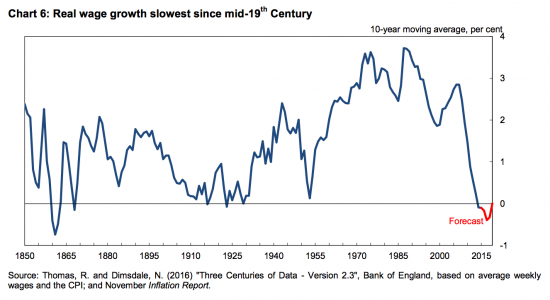

Mark Carney gave a speech yesterday in which he used this graph:

As he put it:

Over the past decade real earnings have grown at the slowest rate since the mid-19th Century

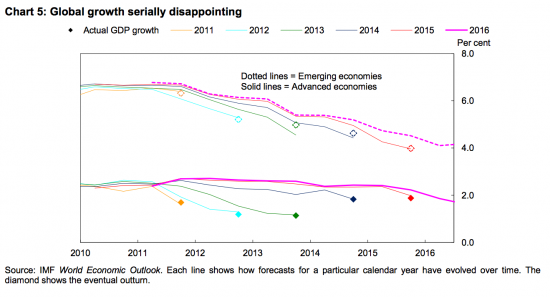

Now, admittedly, growth has been sluggish:

But there has been growth, and it has been unequally shared. This is Carney, again:

In recent decades, as global inequality has fallen markedly, it has edged ever higher in most advanced economies. In Anglo-Saxon countries, the income share of the top 1% has risen notably since 1980. Today, in the US, the richest 1% of households receive 20% of all income. Such high income inequalities are dwarfed by staggering wealth inequalities. The proportion of the wealth held by the richest 1% of Americans increased from 25% in 1990 to 40% in 2012. Globally, the share of wealth held by the richest 1% in the world rose from one-third in 2000 to one-half in 2010.

And as he said in response:

Globally, since 1960, real per capita GDP has risen more than two-and-a-half times, average incomes have begun to converge, and life expectancy has increased by nearly two decades.

Despite such immense progress, many citizens in advanced economies are facing heightened uncertainty, lamenting a loss of control and losing trust in the system. To them, measures of aggregate progress bear little relation to their own experience. Rather than a new golden era, globalisation is associated with low wages, insecure employment, stateless corporations and striking inequalities.

These anxieties have been compounded by the twin crises of solvency and integrity at the heart of finance. When the financial crisis hit, the world's largest banks were shown to be operating in a “heads-I-win-tails-you-lose” bubble; widespread rigging of some core markets was exposed; and masters of the universe became minions. Few in positions of responsibility took theirs. Shareholders, taxpayers and citizens paid the heavy price.

As a consequence of all these developments, public support for open markets is under threat.

He is right. And I admire him for saying it: I am not sure previous Governors would have done. They would not have said this:

And added:

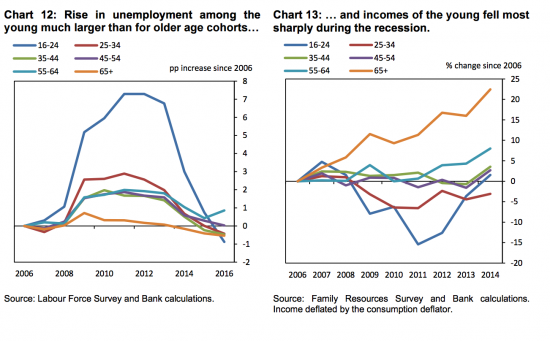

Experience shows that when the economy enters recession, the poorest are hit the hardest. During recessions the lower-skilled, lower paid people tend to lose their jobs first. In the extreme, prolonged recessions can lead to permanent labour market scarring, with potentially devastating effects on livelihoods, identities and communities.

And why he was right to conclude that:

For free trade to benefit all requires some redistribution.

I did not agree with all his comments on the limit of the state to achieve that: let's be clear that the views he offered were not always in line with my own, but he was again right to say:

Redistribution and fairness also means turning back the tide of stateless corporations. As the Prime Minister recently stressed, companies must be rooted and pay tax somewhere: businesses operating across borders “have responsibilities … in terms, for example, of payment of tax.” They must recognise “the role that they play in local communities and the responsibilities that they have in any country they are operating in to abide by the rules.” That is why the G20's BEPS initiative, which will allow all countries to work together to implement measures against tax Base Erosion and Profit Shifting, is so important. And that is why the G20 might at least consider, as Larry Summers has suggested, a minimum tax on reported earnings to be paid somewhere.

I have proposed such a tax.

But there is a pre-condition for it and that is country-by-country reporting. Until global corporations are held to account locally we cannot know where and how and why they owe tax, and yet governments will not commit to this. Nor did Carney.

And whilst Carney called for fiscal reform he still ended up emphasising monetary policy.

I welcome the recognition of the problem Carney offered.

I despair that the obvious solutions remain far away. He did not call for global corporations to be held to account. The calls for fiscal reform were not strong enough. The arguments against the role of the state remained too strong. Even in the face of the obvious implications of the data necessary conclusions, and the need for radical action, were not stated.

Our economy is clearly in a mess and Carney knows it. Offering excuses for maintaining the status quo with a twist or two will not save it or the market system to which Carney is wedded. Only radical action can do that. And we're still not getting to the point when that is realised. Will we before it's too late, I wonder? Right now that failure is what is fuelling the Hard Right. Carney had better get his head round that, just like most of the UK's political class. Because unless accountability, fair tax and real redistribution happen it's not just the market system that Carney seeks to protect that is at risk, it's democracy itself. And that awareness has still to permeate, I fear.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I watched Carney talking to Jon Snow last night on Channel 4 news. It was an engaging interview but you had to listen carefully (I am not accusing anyone of not doing this by the way!).

Towards the end, when Snow was pushing him to say the obvious Carney basically said something along the lines of ‘All the I can do is present the policy makers with facts and it is up to them to deliver the other policies to sort these issues out’. And that is as far as he could go really but he is right – if the Government chooses not do the right thing – what can he do?

He has gone as close as he can to saying it how it is. I admire him for that.

I agree – I would have liked him to go a bit further but in the end he is saying they decide

And even acknowledging that is important

Hasn’t growth been mainly the result of a big increase in the workforce? And is that not the reason why productivity has not grown?

GDP per capita (per worker) is now back at the level of 2007 so there has been a lost decade. You are right that if you can import cheap labour there is no incentive to invest in innovation, the training of the current workforce or the equipment that leads to increased productivity. This is one point where the Labour party (and even the Green party) could build a case to oppose free movement. At the aggregate level (some individuals do benefit) free movement is bad for inequality.

But the issue isn’t just importing cheap labour. When you have tiered minimum wage, so an employer can have a 16 year-old for £3-£4 an hour instead of paying £7.20 for an over-25, there’s equally no incentive to train future staff or build a more productive skilled workforce.

Good point, James Mac. I’ve not seen any data to show what extra distortions upping the age threshold to receive even the minimum wage has produced in the labour market. I shall have to ask my Polish friend, most of whose extended family work at the same 5* hotel, whether she has noticed the staff getting younger.

I watched his interveiw with Jon Snow on C4 News and taking that in tandem with what you report here certainly highlights that a good deal that he said was spot on in terms of analysis and outcomes. And I agree, I don’t think any former Governor of the BoE would have been as forthright – and I have to say in the interview with Snow he came across as both sincere and honest in what he was reporting and that something had to be done about it.

Like you, it’s this last bit I have a problem with and when listening to him yesterday evening (when he didn’t cover the detail as much as you do here). It struck me – and not for the first time with Carney, and I have to say, and more generally you see this with senior figures from across the EU – that his attitiude was: ‘here are the facts, this is why we have so many issues in the world, now governments, big business/finance and the 1% please do something about it.’

In short, here’s yet another person whose an integral member of the elite and estabishment that governs our affairs but for whatever reason he’s unable and/or unwilling to fully grasp the nettle he describes so well and actually do something that WORKS. I thought this came over very clearly when Snow criticised QE and Carney quickly became defensive.

Furthermore, the strength of whatever it is that stops Carney and others from doing something that’s actually effective at tackling the problems he outlines is further illustrated by his reference both in your blog and in his interview with Snow to the fact that after the banking crisis, and with some minor exceptions, no punishment of any consequence was meeted out to anyone and nobody of any significance admitted any kind of responsibility. This rather undermines any view that he or anyone might have that left to their own devices the elite/1% will ever do anything voluntarily to tackle the structural and institutional issues that are rapidly propelling us toward some very nasty forms of populist government, as it has already done in the US.

Consequently, if nothing else, Carney’s implicit belief that the elite/1% can in some way be shamed into acting if only enough of the evidence of where things are going wrong is shown to them is dangerously misplaced to say the least. In short, a policy of fiddling while Rome burns is no policy at all.

I think we are in agreement

Carney gets to the obvious point for change, and stops

Eloquently put Ivan but what can Carney actually do? Where is his mandate to do it? The BoE is the tail that gets wagged by the Government – not the other way around. BoE ‘independence’? Rhubarb – as has been explored here.

Carney’s skilfull reticence is more likely to do with his children or wife not wanting to go back to Canada just yet!

He tested the waters when he gave a bleak assesssment of what might happen in the event of BREXIT and got slated for that. Carney still makes his predessor Mervyn King look deaf dumb and blind in comparison.

I know that Carney is also ex Goldman Sachs and he will carry some GS luggage with him but he is also North American and has a streak of old fashioned north american egalitarianism about him as seen in the post war development of America where the Government invested in people by investing in the economy. I felt Carney wanted to say this – the interview was heavily pregnant with what he could not say because if he had, May and the Tory press would have had him for breakfast, dinner and tea.

I beliive that Carney has come to the same conclusion as Richard and many here to be honest but he cannot say it. He just cannot because he is part of a system designed to thwart power and action and leave it in the hands of twisted austerity politicians.

More broadly I think that the problem lies not with the incumbent but instead within a theme Richard has raised in this blog – that all the instiutions charged with helping to manage the economy and finance are all set up and ran like silos – a system designed to promote un-joined up thinking. They can advise each other on what to do but lack any real power to make anything happen. They are actually quite inert if they try to go beyond a certain limited remit.

Interesting point

Noted

Pilgrim, I read your comment while I was waiting for mine to be approved and saw we were on the same page, given we’d both watched Carney’s interview with Jon Snow. But I did question my ‘why doesn’t he do more’ point, as I agree with you that in his capacity as governor of the BoE he has limited power – whatever the government might say to the contrary.

In my defence one aspect of what I’m getting at sits beyond his formal powers and relates to what I assume are the networks and relationship he’s part of and party to. Anyone whose been involved in government of any kind, or indeed in policy and decision making in pretty much any kind of organisation (or indeed sectors such a voluntary sector) knows that it’s frequently in the so called “informal” networks that exist therein that ideas get floated, actions and decisions are agreed and influence and control (or threats of it) are wielded.

So, leaving aside Carney’s formal position and role and the conditions and limitations that apply, one would think that given the dire nature of the dangers he’s explicitly setting out he might be promoting/pursuing an agenda “informally” elsewhere. Perhaps he is. Sadly, I suspect he finds himself in the position Adair Turner did after he had his epiphany regarding the banking and finance industry: sidelined and frowned upon by those whose bidding he’d once done.

I agree with you Ivan

It is strange that he gives figures for the US regarding the income share of the 1%. It is almost as bad in the UK. According to the World Income Database

Top 1% income share in the UK was 6% in 1979 and rose to 15% in 2008.

In the UK, the last decade was the worst for growth since the 1920s which coincidentally is when we last had such a skewed income distribution.

The economic data tells us exactly what is going wrong, and I am just amazed that the politicians and most of the media are not making this case.

As the great Polish economist Michal Kalecki said: “Obstinate ignorance is usually a manifestation of underlying political motives.”

Agreed

The status quo can only be maintained with the consent of the governed. We are seeing it being withdrawn without knowing what will emerge.

There is no sense of urgency yet.

Unfortunately, whilst most of the governed know that the status quo isn’t working, many of them have been misled into believing the wrong reasons about WHY it’s not working.

As mentioned on another thread, changing the status quo is not just a matter of retreating from engagement. Unless a way forward is found to change inequality and power relationships without drastic upheaval we may all regret our inability to demand and accomplish it. The sadness of Carney’s position at the moment is that he makes the right noises but refuses to do anything about it and if he is not in a position to influence the Davos crowd then what chance do us lesser mortals stand? The alternative is not attractive, as a number of academics are beginning to discuss;

http://www.nytimes.com/2016/12/06/business/economy/a-dilemma-for-humanity-stark-inequality-or-total-war.html?partner=rss&emc=rss&_r=0

Richard you say, “But there is a pre-condition for it and that is country-by-country reporting. Until global corporations are held to account locally we cannot know where and how and why they owe tax, and yet governments will not commit to this.”

I am not sure if I have got this right but I recall a vote in the House of Commons a few months ago on ‘beneficial ownership’ i.e. who actually owns the companies and, If memory serves, the figures suggested Labour voted for and the government against. If my memory is right, this suggests all the fine words about taxes are not matched by their actions.

I am confused

CBCR is not the same as beneficial ownership

And I am not sure who you are saying voted for what and why

Sorry

Thanks, the 10 year moving average graph is interesting. I was curious to look at economic conditions the last time things were so bad: around 1860. I have a technical question (sorry if my Digital Signal Processing language is confusing). Do you know if a causal or non causal filter is being used? if causal (only using past data) then there will be an approximate 5 year lag caused by filtering the data. There seem to have been two financial shocks around that time: the “Panic of 1857” and the “Overend-Gurney panic of 1866.”

I am not sure

Carney refers to the latter in his discussion

Does that help?

Ye Thanks,s looks non causal then as the dips would be delayed by too much. The 1860’s were interesting times.

I have repeatedly in the past suggested to you that a global minimum rate of non-payroll taxes (coupled with zero-sum balancing reductions in payroll-uplift taxes) was a fundamental pre-requisite for fair taxation. On each occasion, you have dismissed my suggestions.

More recently (e.g. 2016-09-30), you yourself have proposed a global minimum rate of non-payroll tax:

http://www.taxresearch.org.uk/Blog/2016/09/30/time-for-an-alternative-minimum-corporation-tax/

And now you quote Mark Carney approvingly with:

‘that is why the G20 might at least consider, as Larry Summers has suggested, a minimum tax on reported earnings to be paid somewhere’

Have you changed your mind, or have I misunderstood?

This is corporation tax

Not non payroll tax