I think it worth sharing the following press release from the National Audit Office, issued this morning:

Today the National Audit Office (NAO) publishes a report on tax expenditures. Tax expenditures are tax reliefs with social or economic objectives. Government uses tax expenditures to encourage a range of activities, such as saving for pensions, to encourage business investment, or to support particular sectors, such as the housing market.

HM Treasury officials advise ministers on the design of tax expenditures and HMRC (HM Revenue & Customs) administers them.

Our report found that:

- Tax expenditures are forecast to cost £155 billion a year in 2018-19 — based on the sum of HMRC's estimates — around 5% more than in 2014-15. In July 2019 the Office for Budget Responsibility, which assesses public finances, identified the cost of tax reliefs as one of four new fiscal risks1.

- HM Treasury and HMRC have improved their oversight, management and reporting of tax expenditures. HMRC has put in place guidance for its staff and committed to publishing more information about tax expenditures. HM Treasury officials now review the value for money of tax expenditures as part of policy making. Monitoring processes are still in development and not yet integrated between the departments.

- HMRC has evaluated only a minority of tax expenditures: since 2015, they have published evaluations of 15 tax expenditures — worth £11 billion a year (just 7% of the total annual cost of tax expenditures).

- HMRC's evaluations suggest that the effectiveness of tax expenditures varies widely. Evaluations found that seven tax expenditures (costing £3.6 billion) were having a positive impact on behaviour. However, five (costing £5.2 billion) had limited impact. For example, the £2 billion a year Entrepreneurs' Relief had limited impact on the decisions of those receiving it.

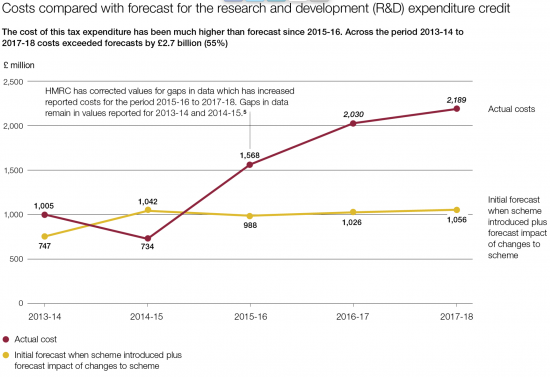

- Some tax expenditures end up costing much more than government's published forecasts, but HMRC does not monitor or report these differences. For example, three tax expenditures — Entrepreneurs' Relief, Research & Development relief for small and medium-sized businesses and Film Tax relief — now cost around £5 billion a year after large increases in cost. This is much more than any published forecasts suggested. Research & Development relief has been subject to increased abuse.

- HM Treasury does not publish information on whether tax expenditures are value for money. HMRC has improved its public reporting but does not yet provide the information necessary to assess the value for money of tax expenditures.

The report makes a series of recommendations for improving the way government manages tax reliefs, and understands and reports on their costs and value for money.

I am not sure that there is much more to add t that, except to note that the tax spend total is actually £400 billion once allowances are taken into account. And what is clear is that these sums are being remarkably poorly managed. The case of research and development tax relief is a case in point, this chart being issued this morning:

Quite clearly this relief is out of c0ntrol, and the benefit is far from clear.

This is a case of 'much more work needs to be done'.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“HM Treasury and HMRC have improved their oversight, management and reporting of tax expenditures. HMRC has put in place guidance for its staff and committed to publishing more information about tax expenditures. HM Treasury officials now review the value for money of tax expenditures as part of policy making. Monitoring processes are still in development and not yet integrated between the departments.”

The plain reading of this is that until now – or very recently: oversight, management and reporting of tax expenditures was worse, and the effects unquantified. HMRC did not have “guidance”, and HM Treasury did not review value for money in policy making. There are, even now still no “monitoring processes”, nor are they integrated between departments.

Meanwhile in Scotland we can rely on this above all; that HM Treasury and HMRC can guarantee 100% that GERS is and always has been, ‘pin-point’ accurate and presents a full and fair picture of everything the Scottish elector needs to know about Scotland’s economy.

I think the NAO was generous in its appraisal and diplomatic in its wording

My reading – and discussions – suggest no one had a clue what was going on and it seemed no one much cared

It was all out of sight and mind

With tongue firmly in cheek is this a case of benefits culture gone mad?

Nicholas says:

“With tongue firmly in cheek is this a case of benefits culture gone mad?”

Why tongue in cheek? It’s precisely what is being described.

…and a distinct lack of sanctions.

£155 billion (or indeed £400 billion) is a large number, but the biggest five reliefs in the report account for almost £100 billion by themselves – capital gains private residence exemption £26 billion, relief for employee pension contributions £20 billion and employer pension contributions £17 billion, VAT zero rating of food £18 billion, and VAT zero rating of new dwellings £15 billion.

Another 18 reliefs account for most of the rest. Hundreds of reliefs have a small cost impact, around £10 billion all together. ER is “just” a couple of billion, although the per-claimant impact is around £60k.

And that is just the third of tax reliefs with a reliable cost estimate. That itself is pretty scandalous – HMRC don’t have good cost estimates for the other two thirds of tax reliefs. Another scandal is the lack of post-implementation review: reliefs often cost much more than originally expected.

As you say, structural allowances “cost” a lot more, such as the income tax personal allowance (over £100 billion), or the NICs thresholds (about £60 billion).

Working out the impact per claimant from the HMRC spreadsheet is interesting. ISA reliefs “cost” £3 billion a year, but there are millions of claimants, saving about £140 each. But for example EMI saves 7,000 people about £27,000 each. The patent box costs over a billion, with an average claim approaching £1m. 1,300 claims for APR cost about £280k each, and 2,200 claims for BPR cost £320k each. And so on.

Precisely….

I agree that for many businesses the reliefs (ER R&D and Film..) are nice to have but do not particularly encourage investment, just new ways to claim some tax back after doing what they would have done anyway.

Contrary to the myth perpetrated by John Redwood et al that there has been no austerity as public expenditure has increased, that this has been due to an increase in tax reliefs rather than a direct increase in expenditure on education, the NHS, and local government etc which have, instead ,suffered a decrease to ‘help’ partially pay for them.

Paul Mayor

“….myth perpetrated by John Redwood et al that there has been no austerity as public expenditure has increased, ”

Austerity has been very specifically targeted to transfer ownership of public assets into private ownership. Much of this has happened under the radar at local government level where councils have had to sell off their remaining ‘family silverware’ to make ends meet. In some places the display cabinet went to the saleroom too.

John Redwood is the sort of ‘Newspeaker’ who can and did, vociferously, identify the problem of single mothers without seeming to notice a corresponding problem of invisible fathers. His ilk see what they wish to see.

From what I’ve seen the Research and Development Expenditure credit scheme is a scam.

RDEC is a clear diversion of resources from public services to the bottom line of private businesses, with no clear benefit at all

I agree with you