The EU Parliament's Economic and Monetary Affairs Committee is to consider IFRS 8 on October 3. The resolution they will consider is here.

Three things are glaringly obvious. The Parliament is

1) quite unhappy about the EU process for approving IFRS

2) not convinced by objectiveness of the review undertaken by the EC on IFRS 8

3) not convinced that IFRS 8 adequately deals with geography

4) not convinced that IFRS 8 reporting will result in comparable financial statements

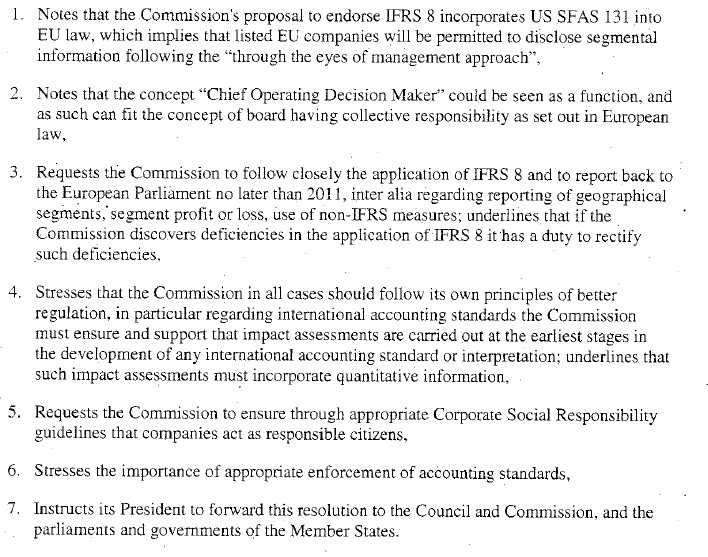

5) Gives just about the most qualified endorsement it can, if this resolution is passed:

All that being noted, there remains room for improvement. I'm sending three suggested amendments to the motion.

Amendment 1 clarifies the governance position and has the advantage of being based on text taken straight from the EU Commission's own website. It says

It is noted that:

With regard to the responsibility of board members, the prevailing principle in Europe is - in contrast to the US - collective responsibility for the financial statements. As can be seen in the Action Plan on Company Law and Corporate Governance the Commission intends to clarify the application of this principle and to extended it to key non-financial information.

Many companies are organised in group structures. However, operations, intra group transactions and the group's transactions with related parties often lack transparency seen from the perspective of investors, shareholders and other stakeholders. This can make it difficult for them to assess the true risks of investing in the companies.

In consequence it is requested that the Commission note the adoption of IFRS 8 and report back to the European Parliament no later than 2011 on changes in the level of reported transparency on the operations, intra group transactions and group's transactions with related parties consequent upon the introduction of IFRS 8.

Amendment 2 picks up the the anti avoidance measures from IAS 14 (para 11 and para 12) which also cover internal state risks. It says:

It is noted that according to IAS 14 which IFRS 8 replaces that:

A single business segment does not include products and services with significantly differing risks and returns.

Similarly, a geographical segment does not include operations in economic environments with significantly differing risks and returns. A geographical segment may be a single country, a group of two or more countries, or a region within a country.

In consequence it is requested that the Commission note changes in the number and nature of reported segments for which information is supplied as a consequence of the the adoption of IFRS 8 and report back to the European Parliament no later than 2011 on changes in the nature and geographic definition of reported segments consequent upon the introduction of IFRS 8.

Amendment 3 notes the request that information on tax paid by country be disclosed by those campaigning against IFRS 8 and says:

It is noted that requests have been made by civil society organisations that information on tax paid be provided on a segment and geographical basis and that the Commission has suggested that this matter be addressed through better Corporate Social Responsibility reporting.

In consequence it is requested that the Commission note changes in the reporting of taxation paid on a segment and geographical basis in the period following adoption of IFRS 8 and notes changes in the same information provided in the Corporate Social Responsibility reports of those companies to which IFRS 8 applies and report back to the European Parliament no later than 2011 on the changes noted.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] EU Parliament on IFRS 8 […]