The UK's headline inflation rate remained at 2.4% yesterday. City economists were expecting it to rise. It did not.

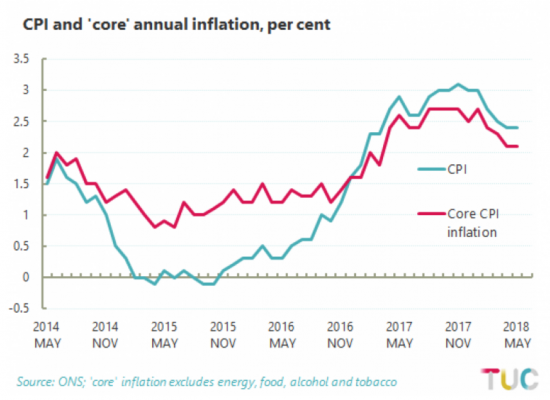

As Geoff Tily at the TUC has noted, this is because the underlying rate of inflation is static in the UK, and absent in many areas. In addition, core inflation, which excludes the volatile energy, food, alcohol and tobacco categories where there tends to be external vulnerability, is lower still:

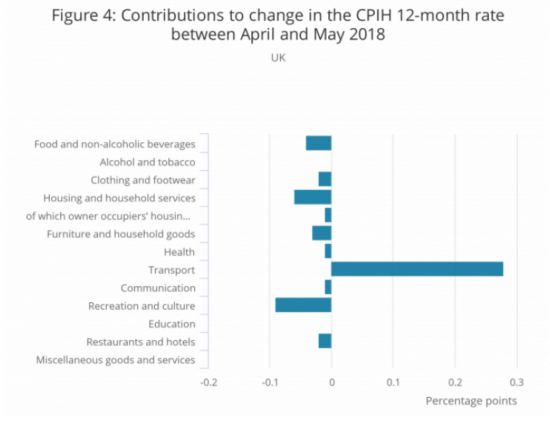

In fact, without changes in air fares, largely due to oil and foreign exchange changes, we'd have had deflation in May:

In the meantime the US Fed has increased interest rates to 2% and says there will be more rate rises this year and next, suggesting that rates will exceed 3% within a year, partly to reflect fuller employment, growth and rising inflation. The contrast could not be more obvious.

A whole life could be spent trying to explain the contrasting fortunes of the UK and other economies or a single word can be used. That word is, of course, Brexit.

Many of us predicted a Brexit downturn. Most of us thought that the Treasury forecast on the issue was always absurd: economies do not react as quickly as they forecast. But that does not mean they do not react to economic fundamentals. And the economic fundamental is that Brexit will reduce economic well being in the UK. The consequence is people are not spending. There is no internal driver of inflation. And as a result there is not the slightest need for interest rate rises in the UK.

There are two consequences. First, monetary policy remains of no use in the UK. And second, we need a fiscal stimulus. Unfortunately I see no chance of that happening.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I don’t have the reference but a while back somebody was making the point that most of the inflationary turmoil of the post war years was driven by oil price rises (shocks even).

This years fairly modest increases could easily be all that is preventing inflation sliding below the decimal point.

If Jeremy Powell is aiming to get his interest rate to the significant 3% level (because he’ll be working on the received wisdom that it needs a central bank reduction of 3% to reverse a recession) we now have a second opinion on when to expect the crash.

The markets and the FED seem to be singing from the same hymnsheet on this.

The thing is (as they say in all the best sales pitches) …..what the market thinks is reactive. What The FED does actually creates the conditions that make the crash happen by building the interest rate to where it can be reduced from.

It’s classic Greek tragedy material. (That’s as in, ancient literary Greek Tragedy, not a reference to a dysfunctional Eurozone)

I am afraid that is exactly what the Fed is doing

Ably assisted by Trump’s inappropriate stimulus to wealthy America

@Andy Crow:-

“I don’t have the reference but a while back somebody was making the point that most of the inflationary turmoil of the post war years was driven by oil price rises (shocks even).”

https://mythfighter.com/2018/03/17/what-is-the-complex-relationship-among-inflation-deficits-interest-rates-oil-prices-tax-cuts-and-gdp/

Spot-on, Schofield,

Many thanks it’s a great link.

WTF do people need me to provide evidence? Why don’t they just believe what I tell them ?

Life would be so much easier. For everybody. They won’t read this anyway even if when they’ve got it.

Returning to a previous discussion, perhaps we should rename the MMT as the Fiat Fiscal System. 😉 I’ll get my coat.

More seriously, Stephanie Kelton gave a lecture yesterday in the House of Lords, hosted by the UCL Institute for Innovation and Public Purpose. As far as I can see, the lectures are not publicly available – do you know if that is correct?

I hear that her talk was pure MMT and, in the Q&A, Prof Charles Goodhart began with “Stephanie is right …”.

Since Prof Goodhart is ex-MPC, it would be good to get the details of the talk and his question.

However, whatever the detail, the quote seems very interesting!

It would be great to know if this is being made available

I think FFS could have legs, George.

I like it 🙂

Nothing to do with Tory austerity then?

Maybe

But inflation is a year on year measure and we had it in both

A policy fundamental for the UK:-

http://www.gregpalast.com/currency-rules-but-its-not-ok/

Thank you, Schofield.

That’s an 18 year old link that is one hell of a read!