I first published this a year or so ago, but think it worth another outing today:

I came across section 32 of the Finance Act 1951 yesterday (as one does, in my line of work).

The key phrase in this is:

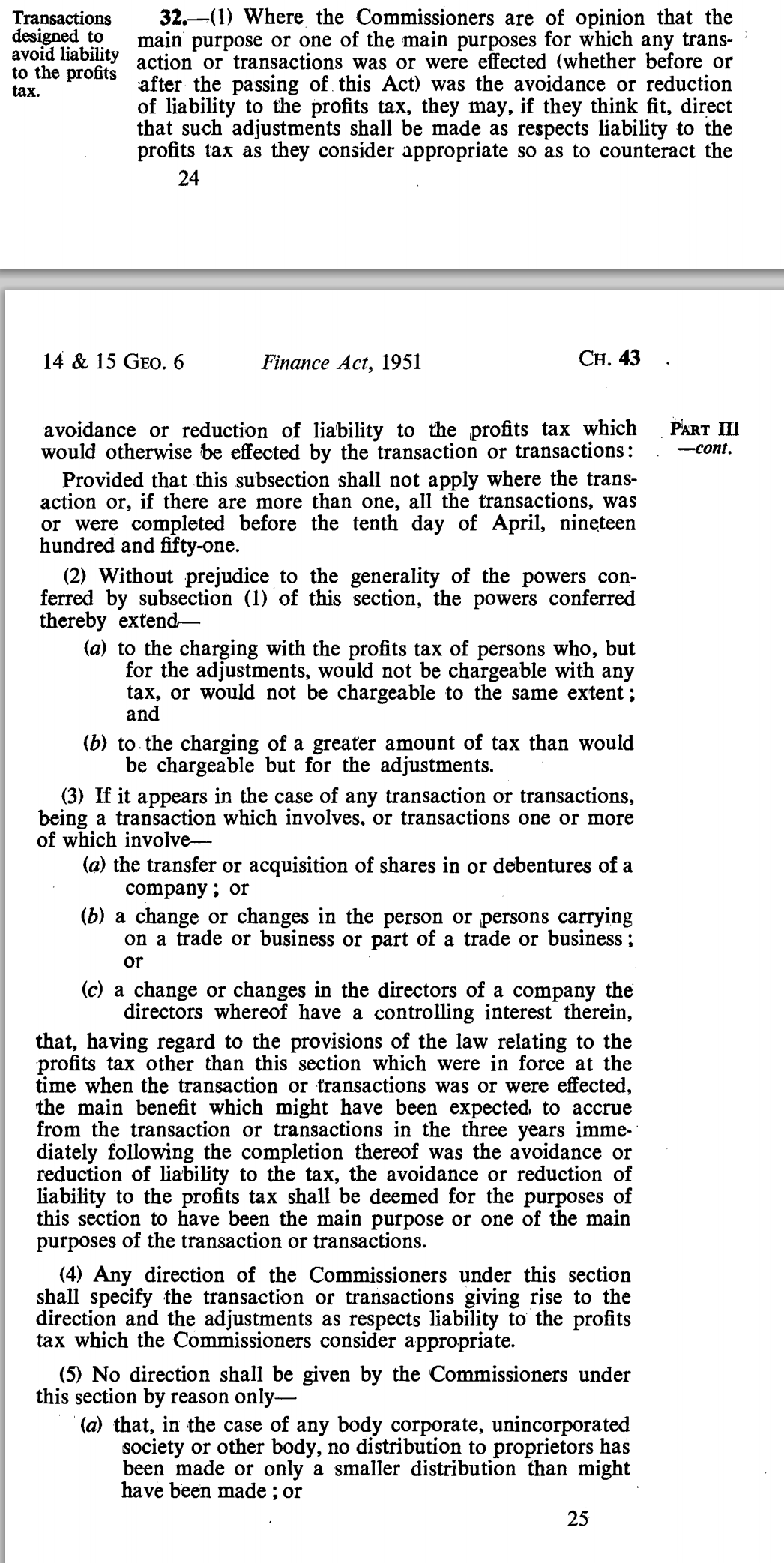

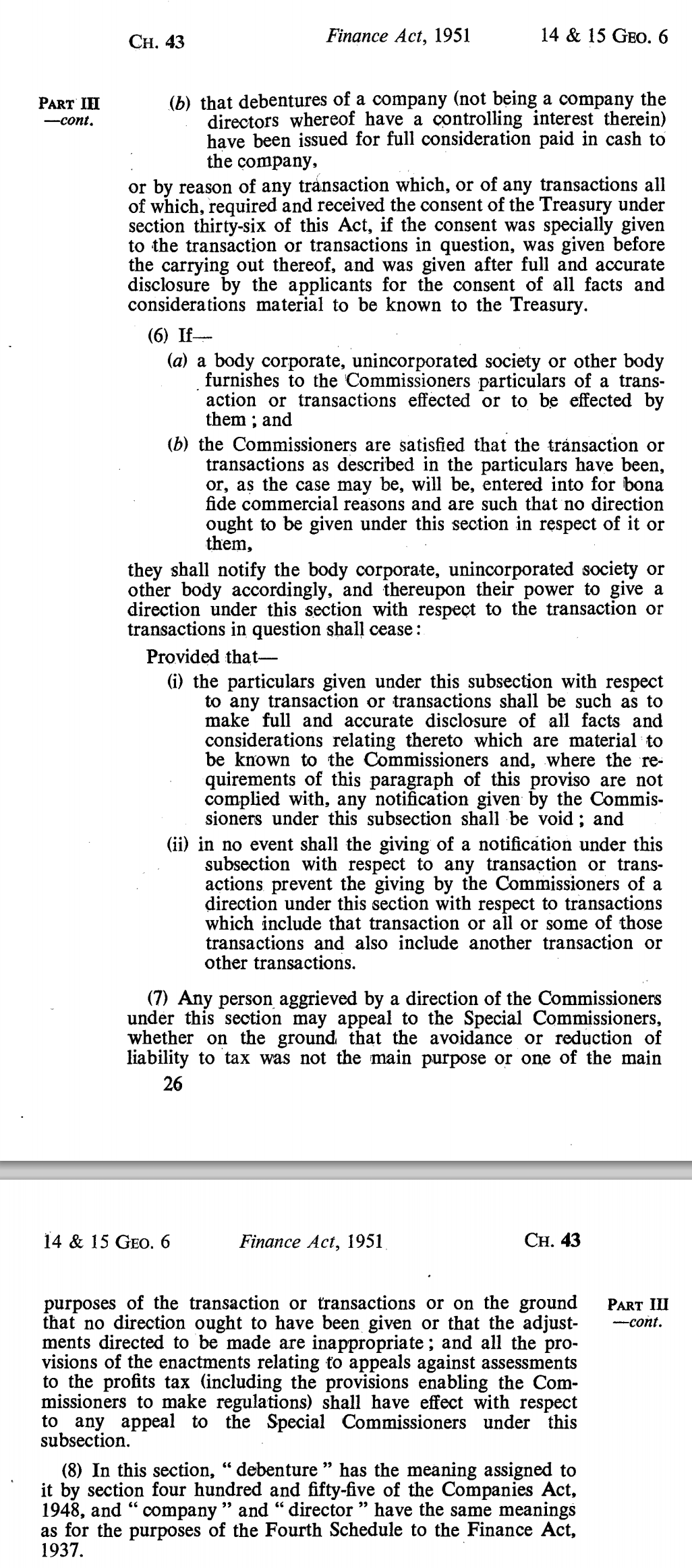

Where the Commissioners are of the opinion that the main purpose or one of the main purposes for which any transaction or transactions was or were effected was the avoidance or reduction of liability to the profits tax, they may, if they think fit, direct that such adjustments shall be made as respects liability to the profits tax as they consider appropriate so as to counteract the avoidance or reduction of liability to the profits tax which would otherwise be effected by the transaction or transactions.

Any way that this section is read it is a general anti-avoidance principle. For the sake of doubt, I reproduce the section in full, below. The title of the section as a whole is

Transactions designed to avoid liability to the profits tax

Can it be clearer than that?

Now, let me put this in context. This section related to profits tax, which predated corporation tax. In other words, this only applied to companies, hence all the discussion of debentures, change of ownership, and the like. And the provision died with the introduction of corporation tax in 1965.

And yet it was radical. It even had a clearance procedure in section 6 as I read it — something that is now said to be impossible.

So the question is, why did this die in law, when it clearly served a purpose and was not (I gather) seriously litigated?

And if that's the case — why did we end up with the near useless General Anti-Abuse Rule (and I say that acknowledging I helped write it, as part of a committee dedicated to producing legislation that would not deliver).

Answers, anyone?

Thanks in the meantime to Paul Donert for this.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Paul Donert? Was it his letter to Accountancy Age about this in 1997 – http://www.accountancyage.com/aa/news/1758218/letters

There is some interesting history here. Sorry, I ended up writing more here than I intended.

The House of Commons debates on this provision in the 1951 Finance Act are very long – http://hansard.millbanksystems.com/commons/1951/jun/11/clause-28-transactions-designed-to-avoid – with what looks like a committee of the whole house starting to consider the clause at around 4am on (I think) 12 June 1951 and carrying on for 12 hours until they moved on to the next clause at about 4pm (it was clause 28 in the Bill, later section 32 in the 1951 Finance Act).

The committee session started considering parts of the 1951 Finance Bill at 4pm the previous day, 11 June, and carried on for about 30 hours, stopping at 10pm on the 12th, before starting again on the 13th. There is an intervention from Winston Churchill at about 11am on the 12th, complaining that a whole day of parliamentary business will be lost. Extraordinary.

Anyway, the debate refers back to similar provisions in relation to excess profits tax in the 1941 and 1944 Finance Acts. Section 32 Finance Act 1951 is based on section 35 Finance Act 1941. For some reason, there is no copy of the 1941 Finance Act at legislation.gov.uk but here is part of the debate on the clause in 1941 – http://hansard.millbanksystems.com/commons/1941/jun/17/finance-bill#column_607 – “As the Chancellor said on the Second Reading, this is, of course, a very drastic proposal. It practically says to the Revenue that it can compel the bad taxpayer to play the game. That is what we want, and the only matter is whether the method is the best one. I believe it is to the interest of the good taxpayer that a drastic provision of this kind should be inserted in our laws. … I think the good taxpayer will certainly benefit if the tax dodger is properly chained. I hope that by this Clause we shall succeed in chaining him.”

And then the addition of the word “main” to “purpose” – http://hansard.millbanksystems.com/commons/1941/jul/01/clause-30-transactions-designed-to-avoid#S5CV0372P0_19410701_HOC_394 – extended to “one of the main purposes in 1944 (and also in some cases where a tax reduction is the main benefit that might be expected to accrue).

As I understand it, these provisions were not replicated when corporation tax was introduced in 1965. I am not sure why that is the case: possibly became the new corporation tax was more closely based on income tax, which did not have such a provision?

(I see David Goldberg said, back in 2001, “I think the only legislative example we have in this country of something approaching a general-anti avoidance rule is to be found in the excess profits tax enacted by the Finance Act 1941.” See http://taxbar.com/documents/gitc_review_v1_n1.pdf )

(I refer you also to Ash Wheatcroft in 1955: http://onlinelibrary.wiley.com/doi/10.1111/j.1468-2230.1955.tb00295.x/epdf )

Fascinating

Thank you very much

Agree with Richard, Andrew, absolutely fascinating. Thanks for the research. This line in particular struck me.

“I believe it is to the interest of the good taxpayer that a drastic provision of this kind should be inserted in our laws. … I think the good taxpayer will certainly benefit if the tax dodger is properly chained. I hope that by this Clause we shall succeed in chaining him.”

I can’t imagine anyone – politician or civil servant – saying anything like it today. But then it comes from an age when even many Tories believed that the benchmark of any legislation, and the purpose of government and public administration, was to serve the public interest, which is not something we can say of government or civil servants nowadays – and particularly not HMRC. And note they are not afraid to call a spade and spade – tax dodger.

Agreed

Quite so Ivan -1951 was a long time before the onset of Globalisation (70’s onward) and ‘free trade’ obsessions brought about more deregulation of Capital controls and speculation with free floating currencies. The rest is the history of what J.R. Saul calls ‘crucifixion economics.’

The pre-Thatcher Tories were a different world of noblesse oblige-now there is no noblesse and much less is there oblige!

I can remember seeing an interview with Dennis Healey (probably filmed in the 80’s where he talks of the impotence of Governments in the face of globalised capital.

Saul points out in his book on Globalisation that what should be the work of Government is now that of NGO’s.

@Simon

But long before that came ‘The Corruption of Economics’. See Mason Gaffney’s important work.

This really needs to be spread far and wide. I’ll try to do something in the Labour Party.

Or, to put it more simply, there was legislation doing something similar in 1941.

To put this in context, the 1941 excess profits tax anti-avoidance provision was introduced at the height (or depths) of the Second World War, which no doubt justified drastic measures being employed which might otherwise have been thought to be excessive. You could make cogent points about the rule of law, and tax needing to be based on laws that are clear and predictable, and not subject to administrative discretion, but needs must in the middle of an existential crisis. Even then, it seems the courts were reluctant to find tax avoidance was “*the* main purpose”, so taxpayers won cases when the authorities tried to use the 1941 provision, which led to the extension in 1944 to “*one of the* main purposes”.

That said, we had something similar from 1951 to 1965…

If any researcher is keen to take this further, it would be interesting to see what the courts made of the 1951 anti-avoidance legislation.

The suggestion has been, I think, that it was not litigated

We are, sadly, going backwards regarding taxing large companies and multi-nationals. The tax base is shrinking onto the PAYE sector and small businesses struggling in a hostile financial and economic climate.

Have you examined other jurisdictions with a more effective GAAR? Australia comes to mind. Many cases before the courts to examine Part IVA (ITAA 1936) and previous S260 ITAA 1936, and legislative change over the years to fix defects. It also reduces the need for parliament to impose a legislative fix to every scheme that comes along.

Of course there are issues with it, but at least it is another tool to use, and one feared by corporates. It also helps to address the mismatch where the corporate has perfect knowledge of motive and method, and the revenue has imperfect knowledge.

Perhaps this type of approach could be considered in the UK in instead of the current manifestly inadequate GAAR. No slight suggested to you Richard in your role in getting it on the statute; more of an observation of the will of the elected.

I did look at GAAR experience, although have not monitored it more recently

Australia also has a clearance regime – most usefully

This thinking was in my own legislative proposal on this issue, which was, of course, rejected

In 1951 “Flying Scotsman” was allocated to the Leicester Great Central running shed as a change locomotive for the “Master Cutler” and “South Yorkshireman” express trains from Sheffield to Marylebone. Sadly, very sadly, times have changed.

Until replaced by V2s as I recall

You’ll have me getting out my copy of Main Line Lament in a minute

Indeed, Richard. But as anyone who worked on steam trains will tell you – I didn’t, but in the mid 1970s I worked out of Derby 4 Shed with many drivers and second men who had – they were bloody awful. And they couldn’t wait to get their hands on clean and warm diesel locos. Not that I too don’t find steam nostalgic and fascinating.

Steam had to go

But I still like th romance of it

I can guarantee you that prosecutions based on “Transactions designed to avoid liability to the profits tax” are alive and well in the UK.

To take but one example: I myself was Expert Witness in dozens (maybe hundreds) of such court prosecutions brought by HMRC in the context of MTIC VAT fraud in the period 2008-c.2012.

A different tax

And it was frraud, not avoidance, that was being prosecuted

I hope you were more use in the witness box

Charming – reasonable example given, sneered at.

With respect, you offer comment anonymously and you expect me to get excited?

Dream on

This is a place for serious debate

My two oldest (7 & 14) harbour ambitions to drive steam………………

More to the point though could we have a link to the relevant Australian Legislation?

Here is Part IVA of the (Australian) Income Tax Assessment Act 1936: the general anti-avoidance rule for income tax in Australia – https://www.legislation.gov.au/Details/C2016C00149/Html/Volume_3#_Toc444766301

There is some official guidance here: https://www.ato.gov.au/general/gen/part-iva–the-general-anti-avoidance-rule-for-income-tax/

There are similar general anti-avoidance rules in several other Commonwealth countries, for example, Canada.

Thanks

Canada’s has, by and large, been a sorry tale

But that was down to the judiciary trying to kill it