As the Guardian note this morning:

The era of low interest rates will last for at least another 20 years, despite gently rising official borrowing costs in the coming years, one of the Bank of England's leading policymakers has forecast.

In a valedictory interview before leaving Threadneedle Street's monetary policy committee (MPC) at the end of the month, Ian McCafferty said structural changes in the global economy meant UK borrowers and savers should get used to interest rates being “significantly” below the 5% average in the 10 years leading up to the financial crisis.

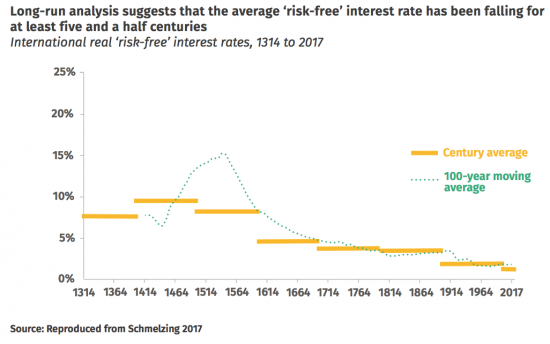

Let me be honest, I did not rate McCafferty as an MPC member, and I do not put much wight on many of his comments now. But it's not hard to agree with his forecast. This is the long term trend in interest rates as plotted by IPPR earlier this year:

Saying average bank base rates are going to be below 5% in the future looks like one of the most reliable forecasts anyone can make, based on the long term trend data.

Saying average bank base rates are going to be below 5% in the future looks like one of the most reliable forecasts anyone can make, based on the long term trend data.

Saying rates may not be far from zero may be almost as reliable now.

But McCafferty did not, of course, draw the obvious conclusion. The first is that in that case monetary policy has little or no roll to play in the economy.

And, second, that in that case giving any significant role in the management of the economy to a supposedly independent central bank makes no sense at all, because the only instrument they have to use is the interest rate and for all practical purposes it will have no impact on economic management in the foreseeable future.

Which also means fiscal rules embracing such thinking are also irrelevant, but that's another issue I may well get back to later.

For now, let me make the obvious point. Anyone wanting to manage the economy in the future is going to have to use fiscal measures, like it or not. That's the only economic reality we now know.

I suggest, as the saying goes, that we ‘deal with it'.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The BoE, rather than being a manager, appear to be like a steward at a football ground. They are not there to run the team, but just to keep some semblance of order as best as they can. Did lee way ever get given to them to have a larger remit? I’m pretty ignorant of the BoE powers before the inflation target came in 20 ish years ago, and was just wondering.

Their remit was increased in 1998

If you want a deeper history of the BOE with an MMT take check out this:

http://econintersect.com/a/blogs/blog1.php/a-brief-history-of-the

Thanks

The whole idea of one rate to control the economy always sounded fishy to me, even before I knew a thing about macroeconomics. Neil Wilson wrote a great post on last year (sadly now removed), and I posted the comment below, which will hopefully resonate with any scientists/engineers reading your blog…

“Just a quick comment on One Rate to Rule Them All and a comparison to my field.

You may have heard about the revolution in computer vision at the moment being driven by deep learning, where we’re finally getting a level of recognition performance for real world images that is making things like driverless cars possible. The ideas behind the models are actually pretty old (at least the 60’s), but it is only in the last 5—10 years with the explosion in the availability of digital images and computer power that we’ve been able to train up sufficiently large and complex models to deal with the variations in natural images. So the state-of-art models will have tens of thousands of parameters that need to be optimised to work out whether an image contains a cat or a dog or a car etc.

In my group we do something similar to find clinically useful information in medical images – so delineate all the pixels associated with an organ, or a tumour etc.

Now the One Parameter to Rule Them All equivalent is the simple image threshold. Pick a number between 0 and 255. Any pixel with a grey-level above that is a tumour, below that is the background. Students typically try this in the first couple of weeks and get very excited when they find a value that works for the first two images. Then very disappointed when it fails on the third, and hopefully by the fourth or fifth they begin to understand what you need are effectively multiple thresholds, that vary both between images and spatially within an image, and crucially depend on the local image context. This is what our models are learning, and of course the more complex the variability in the images, the more data you need to train the models and the more parameters your model needs to explain the complexity.

Moreover, if at the end there is a single God parameter that can be tweaked and has large global effects on model performance, far from being a good thing, that’s usually a bad sign. After all, if your model is so sensitive to getting that one parameter right, how do you know if it really is optimised when you generalise to real world data? In other words, your model probably lacks robustness.

So when it comes to the hugely complex system that is a national economy, I could never understand the thought you could optimise it in any sensible way with One Magic Number, and was bemused by the hushed deference that awaited 9 wise-men periodically tweaking this number.

I’m sure any other scientist or engineer that’s worked with complex systems would agree, and will find your description of how a job guarantee acts to stabilise the system a much more intuitive and robust way of working with the real world.”

Yes, the number one problem with mainstream economics is that they want to be money physics, so they stole all of Newton’s equations, but they were nowhere to be found when the teacher went over degrees of freedom. So they decided to just make up as many unrealistic assumptions as they needed to be able to solve. Paul Romer, the former World Bank president gave the whole profession quite the flogging with this paper which is really quite hysterical if you have a science background.

https://paulromer.net/wp-content/uploads/2016/09/WP-Trouble.pdf

McCafferty was always an inflation hawk on MPC. I asked him, the only time I met him, why he thought MPC exerted real power over money markets, since BoE was a price taker. (He took it as axiomatic that the Bank did have such magical powers, which I would limit to persuasive power.) The sheer expansion of money accommodated by central banks as commercial banks increased their lending without hindrance, and after 2008 with QE, meant interest rates were likely to fall (given certain conditions). Counterfactually, had central banks restricted the expansion of banks’ balance sheets (and I’m not sure how) and had government economic policy maintained effective demand across the population, including fiscal expenditure, interest rates WOULD have been higher. Central Bankers cling to myth of secular decline in interest rates, as if the vast expansion of money had nothing to do with them.

I am no expert on this.

Bit I go back to what Richard Douthwaite advocated in ‘The Ecology of Money’.

Basically, that there should be a wider range of interest rates in the economy that reflects the aims and objectives of money’s use. Savings should (at the moment perhaps) attract higher rates than debt so that saving a little is a real return and still allows people to spend in the economy to keep it ticking over (higher wages would help too).

But then debt also needs to be curbed so the interest rate should reflect the social utility of the debt. Low rates encourage more household debt but also help the Financial sector to raise more debt in pursuit of its aims. The financial sector – with its excessive risk taking – does not need low rates in my view.

Interest rate setting as simple as it is now is a blunt instrument and does not reflect the complex use (and misuse) of money and we’ve lived with it for far too long.

PVSR

Oddly I was discussing this two days ago and how it might be done

A blog may be coming…..

I am thinking how to reconcile micro and macro needs

Richard

My FT letter in 2008:

Sir, If Alan Greenspan is arguing that monetary policy is ineffective in controlling asset bubbles, I agree with him. He also asserts convincingly that the model structures from which many (I would say most) derive their simulations have been consistently unable to foresee the onset of recessions or financial crises.

Perhaps the reason for this is that economists have forgotten that land is a separate factor from capital. Fluctuations in property values derive almost entirely from land values and not the man-made element. It is the fact that there is no cost to ownership that makes the land market function so poorly and this can be corrected only by fiscal means.

Like Turkey…?

Do you really need all the differences explained?

I quite like turkey but I do prefer a good roast chicken

Must we take this “20 year” prediction seriously?

As if all is foreseen, as if we can assume that everyone will be stuck in the same basic rut for 20 years and that no fundamental or historic changes might occur in that time frame that would alter this outlook. Really?

With respect, the author in this case has no greater certainty of what will happen in 20 years than I do and I have no certainty at all.

I wouldn’t take his word

I happen to think the trend is right

@ Marco Fante

“Must we take this “20 year” prediction seriously?”

Hard to say because of the following:-

The kickback against globalisation and the imposition of tariffs which are forms of tax may result in higher inflation and the stupid Neoliberal economists’ attempt to dampen this down through higher interest rates.

Cambridge University announced last week the discovery of a new material to make lithium batteries much cheaper and not prone to over-heat the battery. Scaled up to put on the national electricity grid accelerates the switch to electric vehicles and less scope for the OPEC to use monopoly power to substantially jack up oil prices and cause inflation.

There could be the formation of new political parties predominantly MMT orientated which amalgamate with Green parties to release the power of government created money to tackle climate change and reduce private bankers’ power by nationalising the provision of house mortgage loans the main source of commercial banks revenue. Interest rates would be set low in consequence for both objectives.

Here’s Dan Kervick on this latter subject:-

http://neweconomicperspectives.org/2013/02/austerity-the-political-struggle-over-who-controls-the-economys-liquidity.html

Good article, thanks.