One of the questions that came up in Edinburgh was from a man who was self employed and had engaged an accountant and was disappointed to find that all they seemed to want to do was sell him tax avoidance. As the audience member said, he did not want that: he was quite happy to pay the tax that was appropriately owing on the income that he had made. He wanted to know how to communicate this to his accountant.

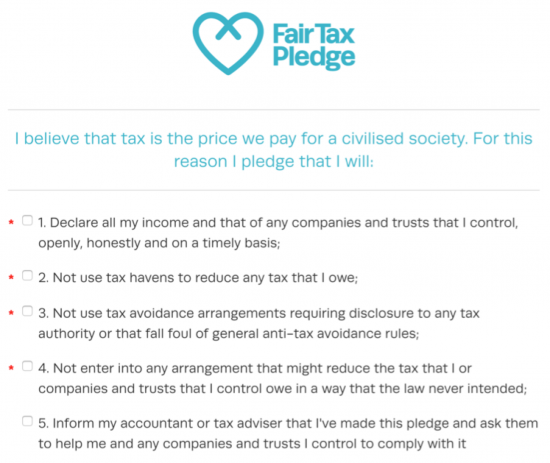

I drew his attention to something I helped create a while ago and which has not, I admit, really flown as an idea. That is the Fair Tax Pledge.

Importantly, the Pledge includes a letter a person who engages an accountant can send to them saying they do not want to be sold tax avoidance, and that they do not want their accountant to go anywhere near such practices when undertaking work on their behalf.

I recommend that letter to anyone who wants to make their feelings clear to their accountant. The wording is as follows:

Dear Adviser's name

I have signed the Fair Tax Pledge, a copy of which is attached to this letter.

As you will see, it consists of undertakings that I have made in relation to tax. Since your advice and recommendations affect my tax affairs, those undertakings mean that a change is necessary to the terms on which you give your advice and make your recommendations.

The change is appended to this letter in the form of a variation to your terms of engagement. As I understand it, the variation has two effects, which are as follows:

(a) you are now formally protected from liability to me in circumstances where complying with the Fair Tax Pledge means that I pay more tax, and

(b) my compliance with the Fair Tax Pledge and my public reputation as regards tax matters now fall within the scope of your professional duties towards me.

I would be grateful if you could confirm that you agree with the variation to the terms of engagement between us, but I would also like to make clear that your continuing to assist me with my tax affairs will confirm that you agree to it in any event.

Yours sincerely

Name

Appendix 2

Variation to the terms of engagement upon which you and/or your firm advise me

Your responsibilities will include assisting me in complying with the undertakings in the Fair Tax Pledge, and in particular (but without limitation) you will:

(a) assist me to declare all my income and that of any companies or trusts that I control, openly, honestly and on a timely basis, taking as guidance on how to do this the notes attached to the Fair Tax Pledge at www.fairtaxpledge.uk ;

(b) make sure that none of the arrangements that might require to be reported by me as a part of my tax disclosures are in any way explicitly linked to the tax havens noted in the Fair Tax Pledge; and

(c) not advise me to make use of any arrangement that might require disclosure to HM Revenue & Customs under the Disclosure of Tax Avoidance Scheme regulations or that might fall foul of the General Anti-Abuse Rule or which might, in your opinion, be considered tax avoidance of the sort identified by HMRC in its publication ‘Tempted by tax avoidance?' (currently available at http://www.hmrc.gov.uk/avoidance/tempted.htm )

You will not be liable for any tax I may pay that could have been avoided but for actions or omissions in pursuance of the foregoing.

You acknowledge that failure to comply with the undertakings in the Fair Tax Pledge could result in non-financial forms of loss such as distress and damage to my reputation, and that your duty of care to me includes protecting me from such forms of loss by assisting me in complying with those undertakings.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Would be interesting to hear people’s experiences with this. The larger firms change their standard terms & conditions for no-one. Smallaccountants I suspect are a bit more flexible

my father, now long retired, worked his entire career as a chartered accountant, coincidently he is also a Quaker,

over my life I have, on occasion, been subjected to strong animosity by people simply for being the son of my father,

it became apparent that the animosity directed at me was because my father had caused these people to pay sums of tax that they later discovered could have been avoided by a more ‘creative’ accountant,

this realisation came to them during the 1980’s, that wonderful Thatcher era that some wax lyrical about,

I think this, in some part, is why I hold you in such a good regard Richard,

never give up, never surrender!

Matt

I never misled a client

But equally I made it clear there were other accountants if they wanted to buy tax abuse

I am sorely tempted to pass this onto extended family members who work in banking in London but I feel it would cause a lot trouble! I’d hate to be ostracised at Xmas dinner this year!

Maybe we could get this form of letter printed up as a leaflet and mailed to every bank/worker in London and addresses in Mayfair, Kensington and Chelsea and other areas of serious concentrations of wealth like Cheshire?

Do any of the readers of the blog have first hand experience of using this letter?

That last paragraph sounds awfully like a threat to sue. Can’t see that creating a jolly working relationship. One firm of accountants has already been sued for NOT giving tax planning advice.

But this specifically counters that

I’d have loved all clients to have agreed to it