The US Federal Accounting Standards Board (FASB) is considering how to revise disclosure to be made by US companies on the corporation tax liabilities. Despite the obvious importance of the issue, and the worldwide debate on it, they are not suggesting the adoption of country-by-country reporting. In failing to do so they stand alongside the UK based International Accounting Standards Board who have always argued that country-by-country reporting is a political and not an accounting issue.

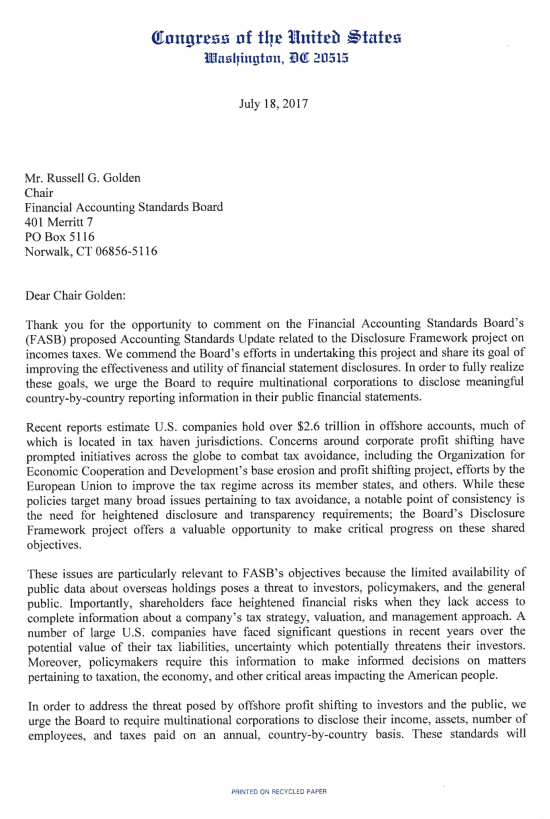

It is good to see that some members of Congress do not agree:

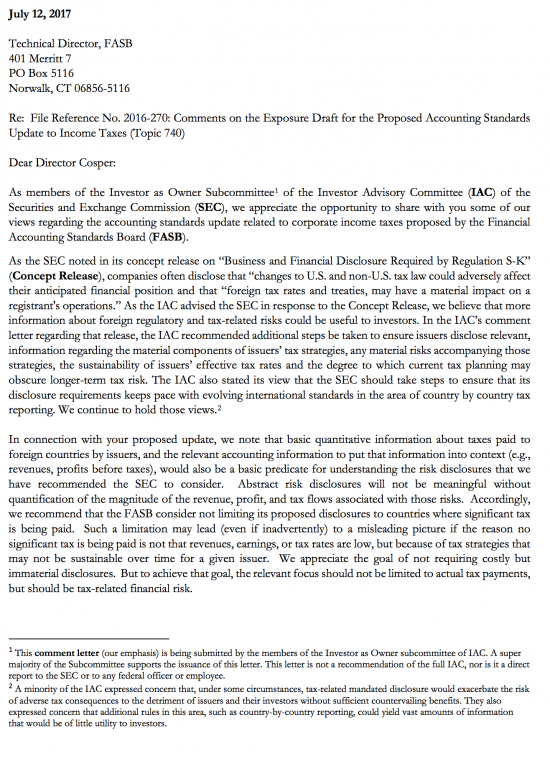

Congress was not alone in expressing concern. The SEC has also made clear that the FASB approach to only disclosing payments in countries where significant tax is paid cannot supply the data on tax risk that investors clearly need, which is on a country-by-country basis to include details those places where little or no tax is paid which is precisely where the risk may really be, saying:

The awareness of the growing risk that tax represents amongst both politicians and investors is welcome. It is time for accountants to show that they realise that if they are to fulfil their public interest mandate in setting accounting standards then they have to meet the demand from investors, politicians, civil society and others for this data. It's that or their role in setting accounting standards has to be taken away from them.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

16 out of 435 voting Congressmen…….. some ways to go.

Agreed

But it’s useful