As the FT notes this morning:

Private equity groups are holding more cash for acquisitions than they had at the height of the leveraged buyout boom, in spite of a fall in the volume of deals being done — raising concerns about overcapacity in the industry.

Data compiled by Preqin, the research group, show that the value of unspent commitments to private equity funds, known as “dry powder”, has surged to $789bn this year — an increase of 12 per cent since December 2012, after four years of decline.

This compares with $769bn of unspent cash in 2007.

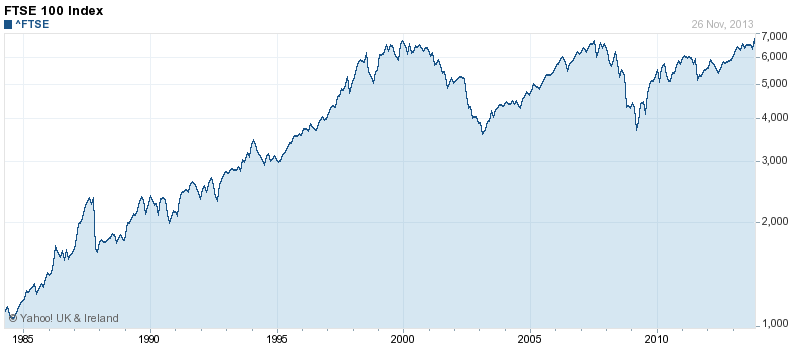

And then there's the FTSE at near enough record highs:

And some emerging bank scandals.

Oh, and hedge funds are opening again.

And there's a corporate savings glut as big business has no idea what to do with the money it has accumulated at cost to labour.

I hate to say it, but all that says there has to be a crash on the way. It's either economic or political, or both, but all this is a recipe for unsustainability, not least because all this is happening whilst governments are running massive deficits, people suffer real wage falls and those worst off are becoming the victims of organised state abuse.

All these events are connected. That's why change is inevitable. It's only when and what the trigger is that we need discuss.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Surely the trigger is the imminent ending of QE (‘tapering’) that will surely be the outcome of the SPD agreeing terms and joining Merkel’s grand coalition yesterday.

China is slowing down. That is the catalyst to the World at the moment. The US spent the past 5 years accumulating debt. This was an incorrect policy in my view. They wont save or help us, they cant. Look at Japan, their situation is the future.

Firstly, I always take your predictions of a crash with a pinch of salt as I think you have predicted at least 10 of the last 2 crashes. Also, while the liquidity taps are on and earning income is so difficult, the search for yield can continue to drive markets. But…

One of my major investments is in Fundsmith, an investment vehicle managed by Terry Smith, who is a controversial city figure. If you want to find out about the fund there is loads online, but in a recent article in the Guardian (not his usual hunting ground) he made the following comment:

“I’m a pessimist on the economic outlook. I closely follow 75 worldwide companies, and another 175 in the next layer down. The vast majority of these are currently showing revenue growth that is significantly slower in the last six months than in the same period a year earlier. Things are getting worse more than they are getting better. I don’t think there’s actually a recovery. Statistics, such as purchasing managers indexes, have been somewhat bent out of shape, and are no longer particularly meaningful.”

He points to a statement last week by the boss of Kraft Foods (a stock he does not own), who warned that the only place where sales were rising was in America’s equivalent of Poundland (called Dollar stores); that people are falling out of the workforce; and that many US consumers have “minimal ability to buy more than what they need for a given week or sometimes a given day”. The economic and financial crisis remains far from over.”

I have made the point before

So?

I am making a systemic argument that the system is bound to fail, again

But is not that what it`s all about? If there was no crash,speculators would not be able to buy cheap,and sell dear!

Of course,some will get it the wrong way around – but it`s gambling anyway – and that`s really for mugs.

Absolutely agree with this. It may not be the trigger but overleveraged China may just cause Asian crisis II.

I agree a crash is coming… only question is when. This time it could take down the entire global financial system… which could be a positive thing in the long run but there is going to be a hell of a lot of pain in the short run before a more progressive paradigm asserts itself (that’s if the left is lucky and/or well organised… if we’re unlucky and/or badly organised we get fascism!!)

The only question needing to be answered is which comes first.

The crash, or war?

Under-reported is the present stand-off between China and Japan over islands in the east China ses, where china has closed the airspace over islands claimed by japan., The US has just flown a B52 over those islands and through the airspace without asking.

Also not much in the press is Iraq, fresh from fooling everyone over nukes, has just seized a Saudi fishing boat (hint: they’re not friends).

According to Elliott Wave, such a crash is matter of when not if. And the trigger can be absolutely anything. When the mood changes, the markets move.

As for war, this may come when Europe and the rest of the world go into GFC 2.

Richard

I don’t know how this will end. We have a situation where more &more people in the “first world” economies can barely afford food, fuel & their house while, at the other end, a few have so much gelt that they dither what to do with it. (“Another Picasso, fercrissakes, I’ve only just got the Francis Bacon up”).

I’m genuinely wondering whether a currency can’t cope with such contradictory requirements. Maybe the poor among us should go back to barter. I don’t fancy having to take some Thyme, apples & mushrooms onto the 50 bus each morning. The queues are bad enough as it is. Also, I could never squeeze the apples into that cash container.

Richard, as I’m sure you’re aware Max Keiser has been banging a similar drum for some time. He recently pointed out (as I think you have) that current Government policies are (deliberately?) re-inflating the bubble. Of particular concern is the obsession with home-ownership. The ‘help to buy’ initiatives are a major worry. The accepted neo-liberal wisdom is that the markets should be allowed to find their own levels yet these policies are helping to maintain over-inflated property prices. According to The Money Charity house repossessions currently stand at 1 every 17 minutes and that’s before any interest rate increases hinted at by the treasury. More worryingly still are the Government’s guarantees to underwrite mortgages… ‘more sub-prime anybody?’.

But the madness goes on. Here in the Black Country the Black Country Joint Core Strategy (the regional development plan) identified that 82% of new housing would need to be ‘affordable’. This, it was felt however, would be too onerous a burden on the developers so it was decided that a minimum of 25% affordable housing would be required for planning approval. This requirement, however, was to be discretionary and could be (in reality frequently is) waived in order to facilitate development. So developers are building houses which are now, and will remain, unaffordable for the people who live here!

I read somewhere yesterday a report on National personal debt statistics that highlighted the plight that so many people are in Nationwide. Hull is the worst with 46% of the population reporting that they are in trouble with debt. That’s not ‘in debt’, or even ‘heavily in debt’ but ‘in trouble with debt’. Similar figures were reported in Liverpool and Nottingham.

The statistics on personal debt were of course published on the same day as the revelation that 31000 people perished due to cold last year, with the obscene increases in energy prices only set to make things worse in the winter ahead.

The term ‘under-reported’ is used by a previous commentator. It is an important one. There is much that is ‘under-reported’. A classic example is Greece which, far from being ‘solved’, actually stands on the brink of civil war, largely as a result of the draconian measures imposed by the Troika. Imagine the effect of that on the EU and its currency.

I would suggest that the tipping point is very, very close, and that any one of the (domestic or international) factors mentioned above will be enough to take us over a very frightening precipice