The government says we're growing again. And they say they think that's going to last. So I've looked for the clues as to whetre they think that's going to come from.

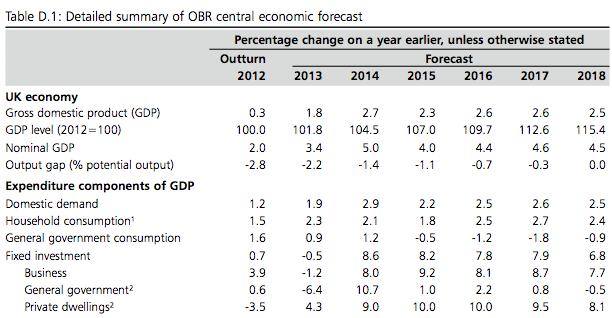

The following table is from page 106 of the budget report:

The data at the top of the table shows expected growth rates. The expenditure components shows what might drive this growth.

You will note that it is not dramatic increases in household consumption that will be having a big impact on growth figures: broadly speaking household spending will go up at roughly the rate of GDP growth and much of that is explained by an increasing population. Overall, most households will be no better off in 2019 and they are now and if there are tax increases, as I forecast, they may well have less disposable income.

The big driver of growth is then, in fact, forecast to be a massive increase in business investment, which will be more than enough to offset falling government spending and cuts in government investment.

On top of that, building new houses will be what drives the UK economy from now until 2019.

So the simple question is whether this is plausible? My candid answer is that at present I can see no reason why it is.

We know that big business has been sitting on the enormous cash pile: the precise amount is open to dispute, but what is beyond question is that they have hundreds of billions of pounds on their balance sheets that they have not been spending. It has always been George Osborne's theory that if only he could cut the size of government spending then big business would suddenly rush in to fill the vacuum that he had left in the economy by investing for a private sector boom. So far, despite all his austerity efforts, this has not happened.

That should surprise no one: what George Osborne created was a cut in consumer spending as a result of falling real incomes. There is absolutely no incentive for any business to invest in that situation, and as the above data shows, and as I have argued on another blog, the reality is that this budget forecasts no real growth in wages over the next five years but that there will be real increases in income tax, meaning that the available spending of most households will continue to fall. That is why household consumption is expected, even in these forecasts, to rise more slowly than GDP.

Now, if I can work this out, so can big business. And if there is no prospect of extra spending, the chance that they will invest heavily is remote. The forecast growth in investment by business looks to me to be an exercise in plucking numbers out of the sky. This has been the pattern of previous Office for Budget Responsibility forecasts, and I think it is being repeated here.

And then there is housebuilding. We do, of course, now have a housing bubble in the south-east of England, which has been generated entirely at cost to the public purse. But what we do not have is a significant housebuilding boom and there is no indication that we are going to get one. Building 15,000 houses on a floodplain in Kent will not change this. Again, without dramatic government intervention to require more housebuilding I cannot see how this growth is going to happen. All I can see is a continued house price bubble around London.

I can see no chance of this growth happening right now. For that you'd need a proper interventionist budget, and that's the last thing that this government is offering.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Only yesterday I rediscovered this comment from J Bradford DeLong from 2011:-

J Bradford DeLong is a professor of economics at the University of California at Berkeley, chair of its political economy major, a research associate of the National Bureau of Economic Research, a visiting scholar at the Federal Reserve Bank of San Francisco, and was in the Clinton administration a deputy assistant secretary of the US Treasury.

“Shame on David Cameron. Shame on Nick Clegg. Shame on George Osborne.

“Their shame would not be quite so great if they had a theory about what elements of spending will grow to offset their 9% of GDP planned fiscal contraction. Is the pound supposed to collapse and are exports than to surge? Is the prospect of rising unemployment in the U.K. supposed to greatly enhance business confidence and trigger a surge of private-sector investment? Is the 30-year gilt yield supposed to fall from 4% to 1% and that reduction in the cost of capital cause a surge of capital formation throughout Britain?

“Cameron, Clegg, and Osborne don’t tell us. They don’t tell us because they are clueless dorks. They don’t even have a theory about how the economy will avoid a double dip. They hope that — somehow, some way — Mervyn King will save them from themselves. But if they actually carry through with their policies, I don’t see how he can.”

Source: J. Bradford DeLong, 21/10/10

I cannot remember where I found it now but it still rings true (to me anyway !!)

‘Is the pound supposed to collapse and are exports than to surge? Is the prospect of rising unemployment in the U.K. supposed to greatly enhance business confidence and trigger a surge of private-sector investment? ‘

We know what is happening: serfdom for non land/property owners and wealth syphoning off their backs. We can expect those on benefits to be hammered for the entertainment and schadenfreude of the middle class – perhaps the Government will introduce benefit claimant baiting -we’re already getting ‘poverty porn’ on TV where the skint are condescended to by ingenue and jejune celebrities.

Well said Richard -the whole thing is ideology driven in guise of ‘necessity’ crated by the fallacy of composition. If I remember, you have used a figure of 700 billion (?) as the amount business is sat on-there seems to be no sign of this shifting in a culture that is very risk averse. Clearly business wants more Government guarantees before the wealth constipation is loosened!

A largely foreign financed housing boom in London will continue alongside false measurements of growth and inaccurate inflation estimates. of course… the poor will be hit hardest….quelle surprise (but of course, the poor are just not working hard enough are they..perhaps if they are bashed more the result will be entrepreneurial zeal where everyone becomes a street corner match seller..)

Interesting points here Richard, has anybody else picked up on it at all?

Not sure!

Richard, this is a point you’ve made a number of times now, in respect of the OBR forecasts and what look like heroic assumptions for business investment. I’m interested to here what response (if any) the OBR have provided to you (as I assume you’ve asked them to justify these assumptions before)

The one massive elephant in the room when we’re looking at the UK’s growth in the last 12 months, that seldom gets mentioned, is the impact of PPI refunds. ONS Statistics (Blue Book 2013, Table 4.2.4) show just how significant these payments were (in 2012 – about 6bn), they are reported to be at least as large, if not larger in 2013. These refunds will eventually cease, and stop being an engine of household consumption – but PPI gets one, very brief, mention in paragraph 3.35 of the OBR economic and fiscal outlook.

It amazes me that people do not appreciate the significance of PPI repayments for the economy, the 6bn handed out in refunds in 2012 was equivalent to a little under 1% of gross wages and salaries for the household sector (and you can bet it was disproportiontely received by individuals and households with a high marginal propensity to consume). FCA data for 2013 (see http://www.fca.org.uk/consumers/financial-services-products/insurance/payment-protection-insurance/ppi-compensation-refunds) shows that banks have paid out another 5bn in 2013, maybe another 0.7% or so of gross wages and salaries, in cash, to the household sector.

This windfall cannot continue indefinitely, and this will clearly have an impact on household consumption.

Keep up the good work!

This a very good point! people have been pointing out that the fines the banks (and associated financial institutions) have been one of the MAIN contributors to growth! Again, Labour (who are no opposition) have failed to emphasize the bizarre nature of this, where growth is reliant on corruption! It would be much better if growth was reliant on intention! The fact that these fines have been one of the main ways of getting money circulating in the zombie economy is truly staggering and only explicable in terms of Government NOT doing its job.

Full details of Osborne’s long term economic plan for your area can be found at: http://longtermplan.org.uk/

Mr. Murphy,

I’m no accountant but studied these very numbers yesterday and was astonished at the rabid, no slavish adulation by the BBC/ITV of Osborne’s budget.

Anyone with half a brain can see that most of these numbers have been pulled out of thin air. If you look at the price forecast for North Sea crude oil for example, the numbers are all the same for each year all the way from 2015 to 2019. This means that they have absolutely no idea what the price or indeed the production will be.

The fall in unemployment is also wishful thinking. There is no obvious explanation for why Osborne thinks it will fall well below 1 million. I can only assume he thinks private sector growth will absorb the great swell of benefit claimants.

Of course, none of this should be surprising. Osborne predicted the deficit would be zero this year but he’s going to borrow 111 billion. He then says the deficit will be net zero by 2019.

Based upon his performance so far, the deficit will not be net zero until at least 2025 or 2030. This is fantasy economics. And the net debt will have breached 1.6 trillion by 2020.

The Con/Dem strategy has been in place for 5 years and none of the key targets have been met. Only a return to moderate growth can be counted as a success. The deficit remains. The debt continues to climb & the benefit bill is colossal by any measure.

I’m staggered by the reaction of the British media to all of this. Are they sleepwalking or what?

There is cynicism about the OBR

But Osborne survives it by saying they are independent

As independent as sharing a water cooler and a paymaster allows, I say