As I noted yesterday, the LibDems have pledged to run budget surpluses of at least 1% in normal times. And they have pledged to keep pension deficits to no more than 1% in recessions.

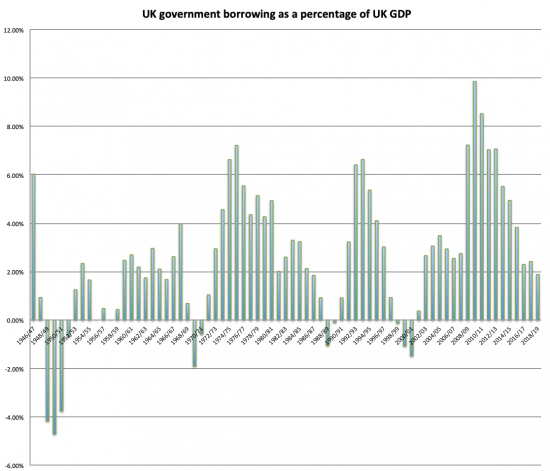

This is the data on deficits since 1946, assembled by me this morning from House of Commo0ns, ONS and OBR data:

First, note how rare surpluses are. There have been eleven, two so small they are hard to spot.

Then note how commonplace deficits of more than 1% are. There are 52 of them in 73 years. They are normal, then.

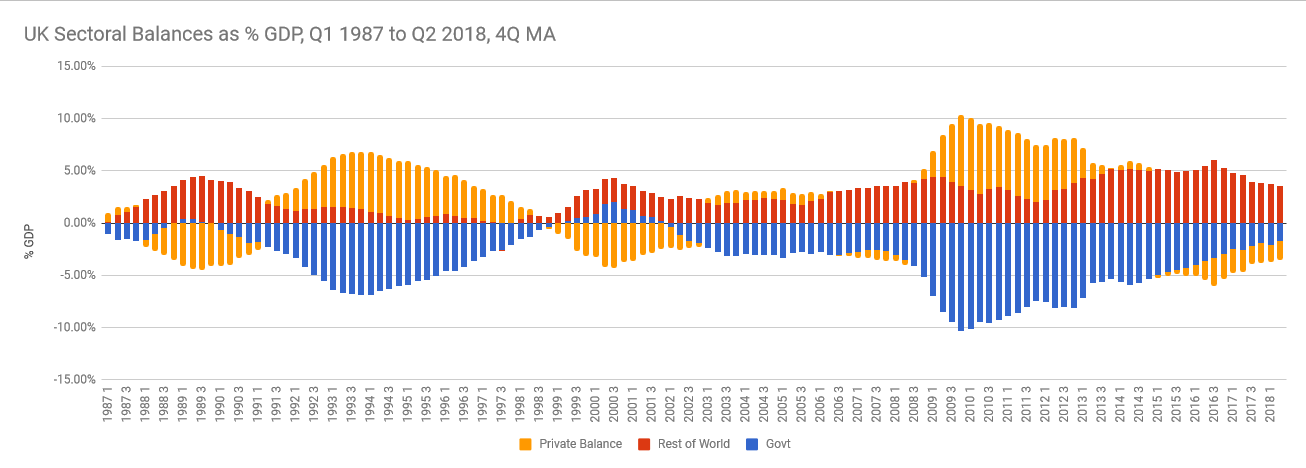

And there is good reason for this. To a very large degree governments have no control over their deficits. They are the borrower of last resort. Sectoral balance analysis shows this. I do not have time this morning to write extensively on this issue. I recommend the introduction to the subject from the Gower Initiative on Modern Money. From the perspective of the current issue, and quoting GIMMs:

When we talk about the UK economy we are referring to the nation's businesses, households, local and regional governments and other institutional bodies.

Economists divide economies into three sectors:

- The private sector (domestic households and businesses, including financial institutions).

- The government sector (the issuer of the currency which adds and removes £s as it invests into the economy and taxes back out).

- The foreign sector or Rest of the World (the countries with which a nation trades).

Starting with the basic rules of accounting for every financial asset there is an equal and offsetting financial liability, this means that deficits and surpluses must always cancel out across the financial system. If the private sector is in surplus, then by the rules of accounting, the government sector must be equally in deficit.

And this is exactly what happens, with the graph again being from GIMMs:

The rest of the world consistently saves in the UK. As a result the UK runs a deficit. And when, in times of recession the UK saves, as it does at such moments, the UK government's deficit grows because it has no other option: as the money creator and borrower of last resort this is what inevitably happens, not by government choice but as the inevitable consequence of the decisions of others.

In other words, Ed Davey will not have the ability to deliver his planned outcome, whatever he thinks.

So, not only has he promised austerity and pro-cyclical policy which is the last thing any responsible government should do, in practice he does not understand that control of deficits is simply not within his control in the way he claims. This makes the policy an even greater indication of economic weakness than it initially appears to be. Making bad promises is electorally daft. Being incapable of delivering on them just makes doing so even more unwise.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Great to see this data pulled together Richard, which nicely reinforces your conclusions about the LibDem economic plans.

The most significant period of surplus appears to be at the end of the 1940’s. Can you explain what happened there to cause that, and whether there were observable economic consequences?

This was the extraordinary situation post WW2 where changes in behaviour post war forced the government to run a surplus

Let’s be honest, it was pretty exceptional

I heard Chukka on R4 at the weekend pledging to raise income tax by 1p in the pound – that increase to be hypothecated for the NHS.

Hypothecated taxes… it’s a completely spurious chimera, which anyone with a basic understanding of tax and money creation should know. Even as a shorthand to explain spending preferences to the majority – which is at least conceptually less offensive – it perpetuates the dangerous belief that taxes pay for spending. Dangerous because it opens the door to harmful and prejudicial policies such as austerity.

As soon as I heard that I realised that I Still Didn’t Agree With Nickâ„¢ – they hoodwinked me the last time over tuition fees. The scales fell from my eyes and I started hearing Roger Daltrey reminding me that I shouldn’t get fooled again.

And then, of course, there’s Brexit. Jo Swinson claims she wants to reverse Article 50. Another spurious policy… because whilst it is without a doubt the outcome that I’d prefer (wot with me being an unrepentant Europhile), I think that simply to revoke the article is to spit in the face of around half of the electorate. I wouldn’t like it if a Brexiteer ignored the wishes of half the people and crashed us out of Europe without a deal, so why is it fair that Swinson treat the other half that voted for Brexit with equal contempt? Don’t get me wrong – I think that half came to the wrong conclusion and I’d try to persuade them of that and “come into the light” of their own free will… but I wouldn’t ride roughshod over their views given the pretty much equal split at the referendum.

Aaaaaand now it’s “We’ll run constant surplusses”. Great. In other words, “We’ll consistently take more money out of the economy than we put into it”. Or, to use yet more stark phrasing, “Public Surplus = Private Deficit… so we’re taking YOUR savings to build schools and hospitals*! I hope you’ve saved enough, cos x-ray machines are expensive”.

Deary, deary me…

* – I know it doesn’t work like that… but I’m going back to that offensive shorthand I mentioned earlier.

Stafford Cripps succeeded Hugh Dalton as Chancellor of the Excheqeur in 1947 and imposed a policy of austerity increasing taxes and reducing consumption. Wikpedia states the following:-

“He increased taxes and forced a reduction in consumption in an effort to boost exports and stabilise the Pound Sterling so that Britain could trade its way out of its crisis.”

https://en.wikipedia.org/wiki/Stafford_Cripps

Remember there was also rationing….

Whenever, I heard the policy announced last week, my initial instincts were that this is for the benefit of Ms Swinson in her own seat which is under threat from the SNP, but has a sizeable chunk of Conservative voters. It also plays very well to the (mainly Tory voting) mindset that thinks running the Country’s finances is like the day to day running of a household.

The Lib Dems are not interested in winning this election, but stopping others from doing so (primarily Labour, but also the Tories). The short termism of a Party whose ambition is 30 seats rather than 300.

I think that the situation immediately after WW2 was that the domestic private sector had a lot of pent up spending power accumulated by saving during the war. The rationing during the war forced the private sector to save rather than consume. After the war the government used fiscal surpluses to delete some of those savings out of existence. The government wanted to reduce the domestic private sector’s spending on imports, in order to reduce the trade deficit and thereby reduce downward pressure on the currency’s exchange rate.

The GIMM chart of sectoral balances tells more than one story, particularly over the last few years as reduced government borrowing has driven the private balance (comprised of households, financial and non-financial institutions) in to net borrowing in the face of continuing Balance of Payment (BoP) deficits and net lending by the Rest of the World (RoW). The rest of the EU (i.e., excluding the UK) and particularly, the Euro Area (driven by the whopping BoP surpluses of its bigger northern members and the gradual closing of southern members’ deficits) provide a large chunk of this net lending to the UK.

These excessive BoP surpluses combined with household net lending are as damaging as persistent excessive BoP deficits that are accompanied by high levels of net borrowing by households. It is the worst form of mercantilism. Keynes was adamant on this point, but he was unable to convince his contemporary policy-makers. So, since WWII, countries with BoP deficits, fiscal deficits and household net borrowing are beaten up while those with BoP surpluses, fiscal supluses and household net lending are garlanded – even though the behaviour of the latter is a major cause of the circumstances of the former. That is why economic stabilisation (both from deficits to balance and from surpluses to balance) is such an important issue.

An unrecognised fallout of Brexit is that the UK will be unable to apply its political and economic heft to persuade the principal offenders, Germany and the Netherlands, to mend their ways. Under the EU Semester Germany has committed to reduce its BoP surpluses, houshold net lending and its fiscal surpluses over time, but it is far too little and too late. Ironically it would be in Germany’s interests to reduce these surpluses, but the economic ignorance of the political elites and the popular aversion to the sinfulness of being in debt know no bounds.