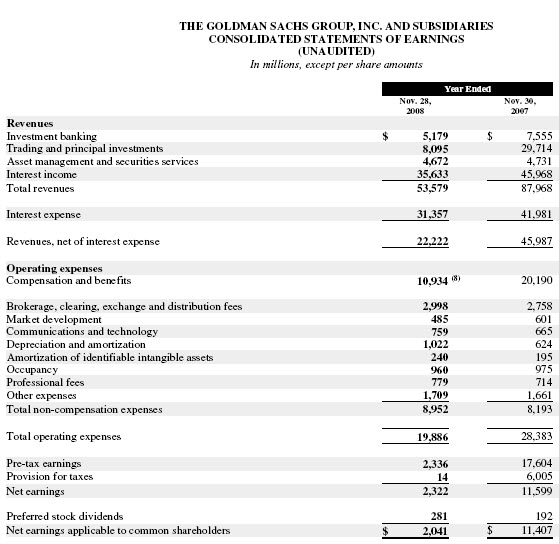

This is Goldman Sachs unaudited result for the year to 30 November 2008 published 16 December:

There's a line to note: provisions for taxes. $6,005 million in 2007, $14 million in 2008. The 2007 result shows that most of that $6,005m was current tax.

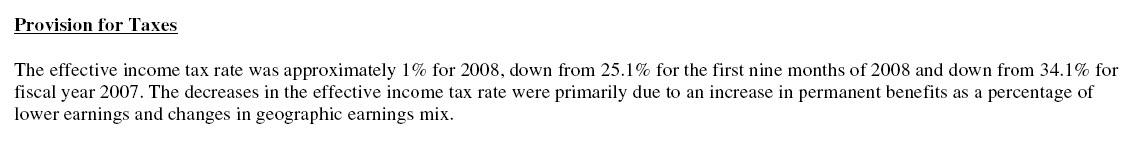

Sure, profit went down by 86% but taxes fell by ,ore than 99%. The effective declared tax rate fell from 34% to 0.6%. The reason, per the statement, is this:

There's an explanation in the 8K:

GS has had a $6 billion bail out from the US government. This is how it responds.

The messages are unambiguous: first of all we need country by country reporting. It is absurd that a company can say that it has reduced its tax liability as a result of a change in its geographic earnings mix and not explain precisely where those earnings have moved to and why the change in such a key variable has been so dramatic as a consequence.

Second, it is wholly unacceptable that at a time when banks are utterly dependent upon the state for the provision of their equity that they should show such contempt for the state by avoiding their obligation to pay tax.

The time for change has arrived. We are all equity holders in these enterprises now, whether in the USA or not. Businesses have to account to the world's population wherever they are for what they do in whichever place they locate.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] Sachs paid tax at an effective rate of 0.6% in the year to 30 November 2008. If that is replicated this year that […]

[…] Sachs paid tax at an effective rate of 0.6% in the year to 30 November 2008. If that is replicated this year that […]