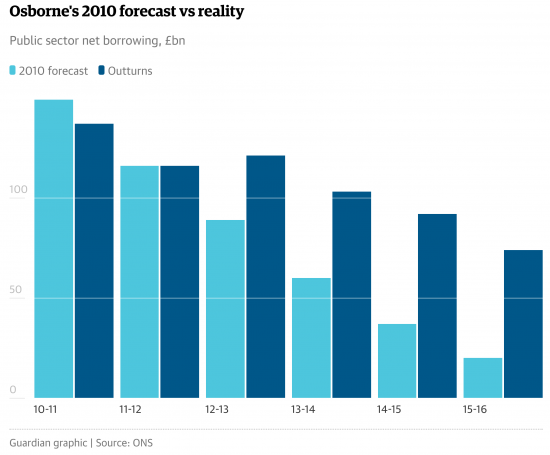

Larry Elliott used this graph in the Guardian on Friday:

I have prepared a more detailed version in this paper.

At one level you could state the facts: George Osborne got his forecast wrong. You could add that the Office for Budget Responsibility were wrong to endorse it. You could repeat that suggestion for every year where we can compare forecast with outcome since: there has been a recurring, persistent pattern of optimism in forecasts from the Treasury. Stating that this is the case suggests either they are very bad at forecasting or that they have made some fundamental errors. It may be both, of course. My point is that understand this and you understand why we cannot clear the deficit, at least using current policies. This was the theme for a lecture I gave at St Catherine's College, Cambridge, last week. It seems worth repeating here.

In the paper Ronen Palan and I put it as follows:

The government forecaster — the Office for Budget Responsibility (OBR) — is adopting a low, and in our view, unrealistic multiplier for government spending (range of 0.6 to 1.0). This is much lower than the one adopted by the IMF (0.9 to 1.7) or Standard & Poor (up to 2.5). The low multiplier adopted by the OBR has led to persistent overestimation of the benefit of austerity and constant upwards revision of public borrowing needs.

The multiplier is explained here. In summary:

In economics, the fiscal multiplier is the ratio of a change in national income to the change in government spending that causes it.

To put it more directly: the government and Office for Budget Responsibility assume every pound of government spending shrinks national income and, in reverse, every pound of cuts increases national income. So they believe that austerity generates growth and so cuts the deficit. The trouble for them is that all the evidence shows that the opposite is true: cuts shrink national income and government spending increases it, as the IMF and many others now agree.

So the government and OBR will always get their forecasts and policy wrong because they are based on a false assumption. And despite the continuing evidence that this is the case they carry on with them regardless, continually repeating the same mistakes at cost to us all.

As someone once said, repeating the same error time and again hoping that despite all the evidence the outcome may change is a sign of madness. And we're definitely suffering from the consequences of it having gripped the Treasury.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

They’re Tories. Stupidity and cruelty are congenital.

Excellent article. Should be required reading for every economics, social and political studies student and every aspiring politician. We live in a critical time facing combined ecological, economic, social and political melt downs. To prevent mass global poverty, resource depletion, irreversible global warming and major social unrest we must get to grips with alternative thinking that you advocate

Stating that this is the case suggests either they are very bad at forecasting or that they have made some fundamental errors.

There’s a third, and much worse, possibility – that Gideon is told the truth, shoots the messenger, and the next messenger creates a set of figures that will please his master but which bear no relation to reality.

A friend of a friend who worked at HMT claimed that this is not an uncommon scenario.

How else will they make their ideological arguement stick. The OBR are just neo-lib supporters with a veneer (very thin veneer) of being fiscally responsible. At the end of the day they work for Osborne and no one else.

As a general rule, seeing someone do something stupid when you know damn’ well that they are far, far smarter than that is *not* a reason to reappraise your view that they are smart: it’s time to check that you understand their agenda.

So: are they stupid at the Treasury?

What, all of them?

No leaks, no dissenting voices, papers, briefings to sympathetic politicians..?

…Actually, the Treasury is quite disciplined about that. It’s not as if they’re the Bank, with the academic back-channel to economic academics and daily contact with the men who run the markets.

And, while the Bank has a distinctly banker-ish mindset, it is primarily an economic organ; and the Treasury is, quite definitely, an instrument of politics.

If a government – or successive governments – with a particular political and ideological world view are in power long enough, that world view, and that agenda, will permeate and motivate the Treasury.

So the question is: which agenda?

Have the senior echelons of HM Treasury become blinkered neoliberals, burbling and repeating ‘Public BAD, private GOOD’, praying at an altar of Ayn Rand memorabilia, praising Rail Privatisation as an inspirational success and wilfully oblivious to evidence?

Or have they taken on the arrogance of neoliberal political cynicism – the agenda of purchased politics, the certainty that fear greed and media ‘spend’ will always get the vote out for Gadarene Conservatism?

In that worldview, it isn’t ‘lying’ if you bellow out a breezy ‘Good Morning!’ to your land and your livestock, knowing that the cows will be milked, the sheep will be shorn, and the pigs will go to the sausage factory today. A bad morning for them, to be sure: but they are mere stock, of no opinion save lowing and bleating and grunting for more at the trough; and nothing you say to livestock is a lie.

What then, of the fodder of nonsense the Treasury feed to us in the forecasts?

The all pervading doctrine of the false premiss (and promise)

The question that flows from this is do we have a government that’s prepared to heed the evidence and change course? The evidence suggests we don’t. Why? Because this is the most ideologically driven/dogmatic government we have seen – making even Thatcher look like a realist.

In short, the commitment of this band of neoliberal/Rayndian zealots and the hordes of like minded disciples they’ve surrounded themselves with in government remains utterly, utterly, committed to the destruction of everything, anywhere, associated with the post-war social democratic settlement they loath so much.

And this doesn’t just apply to economic policy. In health we have a Secretary of State who is quite prepared to destroy the NHS (not that that isn’t underway from many other sources anyway) rather than compromise with a “trade union” like the BMA. In education we have forced academisation even when it’s well know that the real crisis lies in recruiting and retaining teachers (ditto doctors, even before the current dispute) and increasing capacity (and more fundamentally the privatisation of schools and the commodification of education as has already happened across the university sector). In transport we have a programme of motorway upgrades and extensions even as local roads fall into such a state of disrepair that it will take decades to bring them back to the pre 2010 standard. Again in transport we have the scandal of diesel emissions – which kill thousands every year – and a government that lobbied against making emission controls stricter, while simultaneously having a PR campaign that made it sound as if they took the opposite view (a case of double standards that has become a hallmark of all government policy it has to be said).

I could go on – housing, environment, museums, libraries, playing fields, planning controls, etc – the story is always and everywhere the same – ideology trumps evidence, short term outputs trump longer term and longer lasting outcomes and impact. Of course, people will claim that the Tata steel saga indicates a flexibility. But what Tata steel represent is the same as the Panama Papers – manage events until the press/publics’ attention is elsewhere and then let neoliberalism take its course.

So, what’s patently obvious is this government (and that of Johnson and co that follows) is not for turning. The only real question is, how they change the austerity narrative to one that explains away their failures while providing a renewed smokescreen for their particular variant of disaster capitalism.

I think we need to remember that for Market Fundamentalists nothing is their problem, the economy is viewed as a ‘weather system’ that operates outside human agency.

Ivan, what saddens me is that underneath your closing question is a more fundamental one: Will we ever see a government that behaves with integrity?

My answer to that, Paul, would be no: systemically, as well culturally in terms of the rich and corporate elite that control our world, a government of integrity would be entirely unacceptable. It would expose the extent and depth of corruption they have nurtured; their lack of ethical and moral standards; their two-faced lies, greed and avarice; their duplicity in the rape of the resources of our planet and thus their contribution to global warming and therefore the current and forthcoming suffering of many millions of people who already suffer because of the corrupted nature of the economic and social systems foisted on them. Indeed, we only need look as far as events in Greece last year, and indeed to China on a almost daily basis to witness the extent to which our controlling elites go to maintain governments lacking in integrity – and therefore acceptable to and accepting of the neoliberal and emergent neo-feudal system.

I see very little evidence at present that we are anywhere near an event or series of events – a wide-scale public epiphany if you like – that will direct our political systems down a path of honesty and integrity. And even if such an epiphany did occur – as we might say happened in Greece last year – we already know how the might of the elite will be deployed to crush it.

‘I see very little evidence at present that we are anywhere near an event or series of events — a wide-scale public epiphany if you like’

True, there is despairingly little sign of this amidst the brutalising and callousing effects of austerity. However the Corbyn and Sanders phenomenon is at least a fissure through which some light emerges. In fact, I would agree with the actress Susan Sarandon who said that Sanders was ‘a miracle’ for American politics. Of course this ray of light dims again when you realise that it looks as if the Clinton camp is liekly to be nominated.

Sanders has made the point that the poor, in America, don’t vote on the whole =people are browbeaten and demoralised – but the young are showing signs of life which make me ashamed of my generation that lay down and took the neo-liberal crap.

Ivan

There is a lot ignorance out here. Especially about economics and finance.

It amazes me how well trained middle class professionals who are perfectly capable in their chosen field – such as scientists for God’s sake – loose all their powers of enquiry and end up just repeating the latest crap from the Daily Mail or Telegraph as fact.

I think that one of the fundamentals driving this is debt.

These same middle class folk have maxed out credit cards, huge mortgages or re-mortgages and then look at the amount of money they owe because of their own consumption and then turn against say the idea of paying taxes. Or quite easily get sucked into believing that those on benefits are sucking the country dry or that Labour bankrupted the nation. Blaming someone else helps them deal with the consequences of their own actions.

How else can you explain how perfectly intelligent people accept this sort of stuff?

For those who do not vote – well we know why they do not – their disengagement is almost excusable. But for those who do vote and do not try to understand – its is almost unbearable to behold.

I can almost understand poorly educated low paid workers being sucked into the UKIP argument – but university trained middle class professionals?

PSR, you have pointed out something of great importance, in my view. I, personally hold the so called educated middle class highly culpable for their lack of integrity regarding our financial system-it is inexcusable ans they have allowed the poor/ill/;vulnerable to go to the wall with barely a murmur.

It seems that these low multipliers ‘estimates’ (I.e. Roman style auguries) are based on ‘crowding out’ dogma (Ricardian Equivalence) which suits the neo-liberal mindset.

The Tories must know that their for casts are ‘failing’ but also know they will explain it away by ‘cocktails’ of issues beyond their control-the usual reference to the Government as Managerial castrato.

Do the actuals also include stuff like receipts from the sale of public assets (bank shares, post office etc..)and interest on QE gilts?

Surely these should not be included if we are assessing the effectiveness of the structural position.

Cash us all the worry zbout

Worth pointing out that the Treasury had a bad record in forecasting while Gordon Brown was Chancellor – it persistently underestimated the amount of borrowing he would be doing and overestimated the level of revenue. To have errors consistently in one direction (too optimistic) over two different governments and for a long time suggests something wrong with the basic model. My own growing suspicion is that they are too optimistic about the underlying capacity for growth. I hope I’m wrong, as that is rather grim news if I’m right.

You are right

I’m not so sure this is madness.

It could very well be intentional. That remains my biggest concern.

The financial destabilisation of 2008 looks more and more planned to me as I look back because the Trans Atlantic neo-libs just love to create chaos; chaos is opportunity to them – its vulture capitalism.

TTIP being pushed onto Europe by the USA whilst Europe’s economy is in the doldrums caused by lax US Government management of its financial industry in the first place seems to be too co-incidental to me. This is all by design.

We know the Yanks cannot expand internally now – they are killing the wages of their own middle class, so they need someone else’s money – European and British cash to bolster their balance sheets (mustn’t concede too much to the Chinese and the Saudi’s are losing money hand over fist with the drop in oil prices and they own up to about 16% of the American economy any way if I recall correctly).

You know, I watched Obama over here and even though I’d been impressed with his conduct in America, there was something shocking to me about what he had to say and how he presented himself about the UK and the EU.

It wasn’t about the fact that he said we’d be ‘at the back of the queue’ and rather America-centric crap like that; it was the expression on his face as he stood next to Cameron.

You know – I genuinely thought I was in the presence of a typical American huckster – I really did. His face told lies. He made my skin crawl. It was the same sort of face the native Americans would have seen whilst suffering the latest lies calling itself a ‘treaty’ with the white man.

He was sly and knowing. And I was thinking about the people who had made contributions to his election and thinking ‘Who’s your Daddy Barack?’ – and I’m not talking about the Kenyan side of the family either.

His rant about ‘cynicism’ – I mean come on – when an American politician or Banker (are they interchangeable these days?) accuses you of being cynical you can bet that you have got too close to the truth of what they are REALLY thinking. You can bet on it.

It’s a pity because I love and admire American culture – and it resonates with me even now – I can still see and hear Burl Ives in the film ‘Cat on a Hot Tin Roof’ railing about ‘mendacity’ in one of his soliloquies.

Mendacity rules in the UK Treasury and in the house of Obama. It is the glue that binds the trans-Atlantic neo-libs together. If the Americans lose their aircraft carrier called ‘The USS United Kingdom ‘, getting a foothold in Europe might be much harder.

And if we do drop out of Europe, then the next Tory Government will just open up our public services (Schools/the NHS)to American companies anyway.

Some choice eh folks?

In 10 years time – in a British school owned by an American corporation – your child’s teeth will rot because of all the cola he or she can drink in school; or he or she will be taught that men walked with dinosaurs.

And when you wake up from your next operation in an American owned NHS hospital, the first thing you will see is a loss adjuster from the American insurance company telling you that they are not paying for all of the procedure you have just had done because you had not divulged that you had tried one cigarette when you were 12 years old. The next person you will see will be the manager asking you to insert your credit card into the card machine. The nurse will only change you soiled clothes and bed sheets when you have paid.

Am I going over the top? Maybe. But I don’t think so really. Not at all.

Not over the top, you are describing what is happening. The DWP already uses an American company for job searches (The appropriately titled ‘Monster’).

I was outraged at the way Obama condescendingly talked to people in the UK and then in Germany. Most depressing was the lack of heckling.

he sounded like a dodgy second hand car salesman.

I agree with many that the 2008 crash was just the pre-shock and the real quake is yet to come. Osborne’s job has been to make the poor more vulnerable to its effects by funneling their money to the already wealthy, making that rich class proportionately much more able to withstand the coming financial seismic events. Job done, innit?

I believe that quote is from one Albert Einstein:

“Insanity: doing the same thing over and over again and expecting different results.”

Mr Einstein had a good many other things to say, including what happens to clocks and measuring rods that are travelling close to the speed of light. Now in a perfect market model, which the Treasury clearly believes in, there is instantaneous exchange of information. But this violates the first principle of relativity that nothing can travel faster than light.

So what they need to do is introduce a length contraction factor (projected value is smaller than expected) and a time dilation (it takes longer to materialise). If they did this, their predictions might be a closer reflection of reality. But then, this shows that their thinking is totally out of this planet.

A really good post, Richard. I just wanted to make an observation on the OBR’s multiplier estimates. As I understand it, an estimate of 0.6 doesn’t mean that GDP falls when govt spending increases; there is an increase in GDP, it’s just relatively small – i.e. a £10bn increase in govt spending leads to an increase in GDP of £6bn if the multiplier is 0.6. (If the multiplier were *negative*, spending would shrink). Whereas, for example, an IMF multiplier of 1.7 implies that GDP increases by £17bn when govt spending increases by £10bn.

I should have been clearer – and we were in the original piece where we refer to the idea of the multiplier in the context of the absurd narrative of expansionary fiscal contraction which assumes the economy is at equilibrium and there is competition for limited resources

In that case a low multiplier shrinks the economy compared to other activity – hence the suggestion made

I used the short hand without explaining the logic

That makes sense, absolutely – thanks for the clarification Richard.