Jersey has published its figures for tax retained under the EU Savings Tax Directive in 2007. The press release they put out is misleading. I thought it would be useful to compare the 2007 data with that for 2006 as an indication of how things are really going.

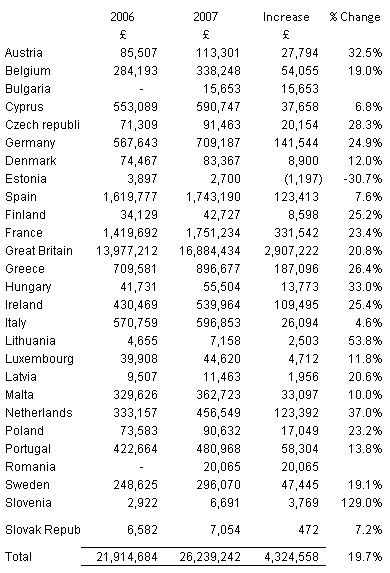

The data is as follows:

It's important to note that these are the funds paid: Jersey retains 25% of the sums retained, and that has been deducted before the above is taken into account.

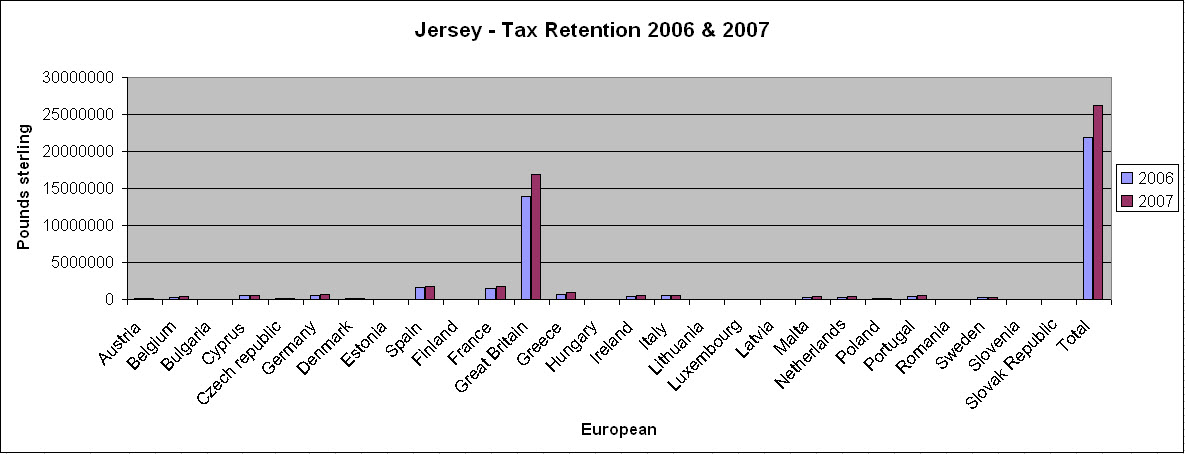

In graphical form the data looks like this:

That gets the message across as clearly as I want: despite all it claims Jersey is a UK captive.

In 2006 63.8% of the sum retained related to UK based accounts. It was 64.3% in 2007.

The amount retained went up by 19.7%.

The even more important fact is this. In 2007 61,600 people opted to have tax disclsoure made. In 2006 that number was 80,191. In other words, despite initiatives such as the UK 'tax amnesty' the number of people cooperating with the UK tax authorities who hold accounts in Jersey fell by 23%. The amount of cash they held went up by 20.8%.

The cost to the UK rose considerably as a result. It is likely that all who refused information exchange were tax evading. There is no reason to refuse information exchange otherwise. It is likely that anyone holding serious funds in Jersey will be a higher rate tax payer. The total sum retained on UK based accounts in 2007 was £22.51 million (having grossed up for the part Jersey keeps). This, at the retention rate of 15% implies total interest paid of almost exactly £150 million. Tax at 40% on that should be £60 million. The UK actually got £16.9 million.

The consequence is clear. Jersey's banks directly helped defraud the UK of tax revenue of £43 million in 2007 by not reporting those who did not agree to exchange information even though they can only have reasonably believed that this was as a result of tax evasion. And that's on cash alone.

It is fair to assume that an average interest rate of about 5% would have been paid during the course of 2007. That means the cash on which this interest was deducted was probably about £3 billion in total.

Now let's note that there were £212 billion on deposit in Jersey at the end of December 2007. Other funds amounted to £246 billion then. Other funds under management amounted to almost £80 billion. That's over £530 billion in all. Most is entirely outside the EU STD - all significant funds will be in trust.

Extrapolation is always a little uncertain on this data: Jersey makes sure it is hard. But what is unambiguously clear is that first of all there is a significant appetite for evasion in Jersey still. The published data proves that. Second it is clear that this is not being reported by the local banks who are not raising suspicious activity reports on all those not disclosing although evasion is the only obvious reason for not disclosing and therefore they are, in my opinion, duty bound to report every single person not disclosing or be party to an offence of assisting money laundering. Third, Jersey has taken no action against the banks not reporting their suspicions and so is complicit in this process. Fourth, the total loss to the UK is vastly bigger than that lost on bank deposits held in personal names alone.

Suppose the UK provides a quarter of all funds in Jersey. That seems generously low given the data noted above and the number of our banks there. And suppose non-disclosure happens on only one tenth of the total funds held. That means UK non declared assets are maybe £26.5 billion of undeclared assets are held. Lost income on that at 40% tax rate is over £530 million a year. That's more than the cost of two fully equipped new hospitals in the UK a year.

Ans I suspect that massively underestimates the cost of this one island alone.

Worse it may massively underestimate the cost of non-disclsoure by our high street banks who hold many of the accounts involved in that island. What price corporate social irresponsibility, I ask?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting stuff, but where do you get a figure of £500 Million from? I work in Jersey and I have witnessed a lot of accounts being closed from the UK, especially since the savings directive came in. But I just wonder how you can claim the UK is losing £500 Million in tax without any actual factual proof to back this figure up. Speculation isn’t really good enough I am afraid and only acts as attention seeking, which, I think is all what you are doing.

I was also pulled to your blog because of the current visit from the UK and enquiry into our finance industry. Here is a link which actually gives us a pat on the back –

“The UK’s Treasury Select Committee continues its visit to Jersey. They are investigating the effect offshore tax centres have on the UK economy.

The man leading the group, John McFall says they planned their trip because the island is a good example of how offshore financial”

http://www5.channelonline.tv/news/templates/jerseynews2.aspx?articleid=15520&zoneid=2

Would you like to comment on this from the Jersey news of today?

Ian

Please of the blog. I explain my logic in there. Of course it is not a perfect estimate. Jersey makes very sure that a perfect estimate cannot be calculated. It does not want the world to know how abusive it is. I am almost certainly being generous. But in the absence of better estimates it is entirely reasonable to put forward the date of the sort that I have and it is impossible for you to dispute it. Of course, that is, unless you wish to publish better information.

As for John McFall’s comment: he is right. Jersey has done everything that has been asked of it with regard to regulation. It has put lots of pieces of paper into place. But the local financial services industry has ignored them. Take a start with our main high-street banks who have branches in the island. All of them are guilty of assisting money laundering by failing to report their suspicion that their customers who refused to exchange information with the UK under the terms of the EU savings tax directive were tax evading when absolutely no other plausible or reasonable explanation of that refusal could have been offered.

The fact that in 2006 not one single suspicious activity report relating to criminal money laundering was submitted to the Jersey authorities is ample evidence that the local financial services community is complicit in ignoring the regulation that is in place. How else could this happen in a place where billions are on deposit, all of them there to take advantage of the secrecy that the island offers to ensure that their abuse of the regulation of other countries cannot be detected.

I think you will find that John McFall knows that.

Richard