produce cloth in Portugal than England, it is cheaper still for Portugal to produce excess wine, and trade that for English cloth. Conversely England benefits from this trade because its cost for producing cloth has not changed but it can now get wine at a lower price, closer to the cost of cloth. The conclusion drawn is that each country can gain by specializing in the good where it has comparative advantage, and trading that good for the other.

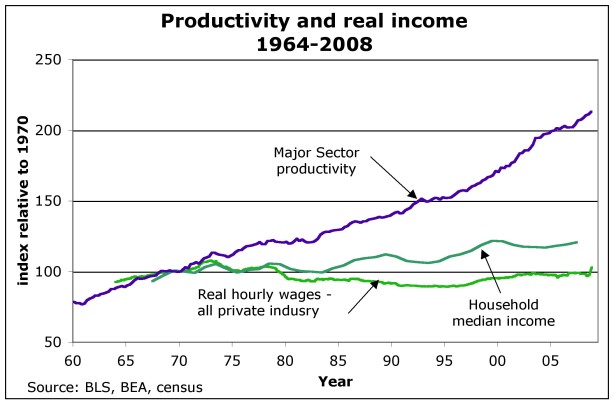

But, as ever there were implicit assumptions that led to this conclusion, most of which have been ignored ever since. One was that labour was immobile, and by and large that is still true. The second was that capital was immobile. It was until 1980, then Thatcher and Reagan gave it free reign to move at will. The result is this:

Productivity has risen because capital has sought out the cheapest labour possible to substitute for that bought in the US. That cheap labour — mainly Chinese in the US case — has forced down US labour rates. But the return to capital has grown enormously — reflected in the supposed productivity curve, which does actually reflect substitution of labour.

So, labour is much worse off as a result of free trade where capital can move and labour cannot. No wonder the Tories want to cap immigration. Keep it at a distance paying it as little as possible is their plan. that increases profit.

But it’s more important than just that — however important this is. Profits have risen for decades on the basis of no innovation or research or development in many industries. All that had to be done was to substitute cheap, sweat shop labour for that in the domestic market and profits rose. Why invest in that case? Unsurprisingly we now find the economies that most heavily embraced globalisation — the UK, the US and in extremis Ireland — the most exposed. They have no skills left. But they also have no innovation of investment base left either. Free riding the system has left them financially, intellectually, and socially bankrupt. France and especially Germany took a different route. And it’s paying dividends.

The fact is that the free flow of capital is not beneficial to most societies. It harms labour returns and reduces the income of the majority. In the states where labour is already poor the pressure to keep standards low is high so oppression continues. And as serious, the guts are taken out of the economies that allow the free flow of capital. So this flow undermines the nation, the state, its people and in the end its whole identity. Ireland is the perfect example. Others please note.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

@ Richard.

Absolutely correct. Spot on. Not often I feel that way about your blog but then this post is not about tax or the size of the public sector.

Chris Dillow reckons that, since WW2, UK profits as a share of GDP have fluctuated at around 21% of GDP (1). So it’s intuitive that labour suffers at the expense of capital, but not obvious from that data that the intuition is correct.

There might be an internationalist element to this. If capital is substituting cheap labour for expensive labour, that would explain why rich labour incomes are broadly flat in real terms, but also why poor incomes are rising fast, thereby lifting millions out of absolute poverty. Reducing poverty is good – right?

(1) http://stumblingandmumbling.typepad.com/.a/6a00d83451cbef69e20133f578c0d7970b-pi Chris is using the data to consider a different point, but the data is what it is.

@Gary

And for another take on that profits data see here

http://www.taxresearch.org.uk/Blog/2006/10/17/tax-paid-by-uk-companies/

Your logic does not work

@Richard Murphy

Just looked at your link: it seems to show profits as a share of GDP growing from 21.5% to 22.5% since 1999.

I don’t disagree with your data at all since it is not another take but a subset of Chris’ data that shows it fluctuating at around 21% since the war. It has on occasion been as high as 24% and as low as 16%. Moving from 21.5% to 22.5% seems to me to be well within the longer run range of 16-24%.

looking at Chris’ data I can see how I could pick different start pointsto generate any conclusion I wanted to, but in the longer run profits as a share of GDP don’t obviously seem to be on any clear trend.

Which still leaves open the alternative explanation that the gains are flowing in large part from the wealthy Brit/US workers to the millions of people overseas being lifted out of absolute poverty. Good news for those concerned by poverty internationally I would say.

Wait, capital flowing out of a country may be bad for labour but what about the country where the capital is flowing too?

It’s not just capital mobility, there must be more to it.

Doesn’t anyone ever think to calculate the movement in the share going to the other factor of production – land?

@Carl

Capital inflows may be good or bad for a country, depending on how that capital is invested.

One would hope that capital gets invested in industrial production, research and development etc, but what I see all around this crazy world is that, for some reason that maybe Mr Murphy can explain, the capital ends up inflating land prices, housing, works of art…commodities….you name it.

My take is that the great wealth created by the rise in productivity mentioned before cannot be invested in the productive cycle because, like the chart shows, household demand does not rise the same way.

@Cesar Esteban

You say ‘capital ends up inflating land prices’. So isn’t the share going to land increasing and why is there no analysis done on the role that land plays in the economy? Nasty cliche, I know, but isn’t the economic concept of ‘land’ the elephant in the room?

@Carol Wilcox

When you say “land”, I am not sure if you are referring to agricultural land or something else.

I think the reason why most blogs will not talk about land reform or anything related to land policy is that most of us are urban creatures, and our heads are elsewhere.

@Cesar Esteban

You prove my point. Most people – even economists – have no concept now of what land in its economic sense means. Just consider this: during the crazy property boom, was it the cost of building materials and services which was inflating the prices?