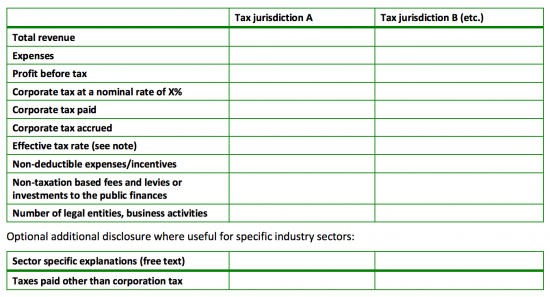

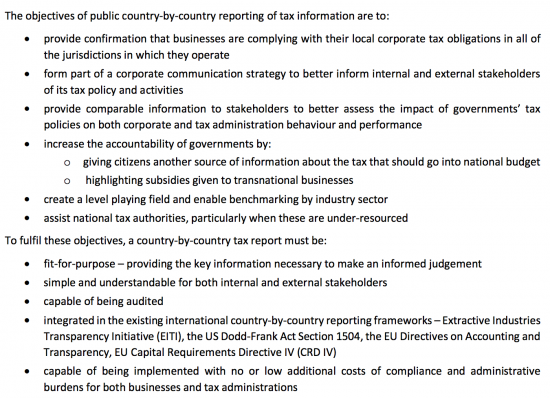

The Federation of European Accountants has published a proposal for a country-by-country reporting template. It looks like this:

These statements are not true. In fact they are deeply misleading, and the resulting template fails to fulfil the objectives of country-by-country reporting as a result.

Country-by-country reporting is not tax data: it is accounting data. To describe it as tax data is wrong. It is information extracted from the general ledgers of group companies relating to group performance at an individual country level. To suggest that it is purely tax data is entirely incorrect as a result.

Its purpose is also not, as the FEE suggest, to suggest whether companies are complying with their local tax obligations, not least because no accounting data can do that: only tax returns can. Instead it is, as the FEE must know, designed to show whether a group is likely to be tax complaint in a country and overall. Tax compliance is seeking to pay the right amount of tax (but no more) in the right place at the right time where right means that the economic substance of the transactions undertaken coincides with the place and form in which they are reported for taxation purposes.

The OECD country-by-country reporting is designed to provide the absolute minimum of data required for this purpose. Country-by-country reporting data will, as a result of the BEPS process, now have to be prepared by all companies turning over more than €750 million with the resulting information being supplied to the tax office of the parent company of the group in question for each accounting period.

1. A list of all the countries where the group operates;

2. A list of all the subsidiaries operating in each country;

And for each such country:

3. Third-party sales;

4. Intra-group sales;

5. Number of people employed;

6. Profit before tax;

7. The current tax provision;

8. Tax actually paid;

9. Equity investment;

10. Retained shareholders funds.

(My emphasis added, see below).

There are three important points to note. First, this is mandatory. Second, every country means every country: there is no materiality limit for non-disclosure. And third this is consolidated data by jurisdiction, and therefore overcomes company boundaries and is entirely new information previously unavailable.

This data is intended to reveal the following (and this is just indicative):

a. The real scale of a company's activity in a jurisdiction (third-party sales, number of people, total investment);

b. A comparison between these real indicators of activity and the proportion of profit declared in place (ratio of third party sales to total sales etc. and ratio of declare profits to total pre-tax profit, etc.);

c. Whether intra-group activities are likely to have influenced this (proportion of intra-group sales to total sales);

d. Whether tax declared to be due is actually paid.

These are the basic tools that tax authorities will now be using to determine whether there is tax risk within companies. It is my belief that the same tool should be available to shareholders so that they too are aware of the risks that they are facing.

What is notable is that the FEE template does not supply six of the ten variables that the OECD will require. This is surprising when that data will be available. It is even more surprising when the OECD has decided that this is the data that will best enable the assessment of tax risk, which is the purpose of CBCR. And it is also surprising because it suggests that business is willing to incur the cost of preparing additional information.

As a result of this data not being supplied the FEE proposed country-by-country reporting template would not let a user of financial statements assess the risks that country-by-country reporting is meant to disclose. By this objective criteria the FEE template fails to achieve the intended purpose of country-by-country reporting.

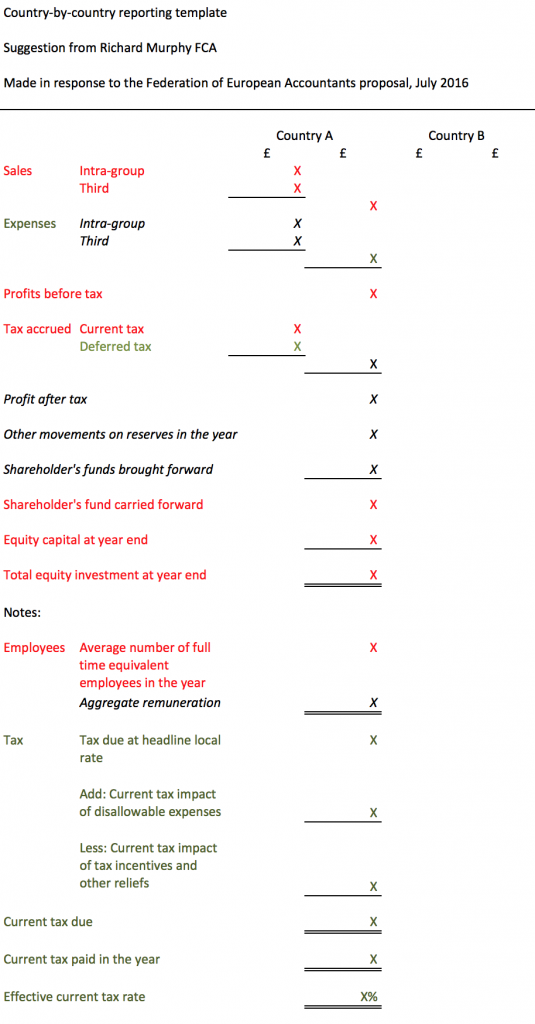

Let me then make a counter-proposal to the FEE. I take on board that they think that shareholders need more data. But I also expect that companies do meet the basic requirements of CBCR and provide the data needed to assess tax risk, much of which has to do with base erosion and profits shifting and which does, then, require intra-group trading to be disclosed. I do as a result combine the OECD and FEE templates as follows:

Red data comes from the OECD template and green from the FEE. I have shown in italics any additions I propose. In practice most of these relate to reserves and will have to be known to the entity to disclose OECD data: I add them just to add accounting sense to the data.

The information on aggregate remuneration that I suggest be disclosed is the key data omitted from the OECD template, in my opinion.

I have split the expenses data the FEE propose in line with the OECD requirement on turnover: this makes sense and adds considerably to understanding of tax risk on an intra-group basis.

A tax reconciliation note in the style noted makes sense of the FEE data. Current tax is the issue here: people are interested in what will be paid, and not in the nonsense that accountants call deferred tax.

I agree with the FEE that narrative notes will be needed.

Additional disclosure of other taxes paid is required in the extractive industries. No one is suggesting it be mandated elsewhere: I leave it to companies to decide on that issue. Many have this data to take part in the PWC total tax contribution exercise but it is costly to prepare. At most I would restrict it to sales taxes, land use taxes and taxes on payroll, split by type. I am open to persuasion here but since I have not suggested it is part of country-by-country reporting data in the past I do not do so now.

Vitally, the data for countries A, B, C etc should aggregate to the consolidated accounts. The FEE do not make that clear. There should in principle be no adjustments not attributable to a state. If there are then a lot of explanation will be required. A full note will be necessary.

My point is that I could prepare this in an hour. It provides the data that public country-by-country reporting will have to supply if it is to be truly meaningful. Because the data is either in the FEE or OECD templates in most cases, or will be readily available (you have to know expenses to calculate profit and intra-group data is readily available in all accounting systems or consolidated accounts cannot be prepared) then the cost burden imposed by this disclosure is minimal.

The FEE did however, I am sure spend longer on this exercise and yet they got it seriously wrong by defining the purpose of country-by-country reporting incorrectly despite all that has been written about it, including by the OECD. And that troubles me. I hope they will explain why they have suggested a template that so seriously misses the whole point of the exercise. Maybe they will be willing to engage in debate on the issue because it is troubling that such a body can make such a fundamental error.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

When a man’s income depends upon his not understanding something you can count upon his not understanding. No?

After all, in business a good accountant answers “What’s 2+2?” with “What do you want it to be?”

No he doesn’t

That’s a bad accountant

Or a corrupt one

First, it was a joke. Second, you know as well as I do that company accounts are not the simple PNL statements that many imagine and that accountants (and executives more broadly) have a large measure of discretion in how accounts are presented–even without entering into the realm of corruption.

Paul,

This is for you:

http://www.abc.net.au/news/2016-07-11/corporate-tax-minimisation-costs-governments-1-trillion/7587092

‘Discretion’ indeed.

Yet another example of a good and just idea being corrupted for an entirely different purpose.

It seems so much in today’s business and political world revolves around the ability to take a simple concept and twist it into something it is not to suit another purpose. Or take simple words and create a completely new meaning for them.

The art of the deceitful never fails to amaze me!

The word stakeholder originally meant a disinterested party. Now it means the opposite.

Lots of words have made that move

Hi Richard,

I like your proposal and I think you should be more precise in respect of Sales and Expenses. My proposal is

Sales: Intra-group a) goods, b) Interests (intra-group loans) c) Fees (Management fees etc.)and then simply third party

Expenses: Intra-group a), b), c) and then simply third parties

Showing the intra-group transaction in more detail will provide sufficient transparency in order to identify what is really happening in each entity e.g. a Cayman Company acts as a bank and provides loans to its group companies for a preferable interest rate. On top if it showing it this way it would also apply to financial institutions.

There is also no additional work to be done because in any consolidation the intra-group transactions must be eliminate in order to calculate the groups profit. Lastly, the net sum of internal transaction should be the difference between adding up all position of all the group s P&L and the Group s profit & loss account in order to double check the calculations.

I hope this helps.

Best,

Ruedi

Ruedi

I’d love that too

I don’t think we’ll get it though

Remember none are in the OECD template

Richard

Thank you Richard,

I have not been aware that none are in the OECD template. I need to do my “homework”.

On the other hand it is so basic knowledge to eliminate or better make the intra-group transactions transparent to have a kind of “true and faire view” about a multi-national conglomerate and its subsidiaries. Anyhow, I agree with your approach “step by step” even though I am used to solve problems once and for ever if possible.

Best,

Ruedi

Better once and for all, I agree

But I am working with what I can get