The World Bank has issued a new paper providing measures for the size of the “shadow” economy in 162 countries. The UK is one of them.

The World Bank has issued a new paper providing measures for the size of the “shadow” economy in 162 countries. The UK is one of them.

It’s important to note in this respect how the paper defines the shadow economy. The authors say:

In this paper the following more specific definition of the shadow economy is used:11 the shadow economy includes all market-based legal production of goods and services that are deliberately concealed from public authorities for any of the following reasons:

(1) to avoid payment of income, value added or other taxes,

(2) to avoid payment of social security contributions,

(3) to avoid having to meet certain legal labor market standards, such as minimum wages, maximum working hours, safety standards, etc., and

(4) to avoid complying with certain administrative procedures, such as completing statistical questionnaires or other administrative forms.This paper utilizes a more precise definition of the shadow economy so as not to deal with typical underground, classical economic crime activities, which are all illegal actions that fit the characteristics of crimes like burglary, robbery, drug dealing, etc. We also exclude the informal household economy which consists of all household services and production. Furthermore, this paper does not focus on tax evasion or tax compliance due to time and length constraints, and the fact that tax evasion is a subject on which a lot of research has already been undertaken.

Therefore, whilst the paper does not look at estimates of tax evasion it does look at the scale of economic activity suppressed to facilitate economic activity.

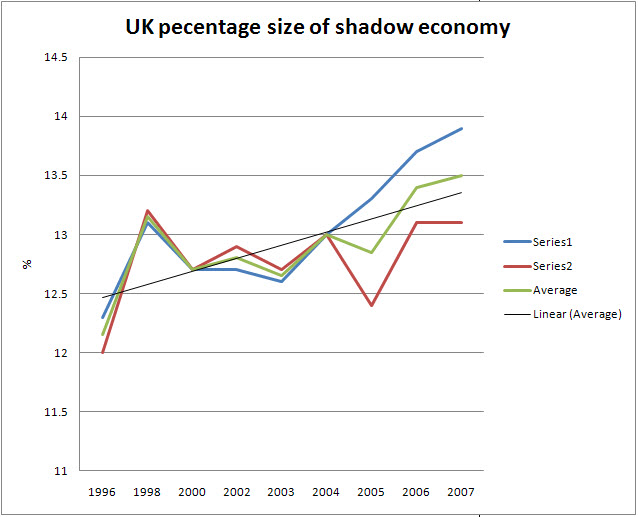

In the UK this is as follows:

| 1996 | 1998 | 2000 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

| % of GDP | % of GDP | % of GDP | % of GDP | % of GDP | % of GDP | % of GDP | % of GDP | % of GDP | |

| Series 1 | 12.3 | 13.1 | 12.7 | 12.7 | 12.6 | 13 | 13.3 | 13.7 | 13.9 |

| Series 2 | 12 | 13.2 | 12.7 | 12.9 | 12.7 | 13 | 12.4 | 13.1 | 13.1 |

| Average | 12.15 | 13.15 | 12.7 | 12.8 | 12.65 | 13 | 12.85 | 13.4 | 13.5 |

I would stress:

a) The authors offer two different measures: I have shown both

b) The authors do not have data for series 1 for 2007: I have inserted a measure which reflects a smaller rate of increase than in the previous five years to allow a cautious average for that year to be calculated. This does not distort the findings noted below and is a statistically cautious extrapolation.

This data can be graphed as follows:

There are three things to note. Firstly, as the trend of the average shows, there is an unambiguous increase in the size of the UK shadow economy over this period. This is worrying, and it is a trend that is bound to be exaggerated by the recession. The ratio had though, on average, reached 13.5% in 2007.

Second, GDP for the UK in 2010 is expected to be £1,458 billion.

Third, UK tax revenues as a proportion of GDP historically have averaged in total between about 35% and 37% of GDP according OECD data, with that ratio being higher at the end of the period noted above, overall. The ratio may have risen now because GDP growth has fallen, but I am not going to allow for this as it would increase the ratios noted here without evidence to support the claim, and this I will not do. .

In combination this data therefore suggests that at a minimum some 13.5% of the economy is operating in the shadows in 2010. At a minimum this is GDP of £197 billion.

Tax at 37% should have been collected on this sum and has not been. This represents a sum of £73 billion.

My estimate of tax evasion in March this year, based on the VAT tax gap of 13.7% on average over a seven year period, suggested that tax evasion cost the UK £70 billion a year. The above analysis, using entirely different data different suggests it might be £73 billion a year.

I do not think that is chance. I think that suggests that this loss is a matter of fact. Which is why we need to act on it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: