The OBR makes clear who it thinks the winners and losers from their modest growth forecasts for the next few years will be in their report.

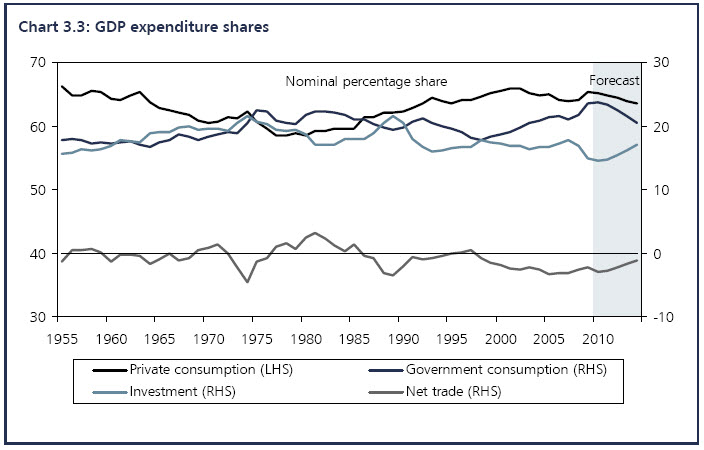

First, they think consumption as a share of the economy will fall by 1%. State spending will fall by 3% of GDP (or one eighth of total state spending now) and investment by bsuiness will rise by 2%. A mild improvement in net trade driven by exports rebalances the books — but still leaves a trade deficit. The graph looks like this:

There are some extraordinary assumptions in here though, apart from the one noted with regard to state spending — which shrinks by 12.5% in real terms. Take this one for example:

Oil prices are assumed to move in line with the prices implied by futures markets as at 25 May 2010.

Oh, that’s all right then. let’s not worry about oil.

And this one:

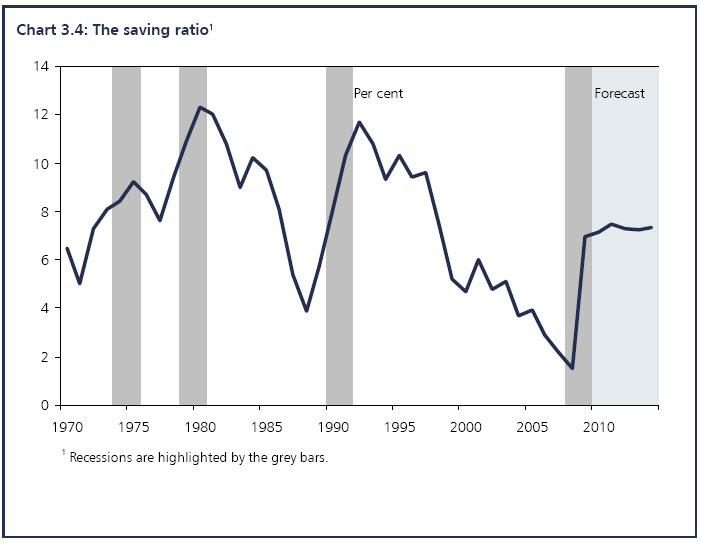

In other words, although the state is going to make hundreds of thousands redundant, reduce benefits, threaten pensions, deny the opportunity to work to millions and quite probably require people to consider savuing to cover health and other risks people are going to carry on spending as before.

This is an absurd assumption. The state is planning to transfer risk from the community to individuals but does not expect the individual to react by saving more? That’s absolutely illogical. Of course they will;. If the state safety net is reduced — for example by cutting public sector employee pensions — then those employees will save more. The last thing they will do is carry on spending as before.

In which case this forecast is wildly inaccurate.

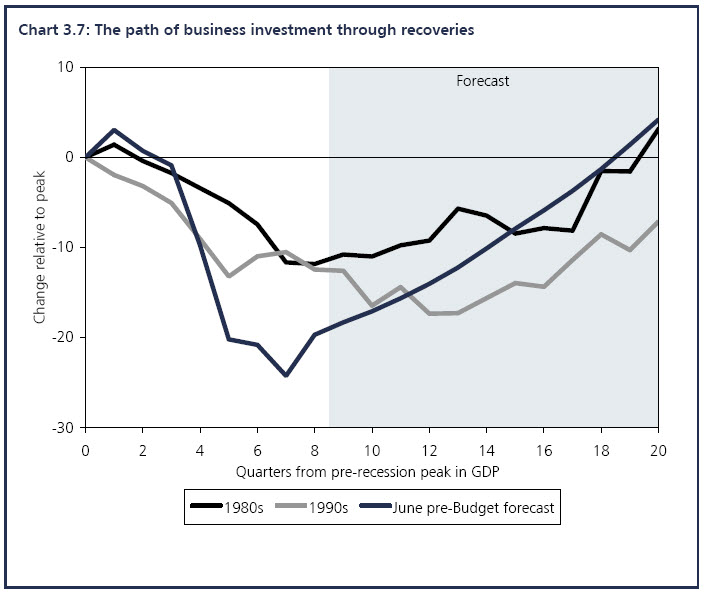

So too is this one on investment by businesses:

The smooth upward line is the forecast. So despite the fact Europe is in crisis, mass unemployment is looming, the state is going to cut spending (and is the biggest single private sector customer) and there are no obvious technological innovations to require investment it’s going to rise anyway, and by more than when coming out of the 1980s recession when, as Larry Elliott pointed out earlier today:

The budget hawks like to cite Geoffrey Howe's draconian 1981 budget as evidence that fiscal tightening is perfectly consistent with economic growth. So it is, providing there is scope for an over-valued pound to depreciate and for excessively high interest rates to be cut. So it is, provided that tumbling oil prices raise the real incomes of consumers and cut costs for businesses. All these things happened in the early 1980s; none of them are likely to occur now. The pound has already fallen by 25%, interest rates are at 0.5% and oil prices show no sign of falling much below $70 (£48) a barrel.

In other words: there is no prospect of this happening.

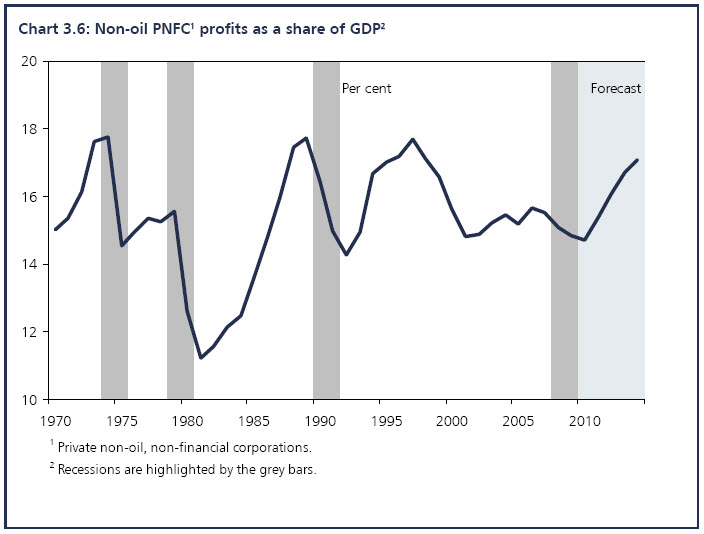

Which does, however, mean one audience Osborne really wants to please will be disappointed. The profit forecast for the next few years by the OBR is rosy:

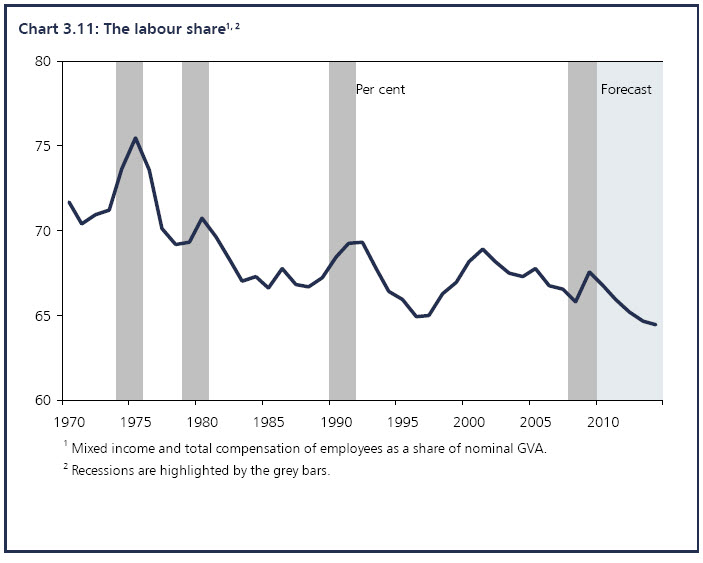

What a jolly time to be in business: profits rise as the share for labour falls — yes that’s what they forecast:

Since this is despite their claim that:

We expect employment to stabilise this year and to start rising in 2011. The ILO unemployment rate is expected to peak at just over 8 per cent in 2010, before falling gradually throughout the forecast period, to just over 6 per cent in 2014. The claimant count continues to decline, from 1¬? million in 2010Q1 to just over 1 million by the end of 2014.

This will be in the lifetime of a parliament that will cut state spending by, on this forecast, more than £85 billion in current terms — a result I think likely to create more than 1.5 million unemployed by itself — all of whom will have to be absorbed, and somewhat more, by the private sector if this assumption is to be true. It’s not surprising they forecast real incomes will fall as profits rise dramatically, but even so this is implausible.

I could carry on — but by now the drift is obvious. This is first of all pure politics, and nothing to do with independence or budget responsibility. Second, it is fantasy wish fulfilment requiring that wholly untenable assumptions be made. Third it shows a deliberate plan to redistribute income upward in society — which would, even if unemployment fell, be wholly unacceptable at this time given what has happened of late. Fourth, a plan built on this basis is bound to fail.

In all, this is a recipe for disaster.

I’ll go back to Larry Elliott again who said this morning that the lunatics are back in charge of the asylum. Not very PC, but he’s right.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Re-writing economic history and a load of inconsistent criticism:

1. Profits increase.

2. Leads to investment.

3. Means more jobs……

Or would you rather:

1. Taxes increase.

2. Reducing post tax profits and cash flow.

3. Leads to less investment.

4. Means fewer jobs……

I suggest you examine the BIS analysis of the debt trajectories of the major economies. Interesting and alarming reading, I think we should conclude that the lunatics have been ejected and there is no choice but to clear up the mess. Try the Austrians……

@Andrew

Of course I could

If I wanted to see the destruction of wealth

Keynes was the outright winner, as we all know