As I mentioned recently, I am giving evidence to the All Party Parliamentary Group on Responsible Taxation in parliament this morning on the subject of how to restore public trust in HMRC.

My speaking notes are as follows:

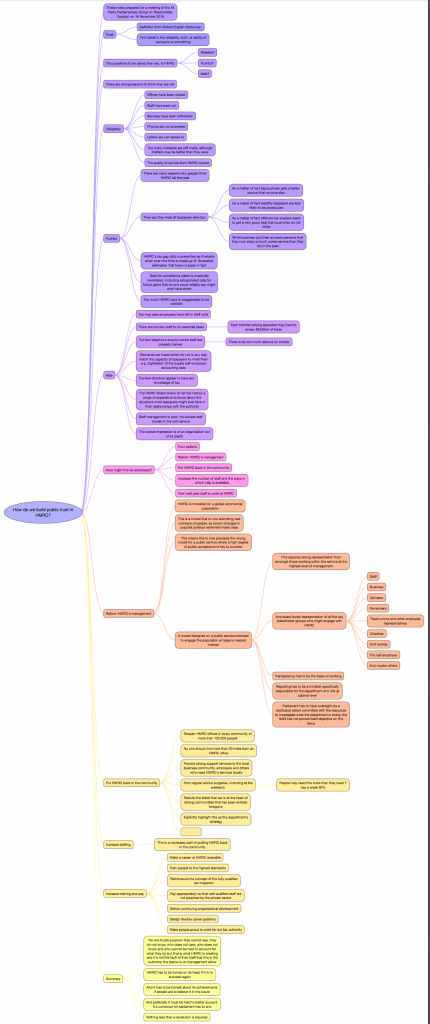

There is a larger version here, or the text is below:

- These notes prepared for a meeting of the All Party Parliamentary Group on Responsible Taxation on 16 November 2016

- Trust

- Definition from Oxford English Dictionary:

- Firm belief in the reliability, truth, or ability of someone or something

- The questions to be asked then are, is HMRC

- Reliable?

- Truthful?

- Able?

- There are strong reasons to think they are not

- Reliability

- Offices have been closed

- Staff have been cut

- Services have been withdrawn

- Phones are not answered

- Letters are not replied to

- Too many mistakes are still made, although matters may be better than they were

- The quality of service from HMRC is poor

- Truthful

- There are many reasons why people think HMRC fail this test

- They say they treat all taxpayers alike but

- As a matter of fact big business gets a better service than anyone else

- As a matter of fact wealthy taxpayers are less likely to be prosecuted

- As a matter of fact offshore tax evaders seem to get a very good deal that local ones do not enjoy

- Small business and their advisers perceive that they now enjoy a much worse service than they did in the past

- HMRC's tax gap data is presented as if reliable when over one third is made up of 'illustrative estimates' that have no basis in fact

- Data for compliance yields is massively overstated, including extrapolated data for future gains that no one could reliably say might ever have arisen

- Too much HMRC says is exaggerated to be credible

- Able

- Too may able employees have left in staff culls

- There are too few staff to do essential tasks

- Each transfer pricing specialist may have to review £8 billion of trade

- Too few telephone enquiry centre staff are properly trained

- There is far too much reliance on scripts

- Demands are made which do not in any way match the capacity of taxpayers to meet them e.g. digitisation of the supply self employed accounting data

- Too few directors appear to have any knowledge of tax

- The HMRC Board draws on far too narrow a range of experience to know about the situations most taxpayers might ever face in their relationships with the authority

- Staff management is poor: the lowest staff morale in the civil service

- The overall impression is of an organisation out of its depth

- How might this be addressed?

- Four options

- Reform HMRC's management

- Put HMRC back in the community

- Increase the number of staff and the ways in which help is available

- Train well paid staff to work at HMRC

- Reform HMRC's management

- HMRC is modelled on a global commercial corporation

- This is a model that is now alienating vast numbers of people, as recent changes in populist political sentiment make clear

- This means this is now precisely the wrong model for a public service where a high degree of public acceptance is key to success

- A model designed on a public service intended to engage the population at large is needed instead

- This requires strong representation from amongst those working within the service at the highest level of management

- And board levels representation of all the key stakeholder groups who might engage with HMRC

- Staff

- Business

- Advisers

- Pensioners

- Trade unions and other employee representatives

- Charities

- Civil society

- The self employed

- And maybe others

- Transparency has to be the basis of working

- Reporting has to be a minister specifically responsible for the department who sits at cabinet level

- Parliament has to have oversight via a dedicated select committee with the resources to investigate what the department is doing: the NAO has not proved itself objective on this issue

- Put HMRC back in the community

- Reopen HMRC offices in every community of more than 100,000 people

- No one should live more than 20 miles from an HMRC office

- Provide strong support services to the local business community, employers and others who need HMRC's services locally

- Hold regular advice surgeries, including at the weekend.

- People may need this more than they need 7 day a week GPs

- Rebuild the belief that tax is at the heart of strong communities that has been entirely foregone

- Explicitly highlight this as the department's strategy

- Increase staffing

- This is a necessary part of putting HMRC back in the community

- Increase training and pay

- Make a career at HMRC desirable

- Train people to the highest standards

- Reintroduce the concept of the fully qualified tax inspector

- Pay appropriately so that well qualified staff are not poached by the private sector

- Deliver continuing progressional development

- Design flexible career patterns

- Make people proud to work for our tax authority

- Summary

- No one trusts a person they cannot see, they do not know, who does not care, who does not know and who cannot be held to account for what they do but that is what HMRC is creating and it's not the fault of their staff that this is the outcome: the blame is on management alone

- HMRC has to be turned on its head if it is to succeed again

- And it has to be honest about its achievements if people are to believe it in the future

- And politically it must be held to better account: it's contempt for parliament has to end

- Nothing less than a revolution is required

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is a vast mountain to climb, but it is vital to get to grips with it. Few people realise that the dumbing down of the Inspectorate was deliberate, a response to the fact that fully trained tax Inspector could be much better paid in accountancy and legal firms because their competency was so high.

The rational way to deal with this would have been to increase the salaries of those fully trained Inspectors; instead, the Department deliberately reduced the quality and nature of the training, so that Inspectors were no longer valued in accountancy and legal firms as they had been.

Of course, this was immensely destructive of the skill and competency of the Inspectorate, with entirely predictable results.

I should declare an interest; I am now retired, but I was a fully trained Inspector of Taxes.

And you are right

And there could not be a more ringing endorsement of your position than Stevie’s, clearly demonstrating that you are bang on target.

Clearly you’re not in need of reassurance on that score but all the same I’m sure it’s gratifying.

Excellent summary of the reforms needed of HMRC, unfortunately if a serving member of staff came up with these sensible proposals they would be marked down in their performance review as not demonstrating “acceptable corporate behaviour”, so it is only those of us like Stevie who are now retired from HMRC, can dare endorse the common sense that you propose Richard.

I was as robust or more so in the meeting