Luca Paolini says in the FT this morning that the 'corporate tax escape trick [is] set to backfire'. As he puts it:

Households have borne brunt of austerity but pressure is growing for companies to share

It is a feat worthy of Houdini. Even as public debts mount, the world's corporations have managed to break free from the grip of austerity.

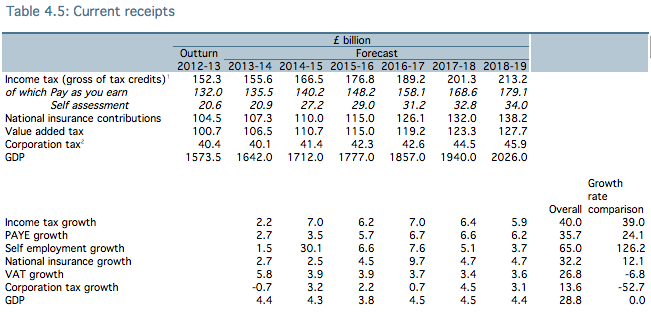

Paolini can't see that lasting forever. He may be right, but George Osborne does not think so and nor does the Office for Budget Responsibility (OBR). The following table is adapted from table 4.5 of the main OBR report for the March 2014 budget:

The table shows forecast increases in revenues from the major taxes over six years. I added forecast money GDP growth from the Treasury's GDP forecast from last December. Then I have compared forecast tax yield growth with GDP in the bottom half of the table, where all numbers are expressed as percentages, unlike the top half which is in £billions. Finally I have prepared a figure for overall percentage growth and then I have compared that percentage growth with percentage GDP growth.

Two taxes stand out for having lower than GDP forecast growth. One is VAT, where growth is expected to be slightly less than that for GDP as a whole. This is reasonable only if rates fall or the proportion of non VATable activity in GDP grows. It is alternatively explained by increased saving out of GDP i.e. people not spending what they earn. Since the OBR is not allowed to forecast tax changes the last is the most likely explanation. So, the OBR thinks savings will increase, which means the wealthiest will get wealthier.

The other tax where receipts will fall in proportion to income is corporation tax. As I have already explained, this is because of a £10bn a year tax giveaway to big business by George Osborne. No wonder some will get richer.

And what of the rest of us? Without exception more income tax is going to be paid than GDP growth would suggest appropriate over the next few years. That is partly because of PAYE growth and partly because the self employed are apparently going to pay 30% more tax in the current year than they have ever done before. This, presumably, is the impact of all those being forced into self employment to get them off benefits. That figure is, of course, totally implausible. But then so are most of these numbers. The lack of correlation in PAYE growth and national insurance is, for example, noticeable, and why national insurance grows in one year by 9.7% but income taxes does not is very hard to explain. But let's, for a moment presume the numbers are right. What, then, does that mean?

Firstly, it means that very obviously people are going to pay more tax in proportion to their income over the next few years than they have to date. This contrasts their position with that of companies.

Secondly, it means that either we are to see a growth in self-employment profits, or the tax gap is going to disappear just at the moment when HMRC are sacking 10,000 staff over the next two years. I do not think either are likely.

Alternatively, more of us are going to work. This data could imply that unemployment is tumbling, with people moving into well paid jobs paying significant amounts of tax but there is no real sign of that as yet.

And there is, maybe, one other option. It could be that there will be a lot more immigrants, and we have to recall that most immigrants work and therefore the proportion paying tax is higher than that for the population as a whole.

The other option is that, of course, these forecasts are completely wrong. That is, quite properly, the most realistic option to consider.

But the message is, whatever happens, that whilst in George Osborne's plans big business is going to pay less tax, and we're, overall, going to be saving more of our incomes over the next few years despite those incomes growing we will also, apparently, nonetheless, be paying a lot more income tax and national insurance. It's a bizarre economic outlook, that suggests we are creating a perfect environment for big business and savers in the UK, but that the rest of us will be bearing the cost.

You have been warned: unless you are a big business, or a big saver, George Osborne is planning to tax you more.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Or could it be interpreted as the environment for business being benign enough for employers to raise wages faster than GDP growth and the self employed to have increased profits enabling more workers and self employed people to save more rather than spend an increasing proportion of their incomes?

But that would be pretty good news so not something to accept as a possible future if you think current policies are an unalloyed failure.

It would be good

Why would we save more though?

And how is increased saving going to provide the wages for growth?

There is no sense in that

If we have rising wages and a rising individual surplus, particularly after years of focusing on personal debt repayment/not taking on additional borrowing we might wish to start saving more, particularly if interest rates start to rise. Saving through investments in equities and in bank deposits would strengthen businesses and provide banks with greater ability to lend to growing businesses.

Obviously if additional saving came at the expense of spending it wouldn’t be so advantageous but a combination of spending and saving but with minimal additional borrowing would help a sustainable recovery.

As the obr projections don’t take account of future tax the figures could also point to scope for tax cuts if you’re right in seeing an increasing tax take on current rates. We can’t really predict with accuracy whether a future tax cut would just raise the savings rate or encourage more spending (and if the latter, whether increased individual spending would just come from having more money after tax or would fuel additional borrowing to leverage that increased take home pay).

I wouldn’t be surprised if Osborne’s inclination for political and economic reasons would be to cut personal taxes seeing the projected increased tax take and rising savings rate.

Saving has nothing to do with lending, at all

As the Bank of England now agrees, it is lending that creates saving, not vice versa

I am not sure I agree with your analysis as a result

I nearly fell off my chair laughing at the first part of this phrase:-

“….or could it be interpreted as the environment for business being benign enough for employers to raise wages faster than GDP growth…..”

Then, I remembered that those lucky enough to be well protected by unions have done Ok to date – BUT going forward, machinery/AI is to replace such workers eg in London Underground.

I also remembered that the sun will continue to shine for those in the 0.1%/0.01% bands, so they can make hay.

For the vast majority they will “benefit” (OK I’ll ease up on the sarcasm) from the “Lithuanian economic model” in other words “capital” and “rentiers” reign while everything is done to really “stick it” to “labour” in all respects, tax just being one aspect!

Apart from a few unions, and a small percent of their members (train drivers, but not station staff, for instance), most union members have seen static wages. At best climbing with inflation (the govs inflation figures, not the real worlds).

In my particular small part of the industrial world, wages are, in many industries, dropping in real terms.

While every under-qualified journalist seem to consider that the automation of industry ¨frees people for the more important tasks that need the human touch¨, in this real world it frees them for the work that automation has not reached; yet. I wonder if anyone really asks decent questions anymore. Like: ¨how is someone on minimum wage going to afford to live and buy expensive consumer products¨….as well as doing all the saving that we are supposed to be doing.

The above comment on peoples increased saving meaning that banks will be able to lend more…ignores the real world where banks have been lending people trillions that they have never had, and never will have. It was, and still is, called ¨fractional Reserve Banking¨. I prefer to call it ¨Large Scale Criminal Fraud¨.

And here is the latest banking joke:

http://www.zerohedge.com/contributed/2014-06-09/uk-bank-rbs-has-%C2%A3100-billion-black-hole-danger-failing-bail-ins-cometh

I agree with ‘Theremustbeanotherway’. Employers will only raise wages if they really have to, which implies a much lower unemployment than we are likely to have for a long time under the deficit-mania austerity policies of the main political parties, which simply reduce aggregate demand.

The analysis by ‘Botzarelli’ employs the failed mainstream economics theories. “Saving through investments in equities and in bank deposits would strengthen businesses and provide banks with greater ability to lend to growing businesses.”

Banks need savings to lend? The Bank of England disagrees.

http://fixingtheeconomists.wordpress.com/2014/03/12/bank-of-england-endorses-post-keynesian-endogenous-money-theory/

I suggest some research in MMT or Post-Keynesian economics for a more realistic understanding.