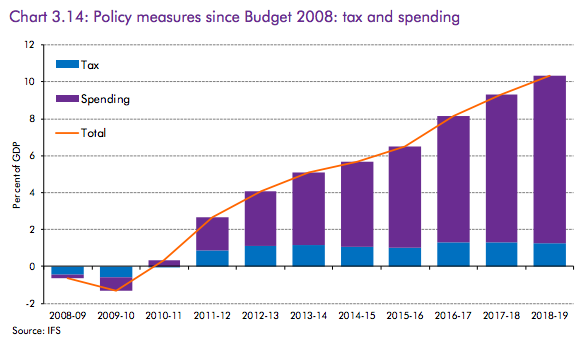

I have already referred to the new Office for Budget Responsibility report on the 2008 financial crisis and its aftermath. This table from it is telling:

Of the measures taken to achieve "one of the biggest deficit reduction programmes seen in any advanced economy since World War II" (their words, I stress) the vast majority have impacted on government spending, and that will also to be the case over the next four years.

This has, of course, resulted in the loss of hundreds of thousands of jobs, and the skills that went with them as the public sector has been decimated. And increasing tax gap has been on consequence.

And those who have kept their jobs in the public sector have seen their real earnings fall, dramatically.

But most tellingly the impact has been on those who depend on the public sector, and these are of course those who are worse off in society including many who are vulnerable through no fault of their own.

The result is obvious. First we are not all in this together. Those who are not heavily dependent on the state are having a good recession, especially now house prices have increased. Many will hardly realise anything has happened,

Those who have real needs have paid and will pay an enormous price for deficit reduction. In fact, they have paid most of it. The table makes that very, very clear.

And what is really galling is that there is no need for this deficit reduction programme. The world is queueing up to buy UK government debt. It's an asset they want to own, but we're trying to deny them the chance to do so by punishing people in our economy and at the same time seeking to crush GDP growth, which is the inevitable consequence of this policy. A more callously inane economic policy would be hard to imagine.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

So why are they doing it? Is the government incompetent or do they know exacltly what they are doing? I suspect the latter and they are simply protecting the wealthiest at the expense of the poorest.

They are trying to shift wealth upwards

It’s deliberate and malicious; an act of revenge for the welfare state, the NHS and the real gains made by and for the majority of citizens in the UK towards greater equality since WWII. We need to wake up and start standing up to it, even if we’re not directly affected. There but for the grace of God…