There’s a perverse untruth about the fiscal deficit that the likes of the Institute for Fiscal Studies and their acolytes, like Stephanie Flanders on the BBC, keep going on about. This untruth is that we had one before 2008. The truth is that if government had accounted like a company — on an accruals basis — there would have been no deficit recorded at all.

The reality is that from 2000 to 2007 the economy grew, and at a significant rate. We could argue whether it was the right growth, but there’s no doubt at all that it grew. And no one complained about it back then.

And so too, partly as a result, partly because growth was predicated on it, did the public sector grow. That is also undeniable.

But now let’s acknowledge another truth — which is that much tax is paid late. VAT always has up to 120 days credit on it. PAYE is, admittedly, only paid a month late. But taxes on profits from companies and the self employed often lag up to a year behind the earnings to which they relate. And as recent evidence has shown — a lot of tax is settled way after its due date.

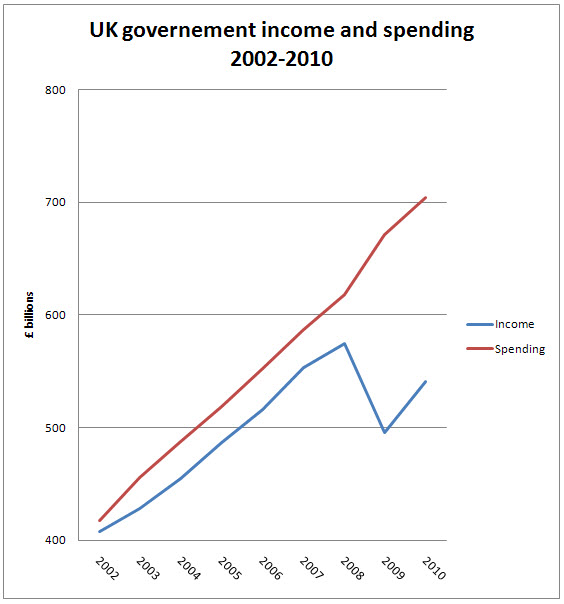

Now look at the patterns of growth in public revenues and spending, the data being taken form HM Treasury budget statements, as shown in this graph:

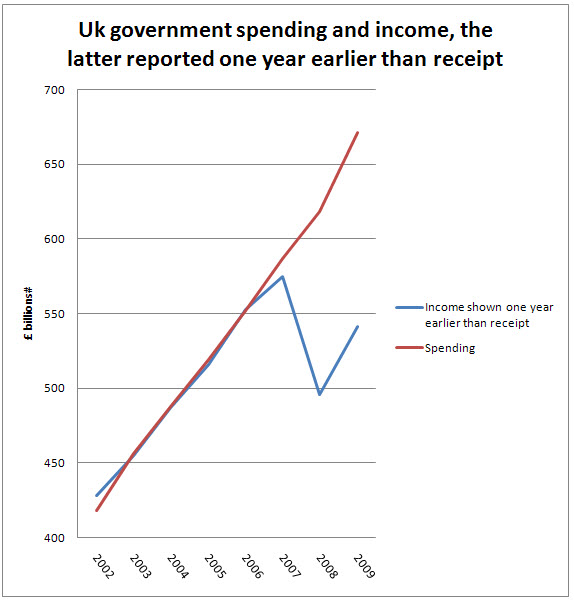

The note what happens if the one year lag in receipts is eliminated i.e. taxes were accounted for when the liability to pay them arose and not at the time that payment was made. The situation then looks radically different:

Same data, just a different view, that’s all. And as a result one could even say the deficit between 2002 and 2007 simply disappears.There is no deficit at all.

This is not an accounting trick. Within tolerable margins this is the refection of economic substance that accruals accounting allows and that cash flow accounting never does.

Now, that doesn’t solve the problem of financing a deficit. But it does suggest that all the argument about structural deficits of up to £45 billion a year is just wrong. There was no such deficit, there was just necessary extra borrowing needed to fund the government to manage the consequences of growth that benefitted the UK.

Put this in another context: if this had been a set of corporate accounts that borrowing would not have raised an eyebrow. No one would have accused such an entity of over trading. It would have been considered an economic success: as it, at least in some ways, was.

So shall we stop this nonsense about there having been deficits and talk about economic realities for a change? The realities that proper accounting can reveal? That will let us focus on the current issue created by the failure of financial markets as a consequence of their own irresponsibility which the rest of us have had to underwrite and reveals that there is no underlying problem to be fixed at all. Which makes the whole issue look and feel very different indeed.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is load of tosh.

It assumes that ALL tax revenue is paid a year earlier when in fact as the author admits PAYE is paid on average 30 days (1/12 of a year) and VAT is paid on average 2 1/2 months late.

Richard,

You are an economist and I am not. But isn’t Keynes all about building up a surplus when the economy is growing so that there are funds to stimulate growth when the economy slows? In the example you cite, you argue that spending matched income during the boom. Isn’t that why we don’t have the surplus now to fund further stimulus?

@mad foetus

I agree with you – there was overspending in the period 2002 – 2007

But of nothing like the scale claimed

And almost entirely on capital items – which if accruals accounting had been used would not have contributed to the deficit either

@John Wood

Utterly untrue

The growth is a) always tail end weighted b) weighted towards profits c) frequently reflected in bonus and other payments frequently settled after the year end in tax terms

Of course the assumption is simplifying

My point is it’s a lot more accurate than a cash flow comparison

And if you deny that you know nothing of tax, accounting or economics

[…] this is actually interesting from […]

“Put this in another context: if this had been a set of corporate accounts that borrowing would not have raised an eyebrow.”

Maybe not, but then there is an important difference. Corporate liabilities fall on the shareholders and therefore remain with the people who were in control at the time the decision was made, or the people who have made the choice to have those liabilities transferred to them.

State liabilities, on the other hand, can and often are, transferred down the generations, from the people who enjoyed the benefits of the borrowing to people who have to accept the consequences, whether or not they like it.

In short, one is socially irresponsible, the other isn’t.

As has been pointed out elsewhere, accruals accounting requires future liabilities to be included on your accounts. This would include things like state pensions and elements of the PFI schemes, which would actually have the effect of making the deficit rather worse, I suspect.

@Paul Lockett

That has to be the most ill-informed comment here for a long time

The liabilities of private sector companies fall on their creditors and /or the state

You may not have noticed that the current crisis was caused by us having to bail out banks – but it’s time you took the blinkers off, I suggest

Tut tut Mr Murphy. Surely you should know that in accounting parlance government borrowing is deferred tax. Accruals don’t come into it. In fact it is appropriate for government spending to focus on the cash flow statement rather than the profit and loss account. As a Keynesian you will understand the idea of balancing the peaks and troughs of the ecomonic cycle – perhaps its a shame that a certain Mr G Brown didn’t understand this.

Richard, if you have any understanding of the subject you are addressing, then you will be well aware that what you’ve stated is factually incorrect, with the slight exception of the mention of creditors, who freely choose to deal with those companies.

I suspect that’s why you’ve descended, as per usual, into childish name calling.

@Paul Lockett

I’m a chartered accountant and was a registered auditor for 15 years

If capital is £2 tell me how the burden of responsibility for debt does not fall on the creditors and state?

And might I just mention failed banks as a passing issue

I did not make childish comment

I deal in facts

You are out in the realm of the fairies if you believe that capital is a buffer to protect creditors in limited companies

@alastair

I note you have no clue what deferred tax is

The rest of what you say is in the same bracket

Not least because accruals accounting recognises the difference between investment and consumption – which was also pretty key to Keynes

“If capital is £2 tell me how the burden of responsibility for debt does not fall on the creditors and state?”

I think I quite clearly in acknowledged in my last comment that creditors stand to lose in the event of a business failure. Having said that, the idea that they are responsible for debt is over-stated. They don’t suddenly take responsibility for the debts of the company, they just stand to lose out on the money that they are owed.

It is the idea that responsibility fall on the state that I fundamentally disagree with. There is no general requirement that the state must take responsibility for the debts. The losses can and arguably should, be left with those who entered into the deals which created them – the shareholders and the creditors.

“And might I just mention failed banks as a passing issue”

Feel free to, as I think it supports my point quite well. It’s the area where the state has most extensively chosen, for its own political reasons, to socialise the risk, through deposit guarantees for speculators and making it clear that the biggest players would be treated as ‘too big to fail,’ amongst other things. They were not liabilities that the state took on post failure, but liabilities that the state had already chosen to accept, for its own political reasons, well before then and were a contributing factor to the problem.

“You are out in the realm of the fairies if you believe that capital is a buffer to protect creditors in limited companies”

In that case it’s probably a good job I don’t believe that is generally the case and have never said that I do. The only area in which it is generally treated that way is banking regulation.

@Paul Lockett

Ah, so we’re not talking fact then

Just your belief

Which I have already adequately described

Richard Murphy: “Ah, so we’re not talking fact then. Just your belief”

No, my comment was based on solid, well reasoned, insightful facts. The only reason that belief was brought up was your statement (emphasis mine): “You are out in the realm of the fairies IF YOU BELIEVE that capital is a buffer to protect creditors in limited companies.” I was just gracious enough to respond to that point by making it clear that it was not my belief.

@Paul Lockett

No

You offered libertarian prejudice

That’s about as far removed from fact as it’s possible to get

It’s based on myth for a start

@Richard Murphy

You may feel I talk from a position of libertarian prejudice and I will freely acknowledge that I have left-libertarian opinions. By the same token, I may feel that you talk from a position of elitist/authoritarian prejudice.

However, none of that has any bearing on whether or not what we say is factually correct. Fact is fact irrespective of why or by who it is presented. I put across a number of points relating to liability and moral hazard. If you’ve got reasons for believing they are factually incorrect, I’m more than happy to address your points and even accept if they show I’ve got something wrong, but at the moment, it just feels like you want to play the man rather than the ball.

@Paul Lockett

Left?

It falls apart from there

Which is why I won’t waste my time with you

@Richard Murphy

Yes, my beliefs are predominantly left-libertarian. You might not agree with them, but as I said, that has no bearing on whether or not what I said earlier is factually correct.

Clearly I made a mistake in thinking you might genuinely be trying to address serious issues in a considered fashion and not just trying to manufacture an opportunity for sniping.

@Paul Lockett

I’ve dismissed you as anyone with any knowledge would see, as I do, that what you calm as facts are no such thing

the comment you claimed is act is almost entirely opinion on the role of the state – not fact. And opinion that says let the market prevail – hard to credit as coming from the left – which makes that another claim I dismiss as a delusion

As for insolvency having no impact on the state – you ignore billions of lost tax revenue and the cost of tax relief on much of the rest of bad debt

Bit of an oversight don’t you think, when claiming to state facts

Don’t bother to reply – I do not have more time to waste on this issue

And

This comment has been deleted. It failed the moderation policy noted here. http://www.taxresearch.org.uk/Blog/comments/. The editor’s decision on this matter is final.

This comment has been deleted. It failed the moderation policy noted here. http://www.taxresearch.org.uk/Blog/comments/. The editor’s decision on this matter is final.

Cash is king though as ever

Accruals accounting has its benefits however everyone in M&A is interested in cashflow only

@Richard

Most M & A fails

Is that answer enough?

Richard,

This is interesting, and it’s nice to see that you’ve taken on board my comments (on your CGT post) about the difference between the year that tax is charged and the year it is collected.

But in fact the shift is going to be far less than you suggest, because only a minority of tax is collected in arrears.

Of the roughly £400bn tax collected last year, approximately:

– £122 bn was income tax collected through PAYE, where 11/12ths is collected within the year;

– £85 bn was National Insurance collected through PAYE;

– £67 bn was VAT, most of which is collected quarterly, so your shift would only be one quarter at most (less where the business year end does not tally with the tax year);

– £55 bn was excise duties, customs duties and suchlike, which again are collected regularly throughout the year;

– £7 bn was stamp duty, which is generally paid almost immediately to get the transfer registered.

That’s about 85% of total tax revenues where the accruals shift between years would be a small fraction (at most a quarter, usually a twelfth) of the total.

I agree that bonuses paid at or after the April year-end will push the tax into the following year, but surely you aren’t claiming that they produce a majority of income tax? Although significant individually, the mega-bonuses only provide a tiny proportion of total income tax receipts. But even of that, most of it isn’t shifted a year because the big “City” bonuses are calculated on a December year-end and generally paid in January or February, so the PAYE will be paid in March, in the same tax year.

Yes, there is an accruals impact (the final quarter’s VAT payment, the final month’s PAYE, plus the taxes that are collected in arrears such as CGT), but that’s only a small proportion of the total. The 15% that is collected in arrears, plus a twelfth of the PAYE, plus a quarter of the VAT and excise duties, gives you about 28% of the annual increase in taxes not being reflected in the government’s figures.

Therefore I agree with the accruals principle, but because the actual missing accrual is significantly less than half of the full year’s shift that you are taking, your method of applying a full year shift to all taxes across the board is in practice actually less accurate than the government’s cash basis.

The true line is somewhere between the two graphs, and probably nearer the government’s line than yours.

Richard

Sorry for a long post.

On a more conceptual level, what about Keynes’ point that governments should spend LESS than they collect in taxes during booms, to be able to spend more in recessions?

@Richard Teather

I agree – that was an error by the Labour government

I can happily say that

I am a member of no political party

@Richard Teather

Adjust for investment and you’ll find within immaterial amounts that my assertion works…

I have now refined for that – but not published it yet

Thank you; I’ll look forward to seeing that.

If you’re removing “investment” expenditure, don’t forget to make sure that depreciation is in, on the same basis (but as an acountant you know that).