There’s a new report out on the secrecyjurisdictions.com web site. It’s entitled Key Data Report 4: Number of banks, accountants and lawyers. The report does exactly what its title says: it looks at the number of banks, lawyers and accountants in each of the secrecy jurisdictions surveyed. As the report notes:

Having a large number of banks, lawyers and accountants in a jurisdiction is likely to generate two effects. Firstly, bankers, lawyers and accountants offer and support financial services and, by interaction and collusion, have the knowledge and means to handle and hide illicit financial flows if they so wish. Secondly, banks, lawyers and accountants active in financial services will have considerable power in any secrecy jurisdiction that is heavily dependent upon financial services (for discussion and explanation of this second effect, refer to Key Data Reports 2 and 3)

There is another issue: if bankers, lawyers and accountants are present in high numbers a culture of constructive non-compliance can be created. In effect this means that the appearance of compliance is present but the rate of reporting of potential money laundering offences is low in proportion to the likely risk that they occur.

The report gives numerous examples.

Accountants can contribute to hiding financial flows by devising complex multi-jurisdiction business structures and aggressive tax avoidance schemes, and giving questionable annual accounts a seal of approval by auditing them with little scrutiny. As example in 2005 the Big 4-firm KPMG “‚Ķagreed to pay $456 million to avoid criminal prosecution by the U.S. government over abusive tax shelters‚Ķ” whilst Professor Prem Sikka noted the following sequence of events in the Guardian newspaper:

On February 27 2008, Carlyle Capital Corporation published its annual accounts for the year to December 31 2007. These accounts were audited by the Guernsey office of PricewaterhouseCoopers, the world's biggest accounting firm, which boasts revenues of $25bn.

Amid one of the biggest credit crises, the accounts claimed on page five that the directors were "satisfied that the Group has adequate resources to continue to operate as a going concern for the foreseeable future".

The auditors were satisfied, too, and on 27 February 2008 gave the company a clean bill of health (page 6).

Less than two weeks later, on March 9 2008, Carlyle announced that it was discussing its precarious financial position with its lenders. And on March 12, the company announced that it "has not been able to reach a mutually beneficial agreement to stabilize its financing".

The company says that it paid $2.5m in fees "principally ... to our independent auditors, our external legal counsel, and our internal audit service provider".

Yet In less than two weeks, the mirage of assurance offered by auditors vanished.

So much for offshore assurance.

However, as the report notes:

While data on the number of credit institutions and banks in a secrecy jurisdiction is often readily available, that on the number of lawyers and accountants is often more difficult to secure even though lawyers and accountants, like banks, are subject to scrutiny within international anti-money laundering frameworks.

In the end we concluded the only reliable data was on banks — itself a damning indictment of the regulation of lawyers and accountants who play such a major role in secrecy jurisdictions.

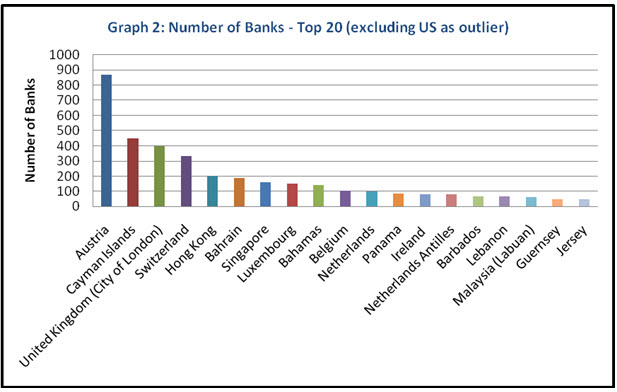

The data on banks is, however, significant in its own right. Data was available for 57 of the 60 jurisdictions surveyed. although the US had to be excluded from the results presentation as it had far more banks than all other jurisdictions combined. The number of banks in other locations was as follows:

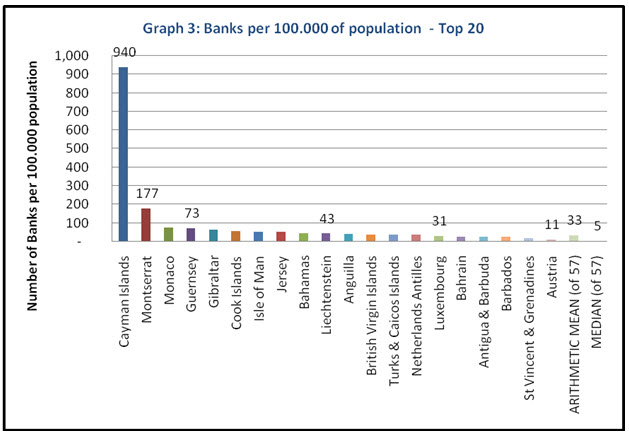

The absurd fact that Cayman has more banks than London is already apparent. Ranking the number of banks by head of population shows how over-banked secrecy jurisdictions are:

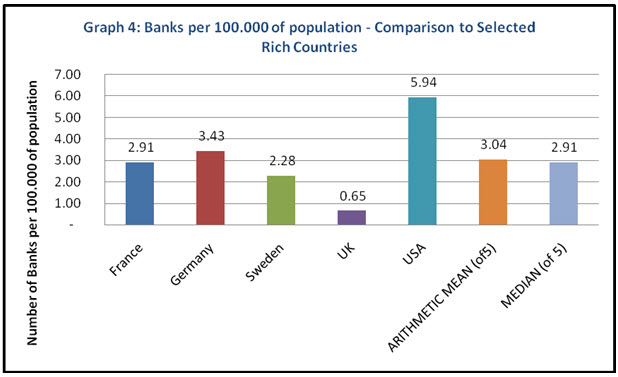

To put this in context this is similar data for a number of quite successful economies;

There appears to be capacity to survive on a low density per 100,000 of population exist in classic secrecy jurisdictions.

As we (for I am an author of this paper, with Markus Meinzer) conclude:

There is a clear and undoubted conclusion that can be drawn which is that as Graph 3 shows the smaller secrecy jurisdictions have far more banks than are necessary to meet their domestic banking needs and as such these institutions can only be in existence to manage international financial flows, some of which will undoubtedly, as alternative evidence shows, be illicit. It follows therefore that the population of lawyers and accountants in these places have the same purpose, with the same risk attached.

The conclusion that can be drawn is this: illicit financial flows through secrecy jurisdictions could not happen but for the presence of a disproportionate population of bankers, lawyers and accountants in these locations.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: